Senior Reporter

July Class 8 Sales Jump Amid Demand for Safety Tech

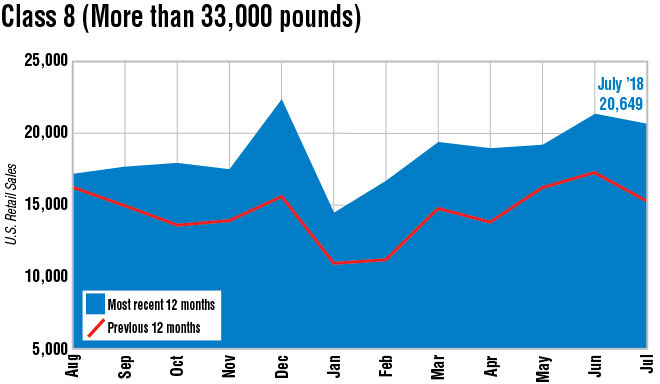

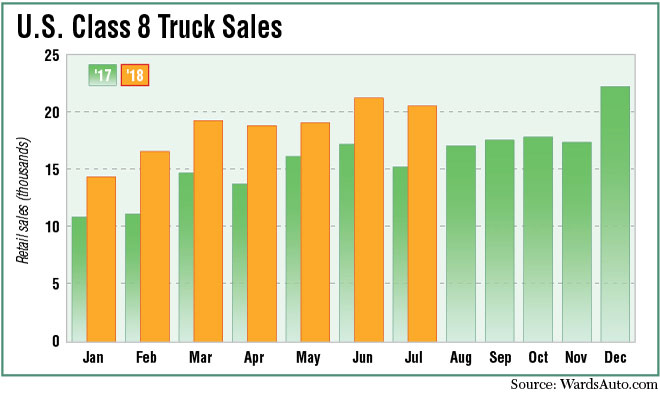

U.S. Class 8 retail sales in July were the second-highest of the year, increasing by more than 33% as they cleared 20,000.

WardsAuto.com reported that sales climbed to 20,649, up 34.8% from 15,317 from the same period a year ago.

For the first seven months, sales vaulted to 130,638 compared with 99,648 in the same 2017 period.

“We’re on track for the U.S.,” Steve Tam, vice president of ACT Research Co., told Transport Topics.

ACT forecasts U.S. Class 8 retail sales will total 252,000 this year.

Last year sales were 192,252, according to Ward’s.

“Just look around. Look at the economy. There are trucks everywhere on the highway. It’s crazy to see,” said Tam.

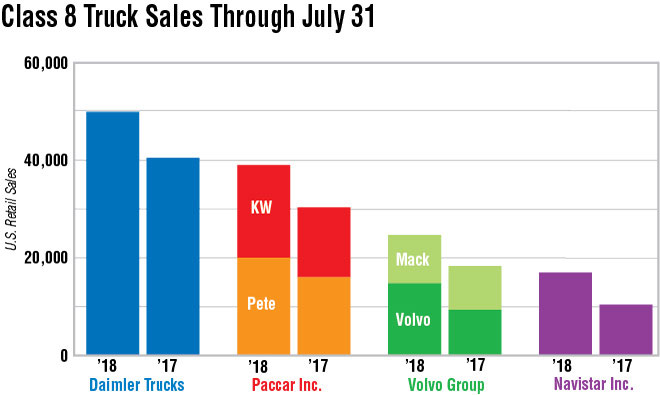

Freightliner remained the market leader with a 36% share after selling 7,438 units on July, a jump of 28.5% from a year earlier.

Freightliner is a unit of Daimler Trucks North America.

“DTNA is benefiting from a very favorable market situation with high demand across the entire industry. Implications of the tax reform, stabilized used-truck markets combined with a very strong freight environment, especially, boost the on-highway segment where we are well positioned with our new Cascadia and our Detroit & Detroit Assurance performance offerings,” according to a company statement.

Western Star, a niche brand at DTNA, sold 507 trucks, or 65 more compared with a year earlier, and earned a 2.5% share.

One carrier group is buying trucks to meet increased demand in one of its key business segments.

“We’re investing in capacity in our commercial glass fleet to continue to take market share,” Scott Wheeler, president of Daseke Inc., said during a recent earnings call with investment analysts.

“The emphasis is on specifying equipment that optimizes fewer mileage, resale value, interchangeability of equipment, reliability, consolidation of subcomponent manufacturers and, of course, pricing and delivery,” Wheeler said, speaking of the efforts of its new Daseke Fleet Services unit.

Daseke ranks No. 29 on the Transport Topics Top 100 list of the largest for-hire carriers in North America. Its strategy is to recruit well-run, open-platform and specialized carriers to merger into its group.

The market research company FTR viewed July’s sales total as a decent number, said Don Ake, vice president of the commercial vehicles unit there.

“However, it still indicates there are still supply chain issues,” he said.

The delays in getting trucks to buyers include production issues resting with the availability of some supplier components, although that is improving, Ake said. “To a greater extent, now, the lag comes from actually delivering the finished trucks to dealers and fleets — that part is still slow.”

Kenworth Truck Co. had the second-highest sales in July, 3,266, and earned a 15.8% share. Its volume was 34.3% higher than the same 2017 period.

Peterbilt Motors Co. notched 3,112 sales, good for a 15.1% share, and notched a 20.3% year-over-year gain.

Kenworth and Peterbilt are brands of Paccar Inc.

International Truck had sales rise to 2,701, up 66.2% from a year earlier, for a 13.1 % share.

International is a unit of Navistar Inc.

One truckload carrier is taking delivery of 20 new LT Series vehicles from International in late August and into September of as part of its replacement cycle.

“Even though the market was extremely tight and stretched out, in terms of build time and availability because of the capacity crunch, we planned for that. We got exactly what we wanted. We try to be proactive with [timing] our equipment purchases,” said Jarit Cornelius, vice president of asset maintenance and compliance at Sharp Transport Inc.

Previously, Sharp had “kind of dipped our toes in the water” with collision mitigation systems, he said. Then it dove in.

The new trucks will have Bendix’s Wingman Fusion technology, its premier version. “It was definitely a no-brainer, for us,” Cornelius said.

Sharp, based in Ethridge, Tenn., operates 125 Class 8s in its truckload division. It recently launched a flatbed division with 15 additional trucks purchased used.

Volvo Trucks North America posted sales of 2,325, up 81.4% from a year earlier, earning an 11.3% share.

“Professional drivers are in high demand, which is driving interest in premium comfort and productivity features,” VTNA Vice President of Marketing Magnus Koeck said, citing Volvo’s active driver assist, remote diagnostics and over-the-air programing as safety-enhancing technologies that also increase uptime.

Mack Trucks sold 1,300, up 13.9% from a year earlier, and good for a 6.3% share.

“We expected to see share impact due to the timing of the launch of the Mack Anthem and a purposely slow ramp to full production in order to maintain quality, both of which also took place during an upswing in the market,” said Jonathan Randall, Mack Trucks senior vice president of North American sales.

“We’ve now hit our stride, and are seeing expected growth, with our best days ahead of us,” Randall said.

VTNA and Mack are brands of Volvo Group.

Other truck makers did not respond to a request for comments.