Bloomberg News

Walmart Breaks Green-Bond Record With $2 Billion Debut Sale

[Stay on top of transportation news: Get TTNews in your inbox.]

Walmart Inc. made its green bond market debut with a $2 billion offering Sept. 8, the largest ever from a U.S. corporation, according to data compiled by Bloomberg.

The retail giant’s inaugural sustainable debt issuance comes amid efforts to reduce carbon emissions, boost recycling and clean up its supply chain. The deal surpasses NextEra Energy Capital’s $1.5 billion June sale, which matched the prior record from Apple Inc. in 2016.

Walmart’s $2 billion 10-year green issuance is part of a five-tranche, $7 billion sale to help fund a tender offer as well as a range of environmental efforts. They include solar and wind projects, energy efficient refrigeration, electric vehicles and waste reduction, according to its green financing framework. Walmart has a target of achieving zero emissions by 2040 and also aims for a 1 billion metric ton cut in emissions from its supply chain by 2030.

“It certainly seems like they’re serious about taking a sustainability leadership role within the retail space,” James Rich, a senior portfolio manager at Aegon Asset Management, said via email. “I don’t know how other retailers will be able to avoid making similar commitments and changes.”

Amazon.com Inc. sold debut bonds for environmental, social and governance projects in May, while Alibaba Group Holding Ltd. raised its first sustainable debt in February.

The bond yields 50 basis points more than similar-maturity Treasuries, according to a person familiar with the matter, after initial price talk of around 75 basis points.

Bank of America Corp. is the green structuring agent for the sustainable portion of the Walmart deal, which was also managed by Morgan Stanley, CL King & Associates, Samuel A. Ramirez & Co., Siebert Williams Shank & Co. and AmeriVet Securities.

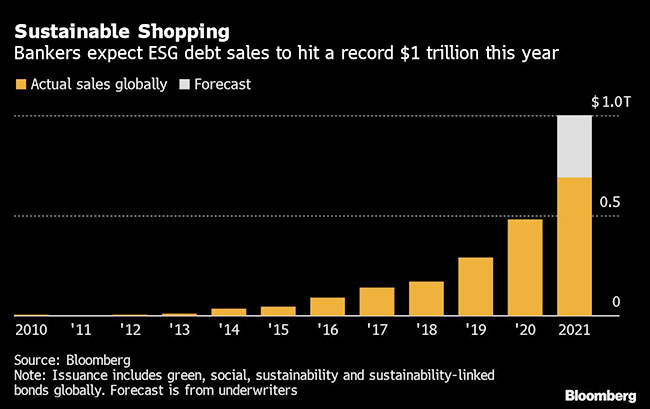

New issuance of green, social, sustainability and sustainability-linked bonds from corporations and governments worldwide has reached a record $691 billion this year, according to data compiled by Bloomberg. By the end of the year bankers expect the sales to exceed $1 trillion for the first time ever.

Companies are using the green bond market to communicate a sustainability strategy to investors — but they are not without risk, according to Carmen Nuzzo, head of fixed income at Principles for Responsible Investment.

“Companies that issue these bonds should explain what role the bonds play in their overall medium-term to long-term strategy,” Nuzzo said. “Greenwashing is not just a risk, it’s happening and there are a lot of instruments out there that are not genuine. Investors need to do their homework.”

Walmart ranks No. 3 on the Transport Topics Top 100 list of the largest private carriers in North America.

Want more news? Listen to today's daily briefing below or go here for more info: