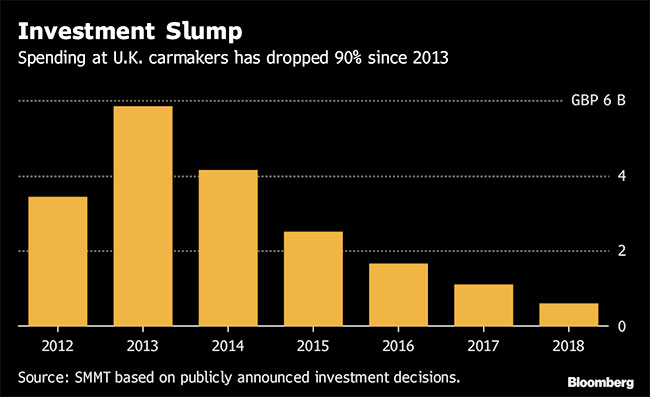

UK Auto Investment Down Almost 50% as Brexit Hits Spending

The British automotive industry saw investment plunge last year as carmakers delayed decisions on upgrading machinery and factories amid mounting concern about the impact of a hard Brexit.

Spending plunged 46% to 589 million pounds, the lowest since the global financial crisis, the Society of Motor Manufacturers and Traders said in a statement Jan. 31.

Concern about the impact of a possible no-deal split on supply chains and demand has prompted companies to devote less cash to the U.K. Nissan Motor Co. has delayed wage talks at Britain’s biggest car plant in Sunderland until Brexit terms are clear, while Jaguar Land Rover, the No. 1 U.K. automaker, has cut thousands of jobs and is moving Discovery SUV production to Slovakia as the looming schism adds to pressure from lower diesel sales.

“Automotive investment is cyclical, but there are underlying investments manufacturers need to make to maintain productivity, to remain competitive. A lot of that is on hold,” said Mike Hawes, CEO of SMMT.

Spending dropped below 1 billion pounds for the first time since 2012, when the group started compiling investment statistics, according to Hawes.

U.K. car output fell 9.1% to 1.52 million autos in 2018, a five-year low. The number of those vehicles sold in Britain dropped 16%, exacerbated by uncertainty about government policy on taxing diesel models.

A continuing slowdown in overall U.K. car sales, which fell 6.8% in the year, according to the European Automobile Manufacturers’ Association, also is discouraging investment, said Stuart Apperley, Lloyds Bank head of automotive.

“Without strong sales of their existing models, carmakers will find it difficult to invest in the technology that will one day power electric and autonomous vehicles,” Apperley said after publication of the SMMT figures.

The slowing Chinese economy took a toll on exports, down 24% to the Asian nation and 7.3% overall. The U.K. sends eight of every 10 cars it produces abroad, with the European Union accounting for about half the total.

Trading on World Trade Organization terms after a no-deal break would be “incredibly damaging” in terms of tariffs and supply chain friction, undermining competitiveness, according to Hawes, who described suggestions that the situation will be manageable as “a fantasy.”

The drop in the pound amid Brexit uncertainty has meanwhile pushed up the price of imported components, he said. In the event of a no-deal Brexit, the cost of EU-made cars would go up, Hawes said, though Britons would be unlikely to abandon brands such as BMW AG and Volkswagen AG.