Infrastructure Boom Seen Roaring Ahead Regardless of Midterm Result

Encouraging spending on roads, bridges and other infrastructure could be one of the rare areas where a Democrat-controlled Congress finds common ground with the Trump administration.

Private investors in such projects aren’t relying on any breakthroughs, regardless of how next week’s midterm elections shake out.

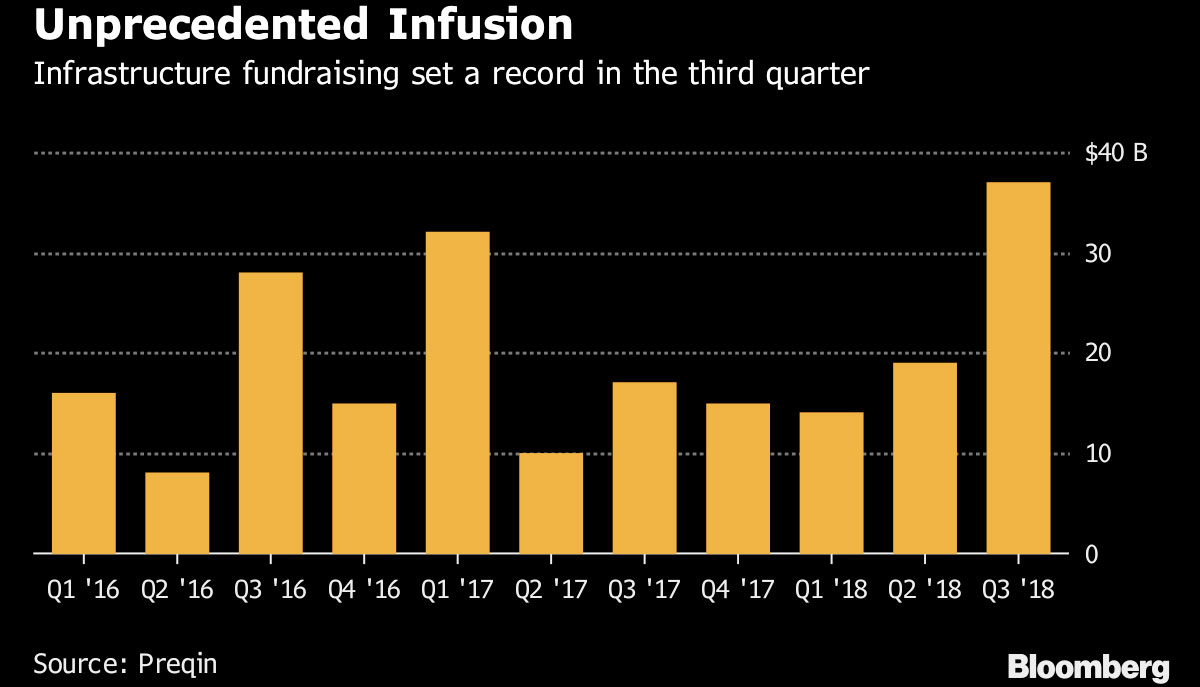

Instead, they’re plowing forward with plans to invest in everything from data centers to airport terminals — assets that require little or no participation from the federal government. Infrastructure funds raised a record $37 billion globally in the third quarter, according to data provider Preqin. Almost three quarters of that was dedicated toward transactions in North America.

“We’re still hopeful the federal government will produce an infrastructure bill, but that’s not the only way” to get money flowing to projects, said Andrew Marino, co-head of Carlyle Group LP’s Global Infrastructure Opportunity Fund. “Private capital is plentiful and already making a difference.”

Kevin Dietsch/Bloomberg News

President Donald Trump’s election in 2016 fueled optimism that the U.S. would embark on a major infrastructure spree. But his administration’s efforts to pass any legislation stalled as members of Congress wrangled over how to pay for it. Democrats have revived talk of approving funding to repair and upgrade the nation’s roads, bridges and tunnels as they seek to take back control of Congress. House Minority Leader Nancy Pelosi recently said she wanted to “build the infrastructure of America from sea to shining sea.”

Investors who’ve watched Congress struggle to pass annual spending bills aren’t exactly convinced an infrastructure package is coming any time soon from Washington. Any renewed effort would be complicated by the fact that federal budget deficits are ballooning. Partisan rancor could make it harder still.

Even without a major infrastructure package from Congress, there are pockets where Washington is already helping. The Federal Aviation Administration, for instance, is doling out nearly $3.2 billion to improve airports around the U.S. The FAA-backed projects range from relocating a runway at Aspen-Pitkin County airport in Colorado to completing a new taxiway at Atlanta’s Hartsfield-Jackson Atlanta International Airport.

But there’s much more work to be done. That’s why pensions, sovereign wealth funds and other institutions have been so enthusiastic about investing in infrastructure. The projects have the potential to generate attractive, relatively stable returns — and there are plenty of assets that can be pursued now.

Among them: Terminal One at New York’s John F. Kennedy International Airport, which Carlyle is helping to redevelop. The Washington-based firm also recently announced plans to build a crude oil export terminal in Texas. KKR & Co., which closed a $7.4 billion infrastructure fund in September, has focused on telecommunications towers and energy storage and transportation assets, better known as midstream. GI Partners is seeking to raise more than $1 billion for a fund that will invest in data centers and other digital infrastructure.

Despite these diverse ambitions, record capital raising has stoked fears that investors will end up chasing the same deals, bidding up prices and hurting fund performance. “The increased competition for traditional brownfield infrastructure assets is leading to higher entry multiples and lower overall returns,” according to a report from consultancy McKinsey & Co.

Dry powder, the money that funds have yet to invest, has risen almost 9% this year to $173 billion, according to Preqin. That number is almost certain to expand, with Global Infrastructure Partners and Brookfield Asset Management Inc. both set to raise in the vicinity of $20 billion for their next infrastructure funds.

‘Buoyant’ Market

Not all fundraising has been a cinch. Blackstone Group LP’s effort to amass a potential $40 billion fund has been shy of expectations. One possible reason: The firm’s cornerstone investor is Saudi Arabia’s wealth fund, with which it struck unusual concessions in exchange for the provision of at least half its war chest, conditional upon matching contributions from others. People familiar with the matter have said there has been concern the nation’s outsize participation could result in it seeking to influence the fund’s investments, though New York-based Blackstone has said it retains sole investment discretion.

With four days until the election, polls are giving the Democrats a much higher chance of recapturing the House than the Senate. The result, though, probably won’t even amount to a speed bump for infrastructure investors, according to Tim Bath, managing director and head of infrastructure at investment bank PJ Solomon.

“The market is buoyant from an activity perspective and there are record amounts of capital being raised,” he said. “That trend is expected to continue irrespective of the outcome of the midterms.”