Truckload Driver Turnover Climbs

This story appears in the May 2 print edition of Transport Topics.

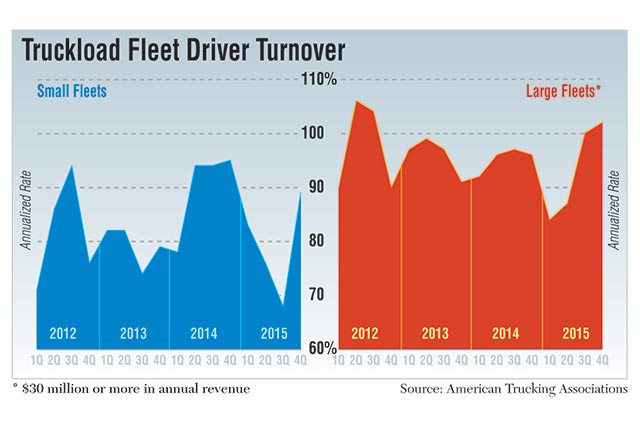

Turnover at smaller truckload fleets leaped 21 percentage points in the fourth quarter of 2015, while churn at larger carriers reached even more elevated levels in spite of lackluster freight demand, American Trucking Associations reported last week.

The annualized rate for smaller fleets, those with $30 million or less in revenue, jumped to 89% from 68%, while the rate for larger truckload fleets with revenue above $30 million rose 2 percentage points to 102%. It was the first time since 2012 that larger fleets’ churn remained over 100% for two consecutive quarters.

“This elevated turnover rate shows that the driver market remains a challenge for truckload fleets,” ATA Chief Economist Bob Costello said. “Obviously, attracting and retaining drivers remains a top concern for the industry.”

He continued: “The rising turnover rate, coupled with anecdotal reports from carriers, shows what a premium there is on experienced, safe drivers. And those drivers have and will continue to benefit from rising wages and benefits.”

Among less-than-truckload operators, turnover was 11% for the fourth quarter and for the full year of 2015, rising 1 percentage point on a sequential basis from the third quarter. Smaller fleet turnover declined 6 percentage points from the fourth quarter of 2014 and rose 6 percentage points among larger fleets over the same period.

For the full year, turnover averaged 79% at smaller fleets and nearly 95% at larger fleets.

“We are constantly thinking out of the box and not resting on our laurels” in driver recruiting and retention, said Cheryl Freauff, driver recruiting manager for TMC Transportation. She added that focusing on the driver and two-way communication are key points in efforts to attract and retain drivers at the Iowa-based carrier, whose turnover is significantly below industry averages.

“We recognize and understand that they have families and try to listen to their needs and wants,” she told Transport Topics on April 27. “Communication is a two-way street. We have open forums where they can vent whatever is on their minds in a room with our executives from different departments.”

She also said that the efforts to attract more drivers continue to be a challenge because there is much more competition for them as older drivers continue exiting the industry.

Swift Transportation Co. President Richard Stocking on an April 22 conference call described the driver market as “challenging” and identified a direct link between driver satisfaction and freight volumes.

“The weakness in the freight market is a frustration for drivers, as it reduces our utilization and the miles the drivers are driving,” he said. “We want to ensure we are getting as many miles as possible to keep our current drivers and to keep them happy.”

Stocking also noted that Swift’s driver retention levels are good, in part, because of a series of recent pay increases.

“Smaller fleets face a growing challenge in driver retention because the gap between them and larger fleets has widened considerably as a result of large and significant driver pay increases by their larger competitors,” Joe White, CEO of Cost Down Consulting, told TT last week. “To compete, small truckload carriers must find the funding necessary to keep driver wages competitive. Funding sources could include increased rates, higher productivity, shedding unprofitable lanes, improved purchasing practices and better-trained management personnel.”

He cautioned that fleets of all sizes need to assess their own unique strengths and weaknesses as they look at three key components of the driver’s job — compensation, home time and equipment — and be sure to be competitive on two of those three criteria.

White said “longhaul companies have to do everything they can to get the drivers home more often.”

In the future, he said, that means more slipseat assignments and more carrier cooperation to mesh operating networks so that drivers get that home time.

Driver turnover and retention are particularly challenging because drivers often don’t see either a path toward a promotion if they want one and because communication between the company and its drivers frequently is deficient, one industry expert said.

“You will always have people who will leave for a few more bucks,” said Jay Green, vice president of business development at Strategic Programs Inc. “Often the real problem [when drivers leave] is that people were communicating poorly,” such as when a driver is forced to wait for instructions or doesn’t know exactly how to get a maintenance problem addressed.

“Most companies have to clean up their house a little bit,” he said. “People blame the operations department for turnover because of the driver managers there, but better communication between operations and the sales department, customer service representatives and the rest of the company would have fixed the problem.”

Fleets can keep drivers who aren’t seeking promotions satisfied with recognition such as special equipment on their truck or a choice of routes based on their performance, Green said.