Stamps.com Craters Without Postal Service Partnership

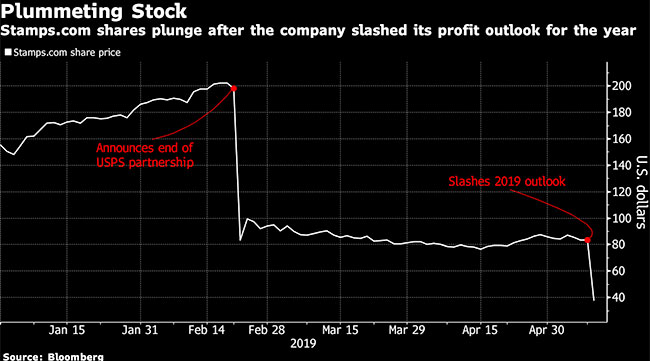

Stamps.com plunged 48% in pre-market trading May 9, poised to drop to a five-year low, after the company slashed its profit outlook for the full year, fueling investor concerns about its ability to protect margins in the absence of a key partnership with the U.S. Postal Service.

The company, which makes software that lets customers print postage for U.S. mail, had set its earnings forecast for the year in February, when it reported fourth-quarter results and also said it had ended the USPS partnership. While it expected the discontinuation to result in some “short-term pain,” the latest outlook suggested that pain may be more severe than anticipated.

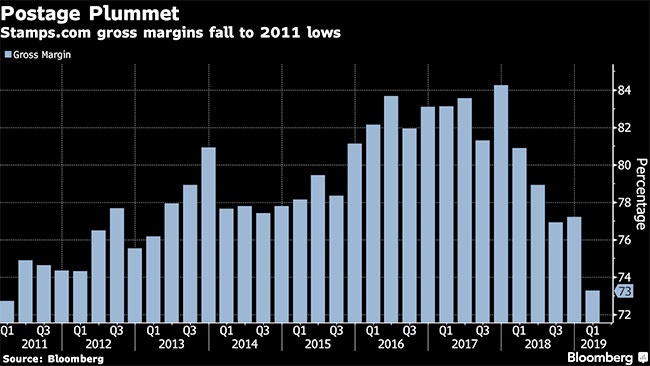

Stamps said the lowered guidance mainly reflected potential unfavorable short- and long-term amendments, renegotiations and termination of certain contracts between USPS and the company’s partners who are part of USPS’ reseller program.

“It appears the USPS is now negotiating with multiple resellers for lower rates, which would negatively impact Stamps’ reseller revenues,” Northland Capital Markets analyst Tim Klasell wrote in a note to clients. He downgraded his rating on the stock to market perform from outperform.

The company said it now expected a profit of $3.35 to $4.85 a share for the full year, down from its prior view of $5.15 to $6.15 per share.

The worsening outlook drew another rating downgrade from B. Riley, as analyst Zach Cummins cut the stock to neutral from buy and slashed the price target by 65% to $45. Roth Capital’s Darren Aftahi, who has the only sell rating on Stamps, cut his price target to $35 from $78.

“The super high-margin business that made the USPS relationship [exclusivity/ commission and reseller program] so attractive for STMP investors, has pivoted so quickly, that the uncertainty of cash flow over the next two to three years is extremely unclear,” Aftahi wrote.

Shares of the company, which sank nearly 60% after the February announcement, already had lost 46% so far this year through May 8.