Senators Favor Tax Reforms to Fund Long-Term Road Bill

This story appears in the March 16 print edition of Transport Topics.

WASHINGTON — Congressional tax policy writers have yet to indicate how they would finance a long-term highway bill, despite the less than three months that remain before funding authority for highway programs expires.

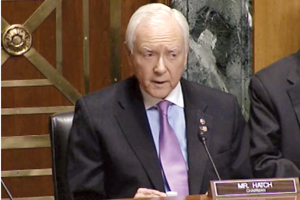

Sen. Orrin Hatch (R-Utah), chairman of the tax-writing Finance Committee, said his colleagues are “working behind the scenes” on a comprehensive plan that would make changes to tax structures to ensure long-term funding for highway programs.

While the chairman did not reveal the plan’s details, he and others have suggested that overhauling the country’s tax code could be a viable way to fund a long-term highway measure this year.

“It’s very, very difficult to find the money,” Hatch told Transport Topics on March 10. “There are no simple answers there. We’re going to come up with it one way or the other.”

Hatch said he is working with his House counterpart, Ways and Means Chairman Paul Ryan (R-Wis.), to figure out a way to boost funding for highway programs.

“We just have to see what we can do,” Hatch said.

Last week, Hatch and committee ranking Democrat Ron Wyden of Oregon announced they would seek input from the public on ways to restructure the tax code. Those comments must be received by April 15.

At the beginning of this Congress, Hatch formed five working groups led by committee members to propose reforms in infrastructure funding and other sectors of the economy.

The Finance and the House Ways and Means tax-writing committees are tasked with coming up with about $13 billion more annually to ensure the solvency of the federal Highway Trust Fund. That’s a tall order because the Republican-

controlled Congress has ruled out fuel-tax increases. Current federal fuel taxes are 24.4 cents per gallon for diesel, while motorists who need gasoline pay 18.4 cents per gallon.

Other congressional policymakers have started linking tax policy to infrastructure spending.

Sen. John Thune, chairman of the Commerce, Science and Transportation Committee, said he favors a tax overhaul to addressing funding woes facing the transportation system. Thune, the chamber’s third-ranking Republican, said he would be open to proposals, such as repatriation, to boost funding as long as they are linked to an overall tax reform.

“I think you can do that in the context of a broader tax reform effort,” Thune said.

Sen. Dean Heller (R-Nev.) argued before the American Public Transportation Association’s annual legislative conference last week that a tax reform package would “take care of our transportation needs over the next decade.”

But congressional observers say the prospects for a tax code overhaul prior to the 2016 presidential election are low. It’s been nearly three decades since lawmakers succeeded in approving significant changes to the tax system.

Sen. Barbara Boxer (D-Calif.), the ranking member on Environment and Public Works, said she would like to see the Finance panel work quicker on its portion of the highway bill.

“Everyone just seems to be hiding. The only action I see is from this committee,” Boxer said at a recent hearing. “They all say they want to do something, and they all said that last time, and we got stuck with this little extension, which is dangerous for our economy.”

The California Democrat teamed with Sen. Rand Paul (R-Ky.) on legislation aimed at encouraging U.S. multinational companies to bring back earnings held overseas to pay for infrastructure projects. Boxer said she plans to hold a forum next month that would feature various stakeholders to pressure Republicans to approve a funding plan before the May deadline.

The Environment and Public Works Committee handles the highways section of the bill, while the Commerce panel oversees truck safety provisions.

This week, Republican leaders are expected to unveil House and Senate budgets that will stick to spending limits enacted four years ago, even though several Democrats argue that doing so would hinder transportation programs.

There’s a growing expectation that lawmakers will approve a short-term funding fix that relies partly on funds from general Treasury revenue to boost the trust fund. The trust fund’s receipts are no longer sufficient to help states pay for most big-ticket road projects. Since 2008, Congress has supplemented the account through general funds.

American Trucking Associations is among the transportation groups that support raising fuel taxes to shore up the trust fund. Sens. Bob Corker (R-Tenn.) and Chris Murphy (D-Conn.) have proposed linking a gas-tax increase with offsets to tax relief in other areas. Key Republicans, however, say they would oppose the move.

Not knowing whether the Highway Trust Fund would provide sufficient backing, officials in Delaware, Tennessee and Arkansas have delayed work on highway projects this year. Transportation Secretary Anthony Foxx has encouraged state highway officials to pressure Congress to back long-term funding for their programs.

“Now’s the time for us to stand together and to go out and make sure Congress understands the critical importance of this moment in time,” Foxx said. “Tell the truth about projects that are being slowed or stopped because of uncertainty.”