Truck Turn Times Lengthen in May at Ports of Los Angeles, Long Beach

This story appears in the June 19 print edition of Transport Topics.

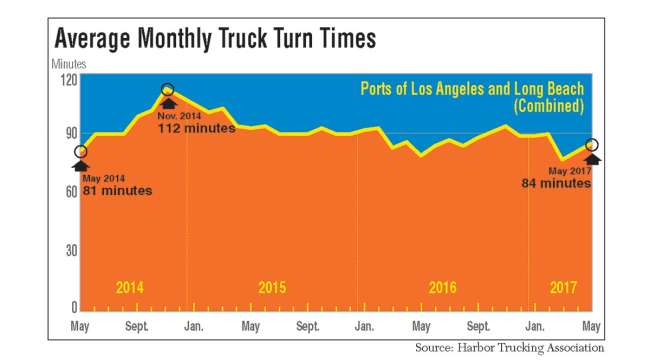

The amount of time it took the average truck driver to do business at the two largest North America ports rose six minutes year-over-year in May due to backups at Total Terminals International, according to data from the Harbor Trucking Association.

The combined average turn time was 84 minutes at the two Southern California ports, the largest in the nation based on container volume.

The Port of Los Angeles (No. 1) had an average of 82 minutes. The Port of Long Beach averaged 87 minutes. The Harbor Trucking Association aggregates the data using GPS devices on drayage trucks from the moment they queue outside the entrance to when they cross the exit gate. The group’s executive director, Weston LaBar, told Transport Topics that the increased delays were due to new shipping alliances.

The Maersk Group and Mediterranean Shipping Co. formed the 2M Alliance, and Hyundai Merchant Marine Co. signed on as a strategic partner. Through subsidiaries, Maersk owns the Pier 400-APM Terminals complex in Los Angeles. Mediterranean and Hyundai Merchant Marine purchased Long Beach’s Total Terminals International in January. LaBar said that Maersk shifted its business to the Long Beach complex when the 2M Alliance began April 1.

As a result, Pier 400’s turn time dropped to 73 minutes from 93 minutes one year ago, but TTI’s rose to 139 minutes from 99 minutes.

“From a volume standpoint, APM was the big loser and TTI was the clear winner. For the trucking community, the loser is anyone who has to go to TTI because it’s an absolute nightmare. It’s been one of the worst-run terminals, even back to the Hanjin days [the previous owner],” LaBar said.

The turn time nearly doubled at Eagle Marine Services terminal to 99 minutes from 50 minutes because of higher volumes from its parent company CMA CGM, he said.

Maersk, CMA CGM, Mediterranean and Hyundai rank Nos. 4, 7, 10 and 31, respectively, on the Transport Topics Top 50 list of the largest global freight carriers.

In Long Beach, the shortest turn time was 33 minutes at the Matson terminal. In Los Angeles, it was 58 minutes at California United Terminals, which lost Hyundai Merchant Marine business to TTI.

Nevertheless, cargo volumes at the Port of Los Angeles increased 3.4% year-over-year last month, the busiest May in its 110-year history. Stevedores handled 796,216 industry-standard 20-foot-equivalent units, or TEUs. Loaded imports grew 3.1% to 413,021, and exports rose 4.4% to 169,639.

“We continue to see balanced year-over-year growth both on the import and export sides of our operations,” said Gene Seroka, executive director of the Port of Los Angeles.

Through May, cargo volumes were 3.75 million, 8.5% ahead of the record-breaking 2016 total.

The Port of Long Beach processed 648,287 TEUs last month, a 1.2% increase year-over-year. The number of loaded import containers rose 1.8% to 336,594, but exports fell 14% to 118,786.

Port officials said May was the best month since September 2015.

“Last May was a great month, so we’re encouraged that we did even better this year,” said Mario Cordero, Port of Long Beach executive director.

Through May, cargo traffic has risen 4.1% to 2.79 million in 2017.

“The new alliances are making more efficient use of our terminals with their deployments,” said Harbor Commission President Lori Ann Guzmán. “Beyond that, the strong U.S. dollar is growing our imports but not helping our exports. Still, we’re in line with our projections for the year, and the port is in a strong position as we head into the peak season.”

Meanwhile, Los Angeles Mayor Eric Garcetti and Long Beach Mayor Robert Garcia renewed their pledge to reach zero emissions at the two ports within 15 to 20 years, signing a joint declaration on June 12. The mayors said that the Clean Air Action Plan will include new investments in clean technology and a pilot program with 50 to 100 zero- emission drayage trucks to begin in a few years.

“The success of our ports has proven that you don’t have to choose between the environment and the economy,” Garcia said.