Bloomberg News

Oil Spread Tightens After Report Shows US Tanks Filling Slower

[Ensure you have all the info you need in these unprecedented times. Subscribe now.]

Oil reversed losses as the pace of stockpile builds at the key U.S. storage hub slowed last week.

Futures rose as much as 3.9% in New York on May 4, before paring gains, after Genscape reported a 1.8 million-barrel build in inventories in Cushing, Okla., the delivery point for West Texas Intermediate crude. The June contract had earlier fallen as much as 8.8%. If the U.S. government reports a similar number, it would mark the smallest increase at the hub since mid-March.

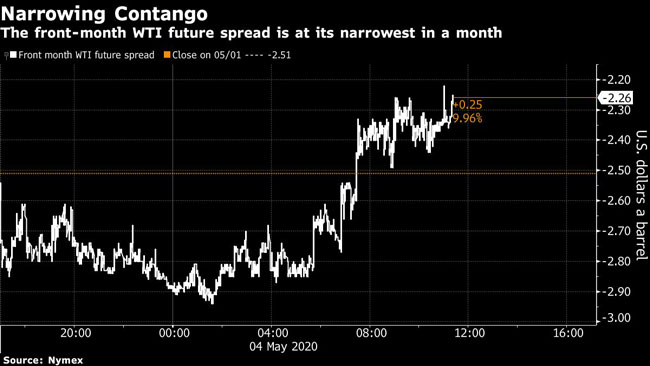

The discount on crude for June delivery relative to July, a structure known as contango, tightened to as little as $2.26 a barrel, the narrowest in about a month.

Last week, crude rallied 60% in three days on early signs of improving consumption and the start of output curbs from OPEC+ and other producers. However, the rebound likely will be a brief reprieve, according to Harry Tchilinguiran, head of commodity markets strategy at BNP Paribas SA, as investors continue to fret over a supply glut that may not be erased by productions cuts.

“There is a lot of upward momentum in supply that needs to be reversed,” Tchilinguiran said.

Even with fuel use recovering, the market will still need to digest the extra inventory dumped by the Organization of Petroleum Exporting Countries last month. OPEC production surged by the most in almost 30 years in April as members waged a price war and kept supplies high even after reaching a cease-fire in the middle of the month.

“Exactly what the market needs to do is have a price that will force the reduction of production,” Tchilinguiran said.

Additionally, the manager of a $500 million oil exchange-traded fund in Hong Kong said its broker refused to let it increase holdings of crude futures. S&P Global Inc., which is behind the most closely followed commodity index, said it will roll West Texas Intermediate futures for July into August, while the United States Oil Fund LP said it will halve holdings in the July contract.

The change in behavior among ETFs such as the U.S. Oil Fund, while disruptive for traders who sought to pre-empt the routine monthly “roll,” has overall been beneficial for the market, said Olivier Jakob, managing director at consultants Petromatrix GmbH in Zug, Switzerland.

“There’s less of an opportunity for some market participants to trade in front of those rolls,” he said. “It’s actually a positive thing: You have a better perception that the market will trade on fundamentals and not just on what will happen with one big ETF.”

Want more news? Listen to today's daily briefing: