Bloomberg News

Warehouses Lure More Cash Than Offices in Pandemic-Fueled Flip

[Ensure you have all the info you need in these unprecedented times. Subscribe now.]

Warehouses are the hottest corner of commercial real estate — maybe too hot.

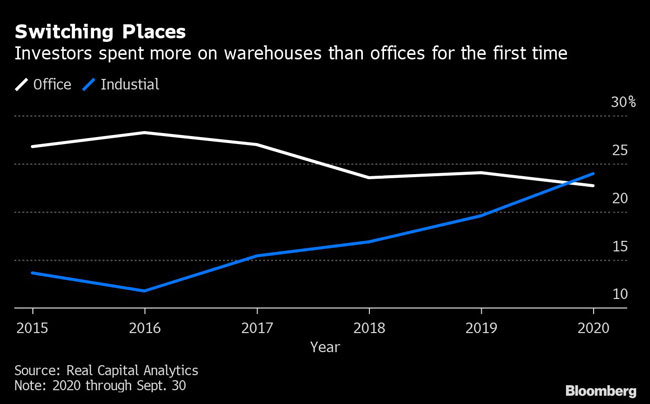

Investors have poured money into industrial properties in 2020, spending more on U.S. warehouses than office buildings for the first time as social distancing pushes even more consumers to e-commerce.

Warehouses are seen as more resilient in the coronavirus economy, particularly as hotels and retail properties are walloped by the pandemic and offices face pressure from remote work.

The world’s biggest private money managers — Blackstone Group Inc., Cerberus Capital Management and KKR & Co. — are all buying logistics centers. The surge of investment is driving up prices, with industrial properties jumping 8.5% in the 12 months through October while retail real estate values fell 5.2% and offices were little changed, Real Capital Analytics Inc. reported.

But as investors buy a smaller slice of commercial real estate, the inflows are fueling a potential bubble, according to Jonathan Needell, chief investment officer at Kairos Investment Management in Rancho Santa Margarita, Calif.

“You’re getting people chasing industrial, in particular, to prices that are unsustainable,” said Needell, whose firm oversees $1 billion in commercial real estate.

It’s not just a U.S. phenomenon. Investments in warehouse and industrial properties comprised 20% of global commercial real estate spending this year, up from 12% in 2015, according to CBRE Group Inc.

One factor driving up prices is the sheer volume of investment in real estate, which is seen as an alternative to volatile stocks and lower-yielding bonds. Private real estate investors are sitting on $196 billion in dry powder as of Dec. 1, Preqin reports.

“In the institutional world, we’re all sharpening our pencils and looking again for opportunities,” said David Gilbert, chief executive officer of Clarion Partners, which manages more than $55 billion in real estate globally. “That capital needs to go somewhere.”

Frozen Market

The pandemic has been hard on commercial real estate, virtually freezing the market for months. Total transaction spending plunged more than 40% in the first three quarters compared with 2019. Still, industrial sales are down the least, slipping 25% compared to 71% for hotels and 44% for offices, Real Capital reported.

U.S. investors put 24% of their real estate spending into industrial and logistics space, compared with 23% for office through the first three quarters of this year, according to Real Capital.

Warehouse and industrial property could face headwinds. At some point, rents will hit a ceiling and investor returns will slow, according to Chris Ludeman, president of capital markets for CBRE. Still, prices are set to climb steadily for 10 years, rising 68% by 2030, according to CBRE projections.

With e-commerce driving demand for 1 billion square feet of new industrial space by 2025, according to a Jones Lang LaSalle Inc. forecast, there’s a construction boom that concerns some lenders.

“There’s a huge amount of industrial space being built now,” said Andrea Balkan, managing partner in Brookfield Asset Management’s real estate finance group. “We are always cautious on lending in markets or on property types which everyone else is rushing into.”

Want more news? Listen to today's daily briefing:

Subscribe: Apple Podcasts | Spotify | Amazon Alexa | Google Assistant | More