Senior Reporter

July Medium-Duty Sales Drop Nearly 20%

[Stay on top of transportation news: Get TTNews in your inbox.]

July medium-duty truck sales dropped almost 20% compared with a year earlier as only the combined total of the two lightest segments posted a small gain, WardsAuto.com reported.

Sales in Classes 4-7 were 17,911, 19.8% less compared with 22,323 a year earlier, according to WardsAuto. Year-to-date sales fell 17.7% to 117,192.

“Our customers, many of whom are small-business owners, are uncertain about the economy and delaying purchases accordingly. That said, cancellations of Classes 4-7 new truck orders are not as much as we had expected them to be,” W.M. “Rusty” Rush, chairman and CEO of Rush Enterprises Inc., said in July during an earnings call.

The truck dealership’s Classes 4-7 sales were down 40% year-over-year in the second quarter, he said.

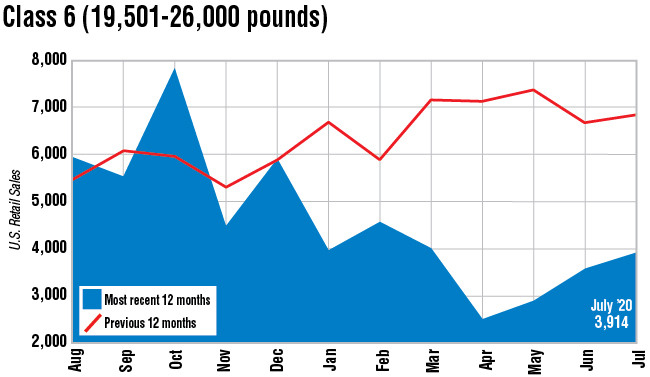

The largest drop in the industry total in July came in Class 6. It fell 43.1% to 3,914 compared with 6,878 in the 2019 period.

Class 6 is heavily used in the lease and rental markets.

“That is very seasonal in terms of how decisions are made there. I think there is a fair bit of equipment out there, as you, I’m sure, know that needs to work its way through the market,” Allison Transmission Holdings Inc. CEO David Graziosi said during the company’s most recent earnings call. “So a fair bit of activity there around rentals being converted to leases and such. So we’re seeing that concept and dynamic continue to play out for North America.”

Such an approach reduces the need to buy new trucks.

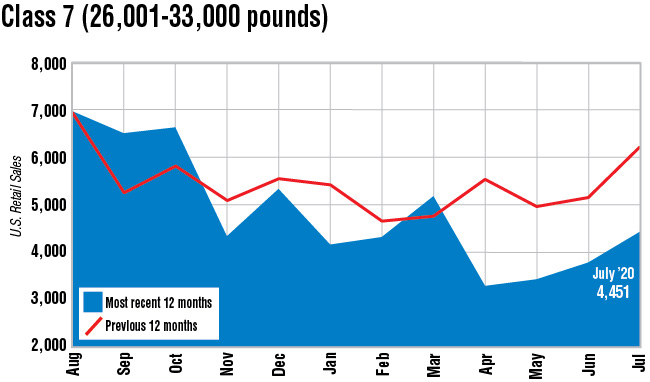

Class 7 sales fell 28% to 4,451 compared with 6,186 a year earlier.

Freightliner, a brand of Daimler Trucks North America, and International, a brand of Navistar Inc., between them controlled 71.5% of the Class 7 market with respective sales of 1,659 and 1,525.

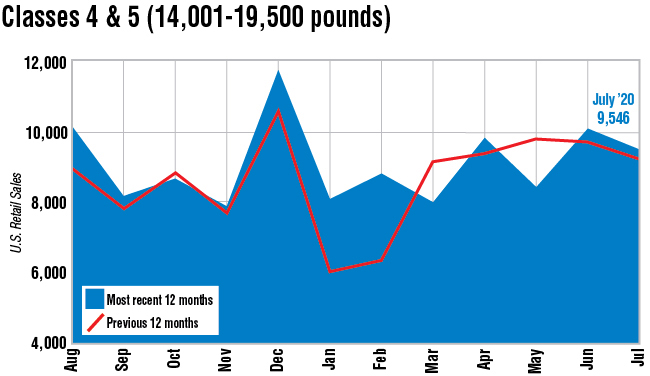

Classes 4-5 posted a 3.1% gain, inching up to 9,546 compared with 9,259 in the 2019 period.

In Class 4, Isuzu Commercial Truck America Inc. led with sales of 1,056 for 41.1% share in that segment. The company this year celebrates its 35th year of selling trucks in America.

In Class 5, Ford Motor Co. sold 4,083 trucks for a 58.4% market share in that segment.

“Body builder lead times, I would say, continue to be stretched as we understand it,” Graziosi said. “There’s a number of reasons for that, but it really gets down to component supply and, ultimately, delivering those vehicles in a timely way.”

Meanwhile, Cummins Inc. Chairman and CEO Tom Linebarger said he expected adoption of battery-electric powertrains to increase in bus and terminal tractor markets over the next several years, “with adoption in segments of the medium-duty truck market occurring thereafter.”

Want more news? Listen to today's daily briefing:

Subscribe: Apple Podcasts | Spotify | Amazon Alexa | Google Assistant | More