Truck Tonnage Surges 7.6% in November

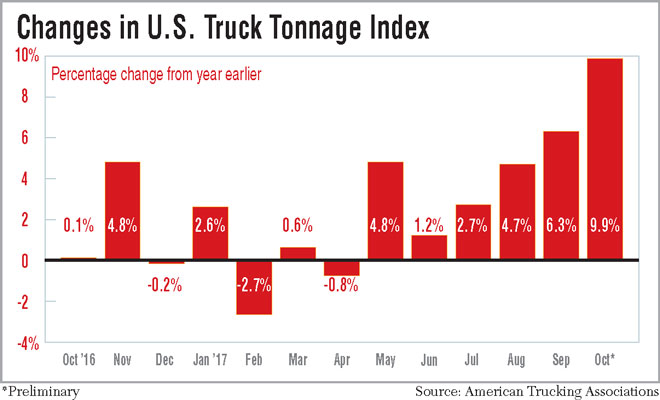

Truck tonnage in November surged 7.6% year-over-year, according to the monthly American Trucking Associations’ index, another signal that the freight market will enter 2018 in a better place than a year ago.

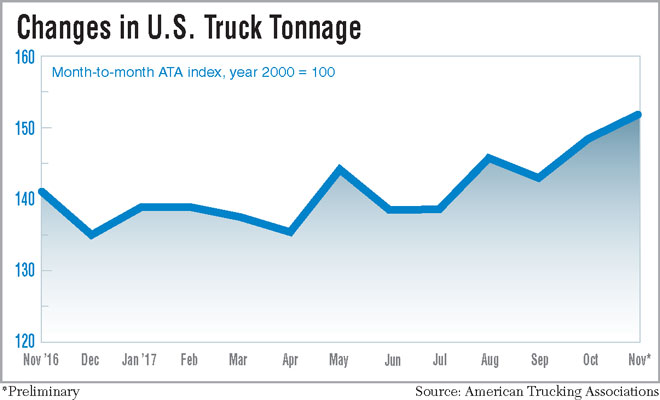

The seasonally adjusted index in November was 151.8, a vast improvement from the 141 in the same month of 2016.

On a sequential basis, the index grew 2.3% from 148.4 in October.

TONNAGE: The solid figures over the last four months suggest the holiday spending season might be better than many expected--and the best in several years. #Freight https://t.co/3cOI2h2me3

— American Trucking (@TRUCKINGdotORG) December 19, 2017

The index uses a base level of 100 for freight activity in the year 2000.

“The freight market is really strong,” ATA Chief Economist Bob Costello said. “The solid truck tonnage figures over the last four months suggest to me that this holiday spending season might be better than many expected and the best in several years. The strength in tonnage also shows that other parts of the economy are doing well, too, including business investment, factory output and even construction.”

The not seasonally adjusted index, which represents the change in tonnage actually hauled by the fleets, was 147.1 in November, which was 3.1% lower than October.

While the ATA index is heavily weighted towards contract market freight, other metrics on the spot market also show a strong business environment.

Industry analysts and researchers pinpoint the inflection point around April or May 2017, but the spot market also received a strong jolt after the hurricanes in Florida, Texas and Puerto Rico.

The Truckstop.com Market Demand Index — a measurement of the ratio between trucks and freight on the spot market — was sharply higher in the final weeks of 2017 than a year ago. The latest index number was 31.8 compared with 17 near the end of 2016. A number less than 15 denotes a market that favors shippers while more than 20 equals a truckers’ market.

The Market Demand Index sunk to a low of 8 early in 2016, but it’s averaged 33 since mid-May 2017. The index also set a new record of 45 shortly after the hurricanes.

“The market isn’t four times more tight, but what it says is that people are posting four times as many loads as the low,” Truckstop.com Senior Economist Noël Perry said. It should be noted that the index cannot filter out brokers posting the same load or drivers listing the same trucks more than once.

Nevertheless, FTR’s capacity utilization percentage is about 100%. If it reaches 105%, then Perry warned shippers will have to prepare for late deliveries.

“There may be some items not delivered at all, but most of the time it’ll be late deliveries. And the later they are, the more likely there is a supply chain failure,” he said.

The Cass Freight Index rose 6.3% in shipments and surged 14% in expenditures in November 2017 versus November 2016. The two indexes have grown every month since December 2016 and January 2017, respectively, and are on par with 2014 and 2015 levels.

Cass uses information from freight bill payments through a St. Louis bank to calculate both indexes.

“Data continues to suggest that the consumer is finally starting to spend a little, albeit not with brick and mortar retailers,” said Donald Broughton, founder of Broughton Capital and author of the report. “With the surge in the price of crude in October of last year, the industrial economy’s rate of deceleration first eased and then began a modest improvement, led by the fracking of DUCs [drilled uncompleted wells], especially in the fields with a lower marginal production cost (i.e., Permian Basin and Eagle Ford).”

In other economic news, the Institute for Supply Management announced the manufacturing index was 58.2%, down on a sequential basis from 58.7%, but better than the 53.5% in November 2016. Out of 18 manufacturing industries, 14 reported economic growth in November, including the transportation equipment sector. A total greater than 50% denotes expansion.

The Federal Reserve’s Industrial Production Index in November was 106.4, slightly up from October and up from 102.9 a year ago.

The U.S. Census Bureau announced that housing starts equaled 1.297 million on an annualized basis, 3.3% above in October and nearly 13% higher than the 1.15 million in November 2016.

Retail sales came in at $492.7 billion in November, an increase of 0.8% sequentially and 5.8% versus one year ago. Total sales from September through November jumped 5.2% year-over-year. The inventory-to-sales ratio fell to 1.35 in October, a data point that lags one month behind other measurements.

In general, a lower number is a positive for the trucking industry because it indicates that products are swiftly moving through the supply chain and not piling up in warehouses. The ratio has declined each of the last three months.