XPO Goes Global in $3.5 Billion Deal

This story appears in the May 4 print edition of Transport Topics.

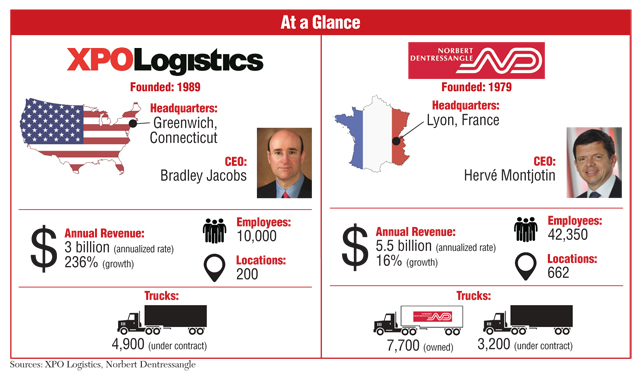

XPO Logistics Inc. last week made its first foray into the global market with an agreement to buy French company Norbert Dentressangle SA for $3.53 billion, the latest move in the consolidation trend in the logistics sector.

Greenwich, Connecticut-based XPO’s move to purchase the logistics, trucking and brokerage specialist represents the largest of its 14 acquisitions in less than four years. The seller’s revenue of $5.5 billion last year was nearly double the size of XPO.

Lyon, France-based Norbert is the second major European acquisition announcement by a U.S. company in three weeks, after FedEx Corp.’s $4.8 billion bid for Dutch firm TNT N.V. The worldwide surge in logistics acquisitions in the past year has reached 11. Most recently, broker Echo Global Logistics expanded in that sector with a $420 million offer for Command Transportation. Japanese companies earlier this year agreed to purchase Singapore-based APL Logistics and Australia’s Toll Group.

“This is a major milestone in the growth of XPO,” CEO Bradley Jacobs told Transport Topics. “Our planned acquisition of Norbert Dentressangle will catapult XPO to a top-10 global logistics company.”

The transaction, targeted for completion this quarter, would boost annual XPO revenue to approximately $8.5 billion, approaching the $9 billion revenue target that Jacobs previously established for 2017. Combined employment would top 52,000, with offices in 27 countries.

On a combined basis, XPO and Norbert would rank No. 7 on Transport Topics Logistics 50, solely based on North American business.

“As we have been saying for the last 3½ years, we believe scale is imperative in this industry,” Jacobs said. “Our customers have been asking us to do things in other parts of the world, and now we are able to say, ‘Yes.’ ”

Jacobs said he first met Norbert leaders at an investor conference in February, where Norbert broached the idea of buying XPO. Jacobs said he responded that his company wasn’t for sale and that XPO wanted to be the buyer.

Norbert’s specialties include contract logistics, brokerage and forwarding, mirroring the XPO units in the United States. Jacobs stressed that he viewed the companies’ geography and businesses as complementary, with few overlapping businesses.

Contract logistics accounts for about half of Norbert’s business, with 20% each in brokerage and asset-based trucking and the balance from forwarding and dedicated services. Norbert has Europe’s largest truck fleet, the announcement of the deal said, with 10,900 trucks and 12,000 others through its brokerage.

“XPO has looked beyond North America to capitalize on three favorable dynamics,” said a report from John Larkin, a Stifel Nicolaus analyst.

He cited “the timing of its investment in the eurozone as the economy begins to rebound from the trough, a strong U.S. dollar relative to the euro and the acquisition opportunities presented by a fragmented European transportation and logistics industry where Norbert Dentressangle holds leadership positions.”

“Norbert puts XPO on the map in several new areas of European and global logistics,” Larkin said, citing Norbert’s prominent role in contract logistics, trucking and freight forwarding for air and sea freight.

The French firm’s name will be changed to XPO Logistics Worldwide. Hervé Montjotin, chairman of its executive board, will become CEO of XPO’s European business and president of the U.S. company.

Norbert entered the U.S. market last year by purchasing Jacobson Cos., an Iowa-based operator. Company reports show that Jacobson’s revenue last year was $780 million, or 26% of Norbert’s contract logistics revenue total.

Jacobs said XPO also sought to buy Jacobson, which is in the same logistics sector as New Breed, which was acquired last year.

Jacobs acknowledged the need, and the opportunity, to find a way to blend those businesses.

As for the Norbert deal, he told TT he didn’t expect any regulatory barriers to the plan that will be funded primarily with $2.6 billion in a financing commitment from Morgan Stanley.

XPO initially will buy 67% of Norbert from the Dentressangle family. Terms of the deal call for XPO to offer 217.5 euros per share for the rest of the stock after U.S. and German regulatory approvals are received.

Jacobs also signaled more deals are in the works, saying, “The acquisition of Norbert Dentressangle is a major leap forward, but we’re still in the early innings of our long-term growth plan.”

The offer includes 2.17 billion euros in cash for the seller’s 9.9 million shares and the assumption of 1.08 billion euros in debt. The acquisition will more than triple XPO earnings before interest, taxes, depreciation and amortization (EBITDA) to $545 million, Jacobs said.

The terms represent a 34% premium above the April 27 closing price and a price that is 9.1 times EBITDA, which Larkin noted was below other recent logistics deals.

XPO intends to maintain full-time employment levels for 18 months and maintain the headquarters and decision-making authority in France, the statement said.