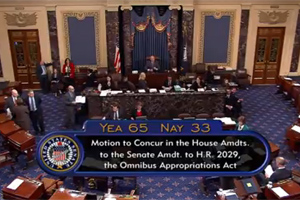

Omnibus, Tax Credits Became Law With Obama’s Signature

The $1.1 trillion omnibus didn’t authorize the use of twin 33-foot trailers, a provision strongly supported by the trucking industry. However, there was better news on the hours-of-service restart rule that currently is suspended.

Before the Federal Motor Carrier Safety Administration reinstates the restart rule, it would need to report to Congress on how the rule delivers improvements “in all outcomes related to safety, operator fatigue, driver health” and work schedules.

The expectation among stakeholders and transportation observers is that the new extensive review of the restart rule will take many months to complete, thus maintaining the rule’s suspension.

“FMCSA foisted these restrictions on the industry without doing a proper investigation into how they might impact trucking safety and truck drivers’ health and longevity, so it is completely appropriate for Congress to establish a safety and health standard,” American Trucking Associations President Bill Graves said.

The HOS rules requiring truck drivers to take off two consecutive periods of 1 a.m. to 5 a.m. during a 34-hour restart were suspended as part of a funding law enacted in December 2014. Truckers still have to adhere to pre-July 2013 hours-of-service regulations.

The long-standing bonus depreciation provision also was extended through 2017 for almost any business asset. In the case of trucks and trailers, an owner can write off an extra percentage of their worth, up to 50%, in the first year of their use.

Tax credits of up to 30% of the cost of natural-gas refueling equipment up to $30,000 and of $.50 per gallon for both liquefied natural gas and compressed natural gas were made retroactive for all of 2015 and extended through 2016.

Several other energy-related provisions also were extended. These include the Alternative Fuel Excise Tax Credit, the Alternative Fuel Vehicle Refueling Property Credit and the Biodiesel Blender Tax Credit. The bill also modifies the fuel credit for LNG to make it consistent with the change adopted earlier this year that applied the fuel excise tax on a diesel gallon equivalent basis and not on a volumetric-gallon basis.

“These tax credits are important, and I think will become more important once natural gas gets back on its feet,” said Glen Kedzie, ATA’s counsel for environmental affairs. “We want to make sure that our members have the opportunity to use the fuel that makes the most sense for them. Trucks that are the same weight and hauling the same amount of goods are being penalized for using natural gas, which is the best alternative we have to diesel.”