Bloomberg News

US Business Debt Soars by Record on Bond Issuance, Loans

[Ensure you have all the info you need in these unprecedented times. Subscribe now.]

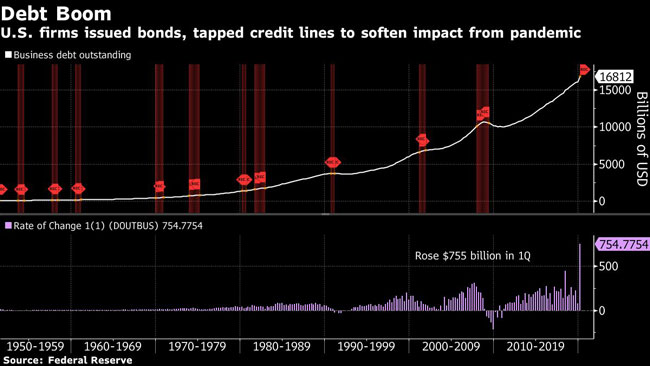

U.S. nonfinancial business debt soared in the first quarter by the most in records back to 1952, as bank loans and corporate bond issuance jumped in companies’ all-out effort to stay liquid during the coronavirus pandemic.

Firms boosted debt by $754.8 billion, or at an 18.8% annualized rate, in the first quarter to a total outstanding $16.8 trillion that surpassed the level of household borrowing, according to a Federal Reserve report out June 11.

At the same time, household net worth fell the most on record — to $110.8 trillion from $117.3 trillion — as stock prices collapsed in February and March amid fears of the coronavirus. Federal government debt surged an annualized 14.3%.

In a matter of weeks, the coronavirus outbreak ended the record-long U.S. expansion. Fed policymakers slashed the benchmark interest rate close to zero, and the unemployment rate jumped from the lowest in 50 years to the highest since the Great Depression era.

Low interest rates helped spur a rush in corporate borrowing as the pandemic began shutting down businesses and keeping Americans in their homes. Business investment posted the largest quarterly drop since 2009 in the January-through-March period.

Corporate bond issuance jumped a record annualized $682.1 billion from the fourth quarter while loans soared $2.3 trillion, as companies tapped credit to withstand a collapse in global demand, the interruption of supply chains and widespread economic uncertainty. Loans from depository institutions surged an annualized $1.6 trillion.

The decline in household net worth almost entirely was due to the decline in the value of equities. Stock prices have since largely rebounded from their March lows, suggesting net worth will recover in the second quarter.

Want more news? Listen to today's daily briefing:

Subscribe: Apple Podcasts | Spotify | Amazon Alexa | Google Assistant | More