Senior Reporter

July Class 8 Sales Top 25,000 for Year’s Highest Volume

[Stay on top of transportation news: Get TTNews in your inbox.]

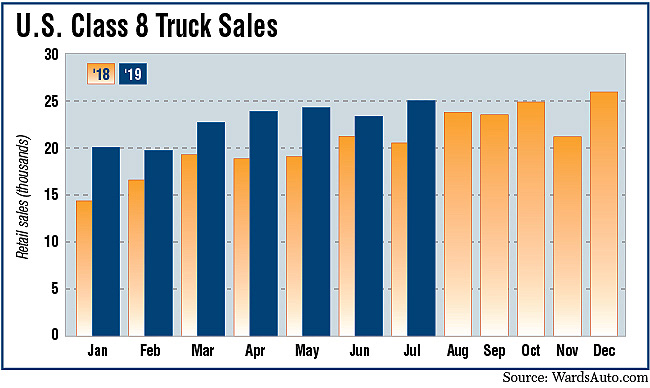

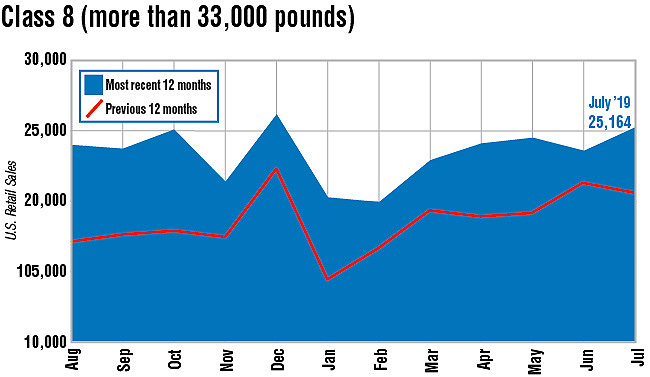

U.S. Class 8 retail sales in July topped 25,000, the highest volume this year, and extended a string of year-over-year gains that began two years earlier, WardsAuto.com reported.

Sales reached 25,164, up 21.9% compared with 20,649 a year earlier, according to Ward’s, but landed against a backdrop of a softening freight market.

Meanwhile, the consecutive improvements began in July 2017 when sales hit 15,317.

Year-to-date sales improved to 159,996 compared with 130,638 in the 2018 period.

“July’s was a good number, but we have been waiting on some good numbers,” ACT Research Vice President Steve Tam said. “We have built some inventory as we’ve gone through the year, and we need sales to catch up to those build numbers. A little of that happened in July.”

All truck makers posted year-over-year gains against a backdrop of carriers’ cautiousness with current conditions.

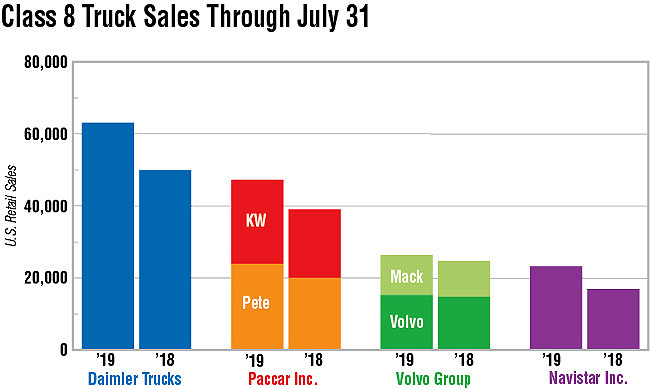

Freightliner, a unit of Daimler Trucks North America, sold a leading 8,875 trucks in July, an improvement of 19.3% from a year earlier.

Western Star, also a DTNA brand, sold 616, up 21.5% from a year ago.

“People are still taking trucks. Trucks are still needed in the market to haul freight. However, we are approaching a point where the supply of trucks will meet the demand of trucks,” said Don Ake, vice president of commercial vehicles for research firm FTR.

“When that happens — and it is kind of happening now, and if that continues to happen — you will see reduced build rates at the truck makers,” leading to lower sales, he said.

Volvo Trucks North America sold 2,486 trucks in July, a 6.9% improvement from a year earlier.

“The first seven months of 2019 have been positive, including a very strong July, and we expect to see continued robust retail sales for the rest of the year,” said Magnus Koeck, VTNA’s vice president of marketing. “However, we see a softening in the market and are watching the situation carefully, while we continue to deliver premium, fuel-efficient trucks to our customers.”

Mack Trucks sold 1,722 trucks, up 32.5% from a year earlier.

“Relatively solid economic factors, including consumer spending, freight volumes and construction spending, have combined with a large industry backlog to drive positive retail sales through July. Mack’s July results reflect these factors,” said Jonathan Randall, Mack Trucks senior vice president of North American sales.

Mack and VTNA are brands of Volvo Group.

Top executives at some publicly traded fleets, in their latest earnings conference calls, mentioned the cooling in freight demand.

One executive will reduce the budget for capital expenditures, such as new trucks.

“As market conditions have continued to underperform earlier expectations, we revisited our capital planning as part of a more broad-based review of our forecast for the balance of the year,” U.S. Xpress Enterprises Inc. CEO Eric Fuller said.

“To this extent, and to prudently manage our cash flows, we have reduced our [capital expenditure] budget to $110 million to $130 million, as compared to our previous guidance of $170 million to $190 million,” he said. “The reduction will come from a combination of deferred tractor deliveries and financing more equipment with operating leases instead of debt.

“We do not expect this change to materially impact the average age of our company tractor fleet as we continue to manage our tractors to an approximate 475,000-mile replacement cycle.”

Said Don Daseke, who stepped down Aug. 15 as chairman and CEO of Daseke Inc., the largest flatbed and specialized carrier in North America: “Industry’s momentum has clearly slowed.”

That includes various areas of construction, such as lumber or roofing materials, according to the company. “Steel has been another one that had some ups and more downs during the course of the year, but it has been across those general commodity segments,” Chief Operating Officer Christopher Easter said.

At the same time, International, a unit of Navistar Inc., sold 3,713 trucks, up 37.5% from a year earlier.

Despite possible economic headwinds, International is confident it can expand its market share.

Company officials recently said it was realistic to expect its new-truck market share would increase by the end of its fiscal year in October to more than 18% — its U.S. retail sales market share was 14.5% through July. The goal is to increase that share to at least 25% by 2025.

Peterbilt Motors Co. sold 3,710 trucks in July, up 19.2% compared with a year earlier.

Kenworth Truck Co. sold 4,042, up 23.8% compared with the 2018 period.

Peterbilt and Kenworth are divisions of Paccar Inc.

Right now, there is excess capacity in the market, said W.M. “Rusty” Rush, chairman and CEO of Rush Enterprises Inc., which operates 100 Rush Truck Centers that sell medium- and heavy-duty trucks in 22 states.

“Class 8 orders have decreased significantly in the past few months. As a result, Class 8 truck sales could begin to decline as early as the fourth quarter of this year,” Rush said during a recent earnings conference call.