Bloomberg News

Trade Deficit Increased to Second Biggest on Record in May

[Ensure you have all the info you need in these unprecedented times. Subscribe now.]

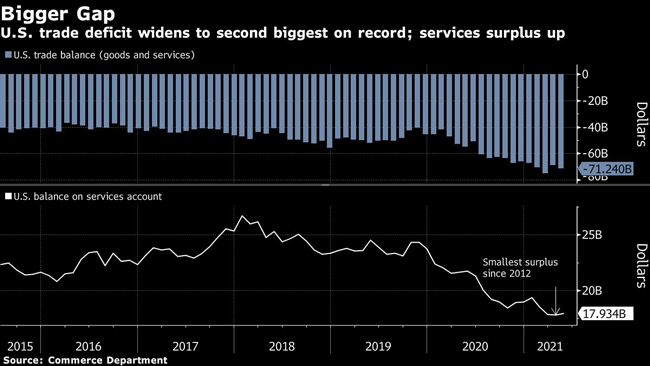

The U.S. trade gap widened in May to the second-largest on record as imports increased faster than exports.

The gap in trade of goods and services rose 3.1% to $71.2 billion in May from a revised $69.1 billion in April, according to Commerce Department data released July 2. That compares with a median estimate for a shortfall of $71.3 billion in a Bloomberg survey of economists.

Exports advanced 0.6% to $206 billion, while imports climbed 1.3% to $277.3 billion.

Although recovering economies overseas are increasing demand for U.S. products and services, American consumers stuck at home during the COVID-19 pandemic have been buying more goods, sending U.S. purchases — and imports — to repeated records. Pandemic-induced logistics bottlenecks have thrown global supply chains out of sync, causing delays at ports, pallet and container shortages, and record-high shipping rates.

Digging Deeper

- The merchandise-trade deficit grew 2.7% to $89.2 billion, the second-biggest on record.

- The nation’s surplus in services trade increased 0.7% to $17.9 billion, bouncing back from the smallest positive balance since 2012.

- U.S. exports were driven by an increase in shipments of petroleum products, organic chemicals and natural gas, while the gain in imports was spurred by an advance in the value of crude-oil shipments.

- Travel is slowly picking up, with spending by visitors to the U.S. climbing 11%, the most this year, to $5.4 billion. This is still about two-thirds lower than pre-pandemic levels. American tourists, meanwhile, are also traveling more, with travel exports rising 17% to $3.7 billion.

- The value of automotive-vehicle exports decreased 4.6% to $11.4 billion, while vehicle imports fell slightly to $29.2 billion as global manufacturers contended with shortages of chips.

- Also reflecting the demand for semiconductors, the value of U.S. goods imports from Taiwan, a major chip exporter, widened to $3.4 billion as President Joe Biden is proposing $50 billion for chip manufacturing and research as part of a push to address a shortage at home.

Want more news? Listen to today's daily briefing below or go here for more info: