Senior Reporter

Medium-Duty Sales Fall 6.5% in August for Second-Lowest Month of 2021

[Stay on top of transportation news: Get TTNews in your inbox.]

Medium-duty U.S. retail sales in August just cleared 18,000 but were the second-lowest of 2021 after February’s bottom of 17,580, WardsAuto.com reported.

Sales in Classes 4-7 were 18,132, down 6.5% compared with 19,386 a year earlier.

“Generally speaking, the medium-duty commercial vehicle market is dealing with the same supply chain constraints that are hounding the heavy-duty market. In addition, most chassis have the added challenge of having to make an interim step at an upfitter/body builder before they can be delivered to the customer,” ACT Research Vice President Steve Tam told Transport Topics.

“Like the vehicle OEMs, the upfitters are also finding it difficult to get all the material and parts they need to add their value,” Tam said. “All of these issues are resulting in slower completion of units, hence the lower sales figures in August.”

Sales through the first eight months reached 157,475 compared with 136,578 a year earlier, a gain of 27.7%, according to Wards.

The year-to-date numbers are encouraging, Tam said, but ACT is increasingly concerned about supply chain issues.

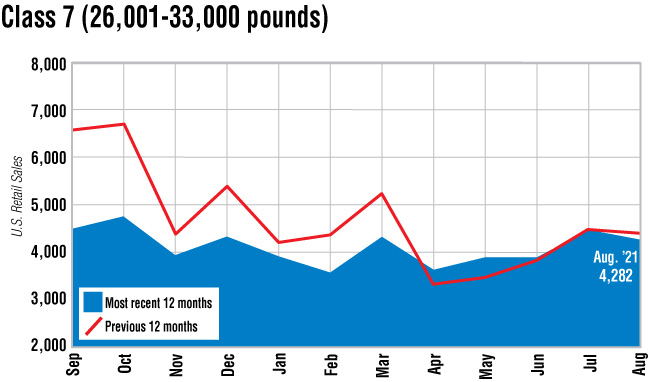

Class 7 sales dipped 2.1 % to 4,282 compared with 4,373 a year earlier. International, a brand of Traton Group’s Navistar, led with 1,801 sales, good for a 42% share.

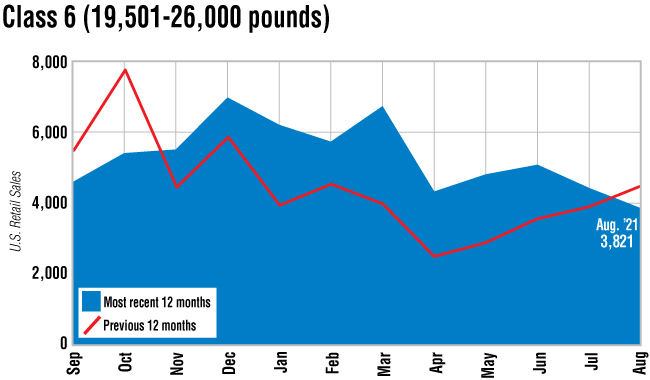

Class 6 sales fell to their lowest point this year, 3,821. The segment, though, is up 36.3% year to date.

In that segment, Ford Motor Co., which has about 675 dealers, notched 1,422 sales for a 37.2% market share. The company has online sales incentives ranging from $4,000 to $4,500 depending on the specific model year 2022 F-650 truck.

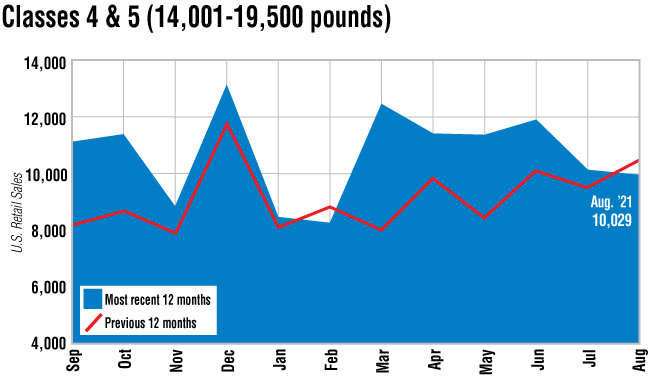

In Class 5, two brands accounted for almost 80% of the sales; Ford sold 4,605 out of a total of 7,735, and notched a 59.5% share. Ram, a Stellantis brand, was next with 1,548, or a 20% share.

In Class 4, three brands had more than 90% of the sales. Isuzu Commercial Truck of America had the largest market share, 42.5%, on sales of 975 out of a total 2,294. General Motors was next with 580 units, or a 25.2% share. Ford was third with 546, or a 23.8% share.

“It is also worth keeping in mind that a number of the medium-duty OEMs shut down production in July,” Tam said, “so there are typically fewer units available for sale in August.”

Want more news? Listen to today's daily briefing below or go here for more info: