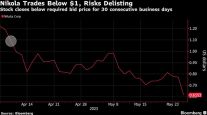

Nikola Plummets After Warrant Call Creates Selling Pressure

[Ensure you have all the info you need in these unprecedented times. Subscribe now.]

Nikola Corp. shares nosedived on July 20 as some investors will now be able to buy the company’s stock at a fraction of recent prices.

The electric-vehicle company late July 17 said a sale of shares related to certain warrants was declared effective, which means the warrant holders will now be able to acquire one share of Nikola at $11.50 — a 76% discount to the July 17 close of $48.84.

Apart from those nearly 24 million shares that are now exercisable through warrants, the filing also registered as many as 53.4 million shares held by private investors, such as mutual funds and other large institutions.

“We believe the potential for a portion of these 77 million shares to hit the market through early investors selling, could create large technical selling pressure on Nikola stock,” Deutsche Bank analyst Emmanuel Rosner said in a July 20 note to clients.

Nikola shares dropped as much as 22% to $38 in New York trading, after gaining 373% this year through July 17.

Electric-vehicle makers have lately caught the attention of U.S. investors amid a strong showing from industry front-runner Tesla, which has topped market expectations even as traditional automakers struggled with flailing demand in the pandemic.

Transport Topics introduces its newest digital interview series, Newsmakers, aimed at helping leaders in trucking and freight transportation navigate turbulent times. Audience members will gain access to the industry's leading expert in their particular field and the thoughtful moderation of a Transport Topics journalist. Our second episode — "The Evolution of Electric Trucks" — featuring Nikola founder and executive chairman Trevor Milton, will air live on July 28 at noon EDT. Registration is free but advance signup is required. Sign up today.

While Nikola is still a long way from proving itself, asking customers to put down as much as $5,000 to preorder its battery-powered truck without even seeing a prototype, the company has found some believers.

Rosner said the current sell-off could create an attractive entry point into the stock, which is a “rare pure-play on zero-emission commercial trucks, whose adoption is poised to take off.”

JPMorgan analyst Paul Coster, who upgraded the stock to the equivalent of a buy on July 8, said that although Nikola is a “story” stock, “we are on board as long as the company executes to plan.”

Want more news? Listen to today's daily briefing:

Subscribe: Apple Podcasts | Spotify | Amazon Alexa | Google Assistant | More