Bloomberg News

Saudi Oil Keeps Flooding Market With Output Pact Yet to Begin

[Stay on top of transportation news: Get TTNews in your inbox.]

Saudi Arabia and other Gulf suppliers may have agreed to cut oil production again starting next month, but by all indications the taps are set to remain wide open until then — swelling stockpiles for at least a few more weeks.

The kingdom’s crude exports during the first two weeks of April were around 9.3 million barrels a day, according to tanker-tracking data compiled by Bloomberg. That compares with 6.8 million barrels a day during the same period in March.

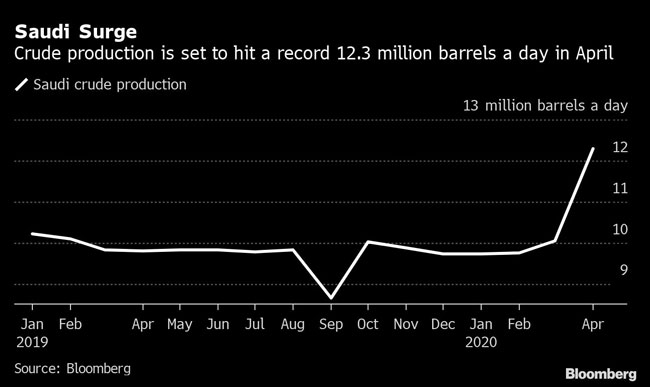

State-owned oil company Saudi Aramco pledged to boost output to 12.3 million barrels a day in April as it slashed prices in a battle for market share, following the collapse of the 3-year- old OPEC+ pact in March. As the coronavirus spread across the globe, governments imposed restrictions on movement and demand declined further, as did prices.

Following marathon international talks last weekend, there’s now a new global deal to limit output, with Saudi Arabia agreeing to trim production to 8.5 million barrels a day in May and June. There’s no sign that any producer will close the taps before May, meaning millions of barrels of unneeded crude are entering the market each day.

“The arrangement is from May,” Prince Abdulaziz bin Salman, the Saudi oil minister, told reporters on a conference call April 13 in reference to the OPEC+ agreement. “All of April was sold.”

In other words, the price war is still on for now. So far, the market hasn’t been impressed. Global benchmark Brent crude futures were trading at $28.35, down 4.2%, by 10:14 a.m. in London on April 15.

Deep Discounts

Another measure — the official selling prices that traders pay for actual barrels of crude in the physical market — indicates that Middle East producers are still looking to gain market share. Saudi OSPs for April were already at their lowest in at least three decades. The kingdom released May’s prices earlier this week, deepening most of those discounts.

The industry is struggling to attract a new generation of technicians to maintain and repair increasingly high-tech trucks. Seth Clevenger spoke in Atlanta with Technology & Maintenance Council President Robert Braswell and Chairman Stacy Earnhardt to find out who's fixing the trucks of tomorrow. Hear a snippet, above, and get the full program by going to RoadSigns.TTNews.com.

In the United Arab Emirates, Abu Dhabi National Oil Co. on April 15 cut pricing to stay in the fight for oil sales in Asia, the Middle East’s biggest market. Adnoc reduced May pricing for its main Murban crude grade by $4.20 a barrel, according to Bloomberg calculations based on a company price list. That’s the same amount by which Aramco cut its flagship Arab Light crude to Asia for May.

UAE Energy Minister Suhail Al Mazrouei said on his Twitter account after last weekend’s discussions that the country “is committed to reducing production from its current production level of 4.1m” barrels a day. That’s at least 1 million barrels a day higher than it pumped in March, according to Bloomberg estimates.

All of that oil has to go somewhere, and with demand decimated, there’s only one obvious destination — storage. With cargo nominations already set for April, Saudi Arabia isn’t likely to reduce shipments to its customers. But it could trim volumes it’s sending to storage tanks in Egypt, Rotterdam and Japan. Without any reduction in those flows, though, stockpiles will continue to build through the remainder of April.

Want more news? Listen to today's daily briefing: