Senior Reporter

Medium-Duty Sales Rise in May, Top 22,000 Units

[Stay on top of transportation news: Get TTNews in your inbox.]

U.S. retail sales of medium-duty trucks in May stayed the course and topped 22,000, slightly higher than a year earlier, WardsAutomotive.com reported.

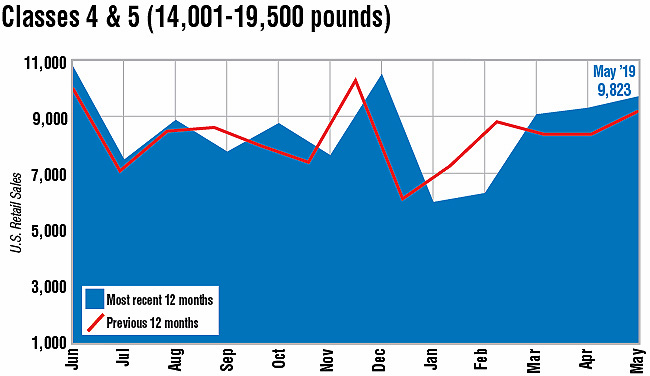

Sales of Class 4 through Class 7 vehicles reached 22,171, up 6.6% compared with 20,801 a year earlier, according to Ward’s.

Year-to-date sales increased 6.1% to 100,417.

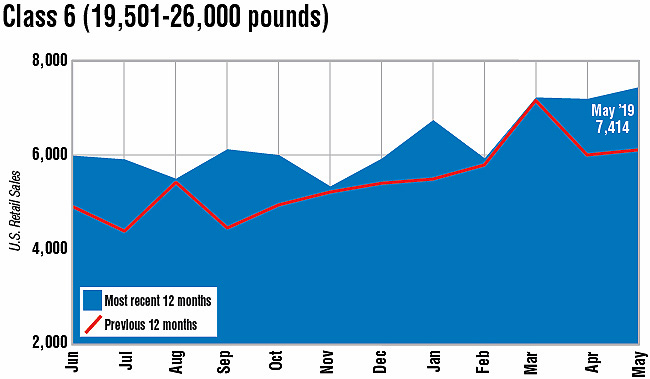

All segments posted gains, with Class 6 leading the way.

“When you start getting down into the medium-duty space, you get less and less exposure to what is happening in the freight portion of the economy [slowdowns in manufacturing and construction] and it gets balanced by the services portion. Many of those trucks don’t ever touch a carton of anything,” said Steve Tam, vice president of ACT Research. “They haul about the people who do real work for a living.”

Class 6 sales rose 20.7% to 7,414.

“My guess is there may be some municipalities that are in there at this point in time,” Tam said.

In the very competitive Class 6 segment, Ford Motor Co. sold a leading 2,556 trucks, good for a 34% share. International Truck, a brand of Navistar Inc., earned a 32% share with 2,342 sales.

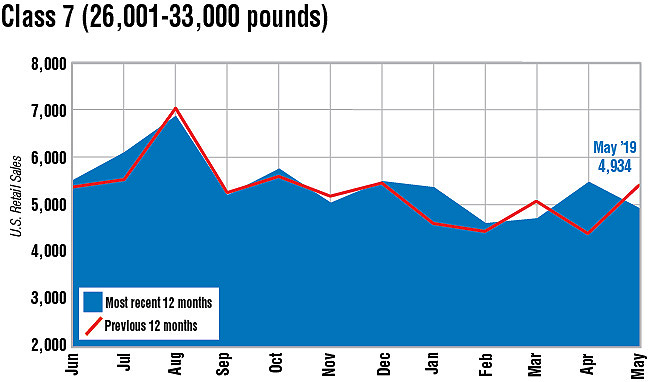

Class 7 sales climbed 9.7% to 4,934. Freightliner, a unit of Daimler Trucks North America, dominated the segment, earning a 48% share with 2,383 trucks.

Classes 4-5 posted sales of 9,823 units, a 6% gain compared with a year earlier. The traditional leaders were unchanged. Isuzu Commercial Truck of America led in Class 4 with 1,361 and Ford in Class 5 with 4,761. Together, the two truck makers accounted for 62% of the combined segments’ total volume.

In related news, The Buckingham Research Group’s latest quarterly survey of 20 International Truck dealers in the United States and Canada found that many were bullish on International’s new CV model, introduced as either a Class 4 or 5 truck in November.

While some others believe the new model will only slightly add to sales “as contacts noted that lead-times for a new CV-series truck have extended to about 12 months,” according to the survey, which appeared in May.

The CV essentially is the same truck as one that Navistar is building for GM’s Silverado lineup. “There’s very few differences. It’s a partnership,” Navistar’s Chad Semler, director of product marketing for medium-duty, said at the launch. “We have had partnerships with other automotive companies in the past, so it’s not totally new.”