Senior Reporter

October Class 8 Sales Underscore Replacement Demand

[Stay on top of transportation news: Get TTNews in your inbox.]

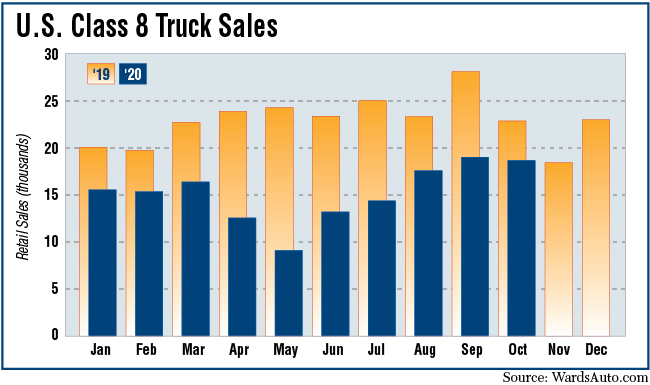

Class 8 U.S. retail sales in October remained 18.4% below year-ago levels and closed in on 19,000 to signal replacement demand is strong, analysts said.

Sales were 18,774 compared with 23,001 a year earlier, according to WardsAuto.com. It was the second-highest tally of the year, trailing only 19,126 in September.

Year-to-date sales dropped 34.9% to 152,695 compared with 234,721 a year earlier.

“Now that rates are on fire and profitability is seemingly invincible,” said ACT Vice President Steve Tam, “they are back at it, getting caught up again” in buying trucks.

ACT forecasts Class 8 sales will fall to 194,000 in 2020 compared with 281,000 in 2019; then climb to 232,000 in 2021 — a shift Tam called getting back to normal.

“Personally, I think there is some fleet growth taking place, as well," Tam said. “I’m not saying it’s uniform or broad-based. That’s the hard thing about this. You can have every possible conceivable situation going on in the market.”

That could be truckers, for instance, losing money and shrinking fleets, or truckers losing money and accelerating replacements to improve operating costs, he said. “Trying to put it together in a macro picture makes your head hurt.”

One truck dealer executive said he is hearing from the fleets that they are sticking with their trade cycles and not growing.

“They could add units, but they can’t find drivers,” said Kyle Treadway, dealer principal at Kenworth Sales Co., which has multistate locations. Recent activity by two large fleets, one in Washington and the other in Virginia, at the dealership involved new Class 8 sleepers.

“That is a change because for the prior nine months, you couldn’t give away a sleeper. There was uncertainty with COVID-19 and its economic impact,” Treadway said. “And there are winners and losers in this game right now. And the winners are actually playing catch-up” in demand for new trucks.

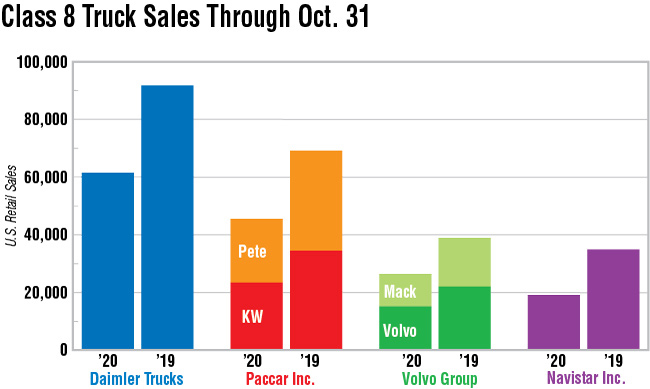

All truck makers in the month posted lower year-over-year sales except Western Star (the smallest), which rose 2.8% to 484 units compared with 471 a year earlier. Western Star earned a 2.6% market share.

Western Star is a brand of Daimler Trucks North America, as is market leader Freightliner.

Freightliner sold 7,332 trucks, compared with 7,673 in the 2019 period. That earned it a 39.1% share.

Kenworth Truck Co., a brand of Paccar Inc., earned the second-highest share, 15.2%, on sales of 2,859 compared with 3,332 a year earlier.

“Early on in the pandemic, we saw the local, less-than-truckload delivery, regional and last-mile delivery [operations] were doing very, very well,” Treadway said. “Now it seems like, late in the game, that the longhaul is catching up and they are competing for those drivers with the regional and last-mile delivery.”

He added automated and automatic transmissions “continue to grab up” market share.

Automated transmissions, especially where grades are plentiful, are sometimes preferred over automatic, he added. “We are also seeing smaller bore 13-liter engines for improved fuel economy.”

Peterbilt Motors Co., also a Paccar unit, posted a 14.4% share on sales of 2,699 compared with 3,444 a year earlier.

International, a brand of Navistar Inc., earned a 12.7% share on sales of 2,377 compared with 4,609 a year earlier.

Volvo Trucks North America, a unit of Volvo Group, posted a 10.3% share on sales of 1,943 compared with 2,248 in the 2019 period.

Magnus Koeck, vice president of strategy at VTNA reiterated the truck maker expects a strong end to 2020, “and the momentum from that encourages a strong start to 2021. But we will have to monitor the continued novel coronavirus pandemic conditions and see how things continue to evolve.”

Mack Trucks, also a Volvo Group brand, earned a 5.7% share on sales of 1,077 compared with 1,224 a year earlier.

“October Class 8 retail sales continued to improve as the trucking industry manages through the ongoing pandemic,” Jonathan Randall, senior vice president of North American sales at Mack Trucks, said.

“The positive trend is related to strong consumer demand, as well as an improved manufacturing environment,” he said. “Mack’s year-to-date results signify robust demand for our trucks serving all segments along with positive customer response to our reliable, durable and fuel-efficient Class 8 vehicles.”

For the 11-month period, all original equipment manufacturers except International and Peterbilt notched gains in market share compared with the 2019 period.

Meanwhile, rapid restocking at U.S. businesses created a wave that supported demand for trucks into fall, said Andrej Divis, head of global truck research at IHS Markit. “But the fast pace of recovery may also signal an early end to the restocking cycle and lessen some of the urgency around new-truck purchases.”

Want more news? Listen to today's daily briefing:

Subscribe: Apple Podcasts | Spotify | Amazon Alexa | Google Assistant | More