Managing Editor, Features and Multimedia

Tech Startups Add to Wave of App-Based Freight Services

This story appears in the May 9 print edition of iTECH, a supplement to Transport Topics.

LOUISVILLE, Ky. — More startups have joined the growing wave of technology firms offering mobile app-enabled freight services, a trend often described, for better or worse, as the “Uberization of trucking.”

Overhaul previewed its soon-to-launch technology platform while Trucker Path marked the public availability of its previously announced Truckloads marketplace during the Mid-America Trucking Show, held here March 31 to April 2.

Blue Bloodhound, meanwhile, showed its mobile app and online resource for hiring qualified drivers on demand.

Trucker Path

Trucker PathOther firms offering technology-based freight services to connect shippers and carriers include Cargomatic, Convoy, Cargo Chief, uShip, Transfix, LaneHoney, Next Trucking, Traansmission, On the Move Systems, FetchDesk and Tugforce.

BEST OF MAY iTECH: More stories, columns

These app-enabled services often are likened to freight versions of the Uber ridesharing app, a comparison that some technology firms embrace.

Overhaul, on the other hand, is quick to reject that description.

“We’re not the Uber of trucking,” said CEO and co-founder Barry Conlon.

Simply developing an app to connect shippers with carriers is not enough in the trucking market; accounting for the nuances and technical nature of the transportation business is essential, said Conlon, formerly CEO of FreightWatch, a cargo security-monitoring service.

“We agree with the broker community. This industry can’t be Uberized,” he said. “But we believe it can be disrupted and radically changed by the application of technology.”

Overhaul’s web-based platform and mobile app are unique in that they focus on shippers of high-value cargo who place a premium on dependable transportation.

The company is establishing relationships with shippers and small carriers ahead of the launch of its service in July. Overhaul is targeting owner-operators and small fleets, Conlon said.

He estimated that trusted drivers using the Overhaul platform will be able to earn 30% higher pay by hauling freight for a class of shipper they otherwise would never encounter on their own.

Overhaul eliminates the need for drivers to factor invoices, Conlon said, adding that drivers also gain rapid access to cash with 40% of the contract fee paid while in transit.

Trucker Path is also using technology to streamline freight shipments.

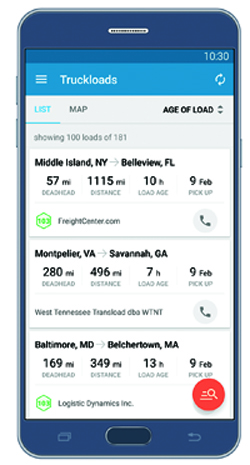

The company’s Truckloads freight marketplace, accessible via a free app for Android and Apple devices, is designed to enable shippers to quickly find available trucking capacity, while carriers can use it to efficiently find and book loads.

Prior to the general release, Truckloads was downloaded 25,000 times during a beta testing period. Currently, 300 freight companies are posting more than 800,000 loads per month using the platform, with 325 more expected to join in the near future, Trucker Path said.

The company also offers crowdsourced trip planning and point-of-interest features on its Trucker Path app.

Blue Bloodhound, meanwhile, said its service leads to better pay, more routes and greater flexibility for drivers, while carriers can benefit from just-in-time driver availability with a pay-per-run structure.

Drivers looking for extra work can use the platform to market their skills to motor carriers who need someone to pick up an extra load, said Todd Warner, chief operating officer at Blue Bloodhound.

“It’s Match.com meets CareerBuilder with a little Uber at the end,” he said at MATS.

More than 6,500 drivers have registered to use the app since its launch late last year, Warner said.

Transportation consultant Satish Jindel of SJ Consulting Group said the idea of connecting shippers with carriers is nothing new — freight brokers have been doing it for decades.

The real value of the companies offering app-based freight services is in their technology, he said.

He predicted that these firms will carve out a niche in the industry and could push brokers to ramp up their technology investments, but won’t displace them.

Earlier this year, at the Transportation Research Board’s annual meeting in Washington, technology executives and researchers said the emergence of Uber-like services to arrange on-demand freight shipments could lead to more efficient supply chains.

Cargomatic, for example, is working to streamline shorthaul freight transportation, which is “inherently a very inefficient market,” Dan Harman, general manager of East Coast operations, told TRB.

The company’s app-based platform, which connects shippers with local truckers who have available capacity, launched in 2014 in Los Angeles and now is available in the New York and San Francisco metropolitan areas as well.

“As with any startup, we’re here to solve a pain point,” Harman said. “On the demand side, the challenge for shippers is broad. Sometimes it can be very difficult to actually find capacity, especially if it’s a good that you’re not moving frequently.”

At the same time, small trucking companies and owner-operators are under financial pressure to find backhauls whenever possible to minimize deadhead miles.

“If you’re on Cargomatic, you can pull up the app and see if there’s any freight available on the way to your next job or heading back to your warehouse. If it fits on your truck and the payout is appropriate for you, you can select it and fill out that excess capacity,” Harman said.

In recent months Cargomatic laid off part of its workforce — reportedly about half of its employees — but also hired two logistics industry veterans to boost its sales efforts and cited continued growth of its platform.

At TRB, Jennifer Pazour, an industrial and systems engineering professor at Rensselaer Polytechnic Institute in Troy, New York, agreed that these types of on- demand logistics services can improve asset utilization and flexibility.

“What this on-demand economy allows us to do is tap into those unused resources and use them very efficiently,” she said.

Traditional supply chain networks tend to be somewhat static, which can limit their efficiency and resiliency, Pazour said. In contrast, the on-demand model represents a more dynamic supply chain that potentially can incorporate infinite participants, transfer points and pickup and delivery locations, which makes it more adaptable and resilient.

However, this “boundless supply chain” also is much more complex, Pazour said. Authenticating personnel and facilities, for example, can become more complicated under the on-demand model.

Technology-based freight services also can improve efficiency by automating time-consuming processes, Cargomatic’s Harman said.

When a shipper enters the dimensions and timeframe for a shipment, Cargomatic calculates the price of the load, including fuel and tolls.

The platform also uses its mobile app to track the vehicle from pickup through arrival and automate proof of delivery.

“There is absolutely no paperwork to chase … or ever a question of where is my freight,” Harman said.

In the future, Cargomatic aims to expand its technology to add features such as route optimization, he added. ³