Bloomberg News

Initial Jobless Claims Rise for First Time in Five Weeks

[Ensure you have all the info you need in these unprecedented times. Subscribe now.]

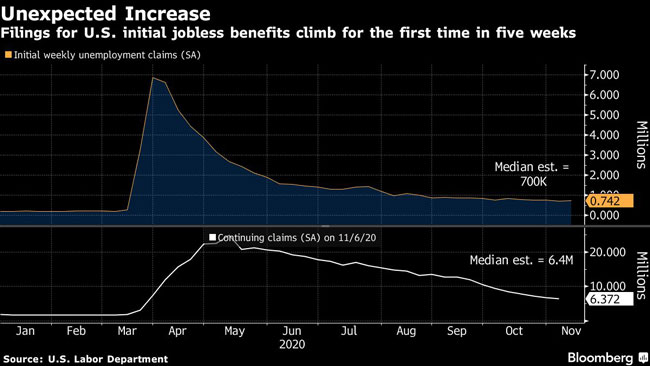

Applications for U.S. state unemployment benefits rose for the first time in five weeks and remained well above pre-COVID levels, suggesting the labor market recovery is slowing amid a surging pandemic and fresh business restrictions.

Initial jobless claims in regular state programs totaled 742,000 in the week ended Nov. 14, up 31,000 from the prior week and compared with expectations for a decline, Labor Department data showed Nov. 19. On an unadjusted basis, the figure increased by about 18,000. The week included Veterans Day, and claims data tend to be more volatile around holidays.

Continuing claims — the total pool of Americans on ongoing state unemployment benefits — fell 429,000 to 6.37 million in the week ended Nov. 7. The number of Americans claiming extended assistance continued to rise as many unemployed exhausted regular state benefits.

The main figures compared with economists’ projections for 700,000 initial claims and 6.4 million continuing claims, based on the median estimates in Bloomberg surveys.

The U.S. labor market is already suffering anew from the record pace of COVID-19 infections, which has spurred a new wave of government restrictions on businesses across the country. Restaurants are likely to be hit particularly hard by the loss of indoor dining in colder weather, and a lack of fresh stimulus will also weigh on the recovery during the wait for widespread vaccine distribution.

“The road to recovery is likely to be quite rocky, unfortunately,” Nathan Sheets, PGIM Fixed Income’s chief economist and a former Federal Reserve official, said on Bloomberg Television. “The virus and the restrictions being put in place to fight the virus are likely to take a bite out of economic activity over the next, say, three or four months.”

U.S. stocks fell at the open, while 10-year Treasury yields were lower and the dollar rose.

The increase in initial jobless claims was driven by a surge in Louisiana, where filings more than quadrupled from the prior week to 42,724, a six-month high, on an unadjusted basis. Claims also rose in Massachusetts, Texas and Virginia, while Illinois, Florida and New Jersey saw declines.

Initial claims for Pandemic Unemployment Assistance, which provides benefits to self-employed and gig workers, also quadrupled in Louisiana to almost 40,000 last week, the highest since April.

Continuing claims for PUA decreased nationally by 751,000 to 8.68 million in the week ended Oct. 31.

More people have been rolling onto extended programs like Pandemic Emergency Unemployment Compensation, but these programs will expire by year’s end and leave many without government aid. PEUC claims increased about 233,000 to 4.38 million.

A separate report Nov. 19 from the Federal Reserve Bank of Philadelphia showed that a gauge of employment at firms in the region’s manufacturing sector showed a fifth straight month of expansion and reached the highest level since July 2019. The bank’s broader gauge of factory activity continued to grow, but at a slightly slower pace.

Want more news? Listen to today's daily briefing:

Subscribe: Apple Podcasts | Spotify | Amazon Alexa | Google Assistant | More