Senior Reporter

July Medium-Duty Sales Dip Year-Over-Year

[Stay on top of transportation news: Get TTNews in your inbox.]

Classes 4-7 U.S. retail sales in July slipped 7.3% compared with a year earlier, and only Class 6 with its typical base of bigger customers posted a gain, Wards Intelligence reported.

Total sales were 17,682 compared with 19,082 in the 2021 period.

Except for March’s 21,002 sales, the Classes 4-7 market has been steady, albeit at a low level, with only 1,932 trucks separating the peak from the low in the rest of the months this year.

Tam

“We like the consistency,” ACT Research Vice President Steve Tam said. “That’s actually a good thing, but we’d like to see it at a higher absolute level.”

Next month, some medium-duty sales might be better, he added, as manufacturers built about 2,500 more trucks than expected in July.

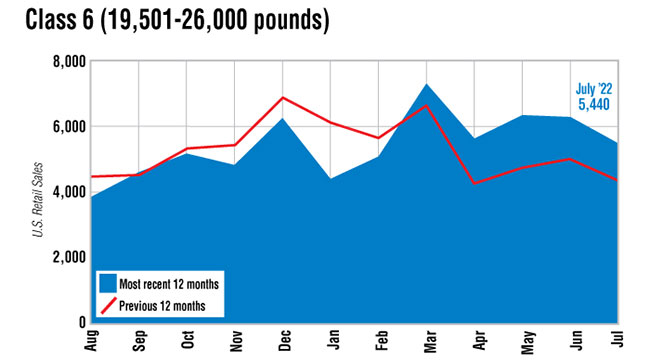

Class 6 sales in July rose 24.1% to 5,440 compared with 4,385 a year earlier. That volume was the third lowest this year, according to Wards.

Ford Motor Co. had the most Class 6 sales with 1,879 and earned a leading 34.5% share. Its vehicles in the class come with either a diesel or 335 horsepower V8 gasoline engine, which has the largest displacement in its class and features an overhead valve architecture that generates power to help get heavier loads moving sooner, the company reported.

Source: Wards Intelligence/Transport Topics Graphic

The gas engine also features a variable-displacement oil pump, extra-large main bearings, forged steel crankshaft for durability and piston-cooling jets to help manage temperatures under heavy load.

Southern California Gas Co. recently announced it is working with Ford on a demonstration project to develop a F-550 Super Duty hydrogen fuel cell-electric truck to reduce commercial fleet emissions.

The collaboration is part of the U.S. Department of Energy’s SuperTruck 3 program, which aims to significantly reduce emissions in medium- and heavy-duty trucks.

The utility noted it is working to replace 50% of its over-the-road fleet with clean-fuel vehicles by 2025 and operate a 100% zero-emission fleet by 2035.

The demonstration project also will include a temporary hydrogen refueling station at SoCalGas’ Bakersfield facility. The truck is expected to deploy in 2025.

Buczkowski

“For our wide spectrum of Ford Pro customers, there are application gaps that battery-electric vehicles just can’t fulfill yet,” said Jim Buczkowski, executive director of Ford research. “So we’re looking at hydrogen fuel cells to power larger, heavier commercial vehicles while still delivering zero tailpipe emissions.”

Classes 4-5 sales dropped 14.9% to 8,682. Ford led in both segments, and dominated in Class 5 with a 51% share and in Class 4 with a 35% share.

Ford has a full suite of products from Classes 1-7.

“So why would they not focus on the higher-margin [truck] products and try and deliver as many of those as possible?” Tam said.

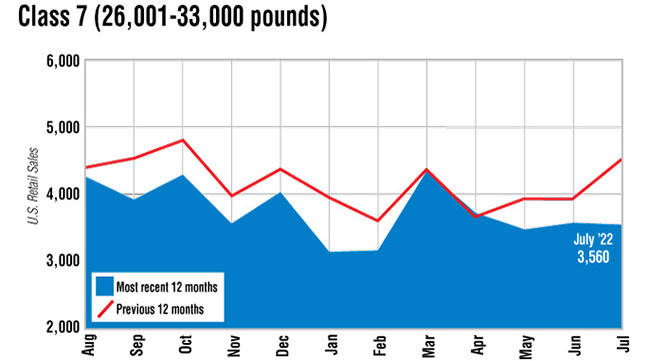

Source: Wards Intelligence/Transport Topics Graphic

Class 7 fell the most, 20.7%, to 3,560 compared with 4,490 a year earlier.

Year-to-date sales dropped 11.3% to 123,593 compared with 139,333 a year earlier.

Meanwhile, ACT reduced its North American 2023 Classes 5-7 production and sales forecasts to 246,750 from 263,400 and to 253,750 from 259,250, respectively.

Want more news? Listen to today's daily briefing below or go here for more info: