Senior Reporter

Medium-Duty Sales Continued to Climb in October

[Stay on top of transportation news: Get TTNews in your inbox.]

U.S. retail sales of medium-duty trucks rose 12.4% in October, led by strong gains in Class 6 vehicles, WardsAuto.com reported.

Sales overall reached 21,184 compared with 20,631 a year earlier, according to Wards.

Year-to-date sales climbed 7.1% to 210,930. In the 2018 period, they were 196,997.

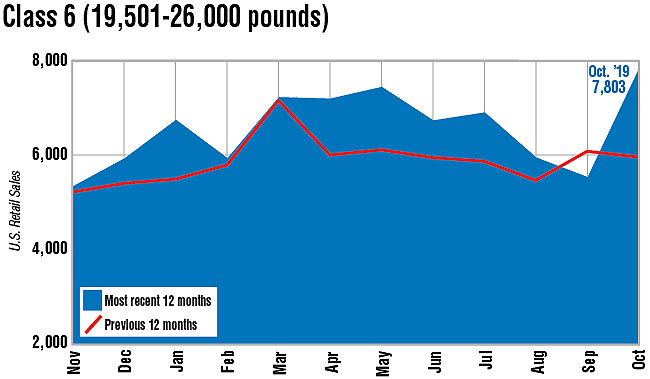

Class 6 sales soared 30.3% to 7,803 compared with 5,988 a year earlier. Ford was tops, selling 2,601 trucks, or 33.3% of the total.

“I think the stronger Class 6 sales are the manifestation of the very strong order intake in 2018,” said ACT Research Vice President Steve Tam. “My hunch is that most of the sales are to municipalities and construction end markets. From a volume perspective, Ford’s new product continues to be very well received.”

Ford Motor Co. undertook a complete refresh of its entire commercial vehicle lineup beginning in April 2018. Optional elements on these lines include adaptive cruise control, electronic stability control, lane departure warning and driver alert system. Telematics and data services are also available as is automatic emergency braking, according to the company.

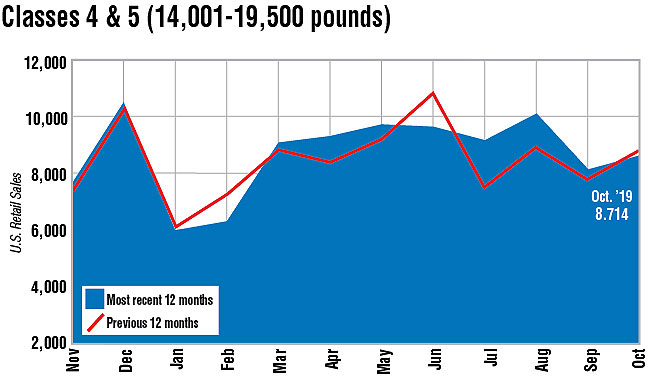

Class 7 sales jumped 15.2% to 6,667 compared with 5,785 a year earlier.

Freightliner, a unit of Daimler Trucks North America, sold the most, 2,475, or 37.1% of the total.

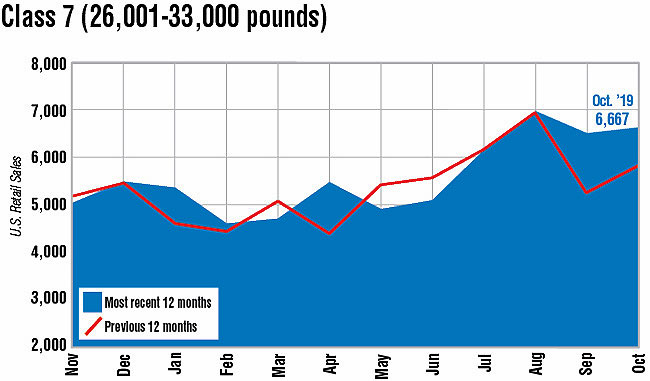

Sales of Class 4 through Class 5 trucks slipped 1.5% to 8,714 compared with 8,858 in the 2018 period.

“I am not quite certain what to make of the slowing in the Class 4 and 5 market. There is some shifting of share, but nothing that suggests what end markets might be responsible for the softness,” Tam said.

In related news, Mitsubishi Fuso, whose major shareholder is Daimler AG, announced it recently began shipping its FE180 gasoline fueled cabover Class 5 work truck to dealerships in the United States and Canada, and described the truck as an industry first, given its fuel.

Tam called the truck an interesting move.

“Medium-duty buyers are subtly shying away from diesel and selective catalytic reduction in favor of less expensive, simpler gasoline. It removes a hurdle for any truck maker. It is also an interesting play for those who hope to play well in the California Air Resources Board market,” with its strong emissions-control regulations, Tam said.

Justin Palmer, CEO of Mitsubishi Fuso Truck of North America Inc., said: “We’ve listened to our customers and answered their request for a less complex powertrain enabling them to focus their attention on their business, not their truck.”

Want more news? Listen to today's daily briefing: