Inflation Remained Muted in October Despite Solid Economy

U.S. inflation showed little sign of breaking out in October despite strength in the economy and wages, likely keeping the Federal Reserve on its path of gradual interest-rate increases.

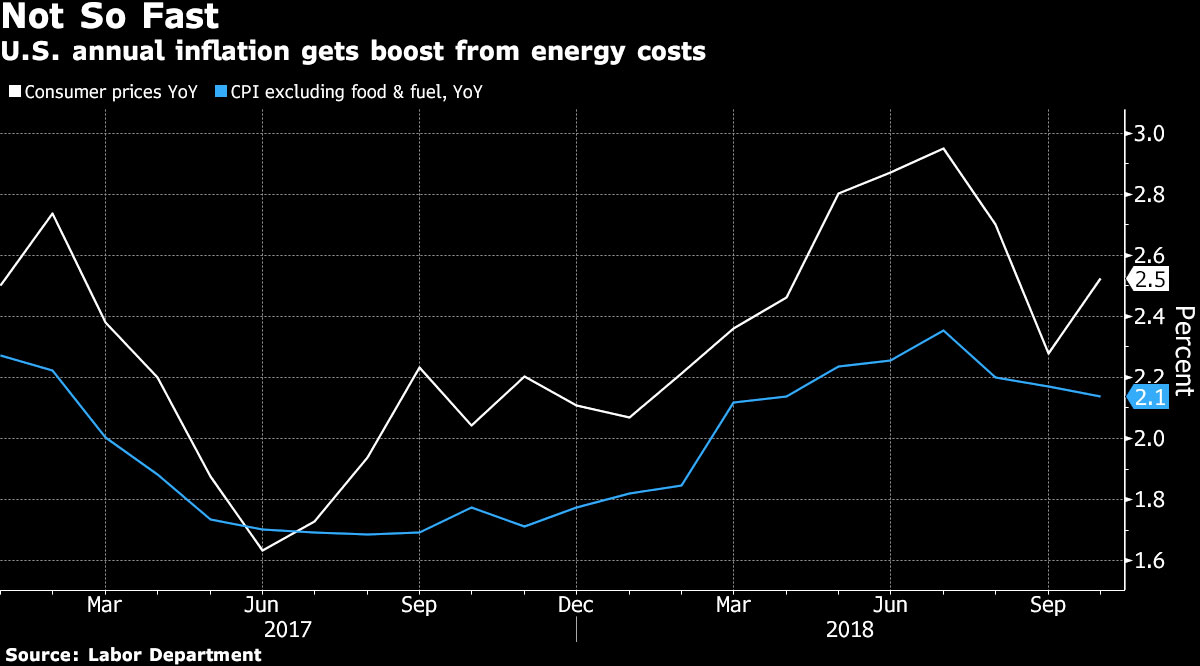

Excluding food and energy, the core consumer-price index rose 2.1% from a year earlier, according to a Labor Department report Nov. 14, slightly short of the median estimate of economists for a 2.2% increase, which was also the gain in September. It was up 0.2% from the prior month, the fastest gain in three months and in line with projections.

These are pretty steady inflation prints, nothing in here that argues inflation is going to overshoot.

Omair Sharif, senior U.S. economist at Societe Generale

Inflation is gradually gaining traction, with help from solid household demand and a tight job market, while the tariff war with China may further boost price pressures. At the same time, some of the latest advance reflected quirks such as a rebound in used-car prices, and the figures may potentially be seen as validating a recent decline in inflation expectations in financial markets, amid tumbles in crude oil and equities.

“These are pretty steady inflation prints,” with “nothing in here that argues inflation is going to overshoot,” said Omair Sharif, senior U.S. economist at Societe Generale. Also, there’s little to concern policy makers, so they’ll “continue to stay gradual” with interest-rate hikes, he said.

The biggest gain in energy prices since January boosted the broader consumer-price index, which rose 0.3% in October, matching estimates and following a 0.1 % gain the prior month. It was up 2.5% from a year earlier, also in line with forecasts. The CPI report showed gasoline prices rose 3% from the prior month on a seasonally adjusted basis.

Investors expect the Fed to go ahead in December with this year’s fourth interest-rate hike, and policy makers see several more increases in 2019. While the Fed’s preferred gauge of inflation is a separate measure related to consumption, those October figures will be released on Nov. 29, making the CPI a key report at this time.

Policy makers and economists look at core inflation as a better indicator of underlying trends because the broader figures are subject to bigger swings from energy prices.

The Fed-preferred index and its core gauge both rose 2% in September from a year earlier; those measures tend to run slightly below the Labor Department’s CPI. Fed Chairman Jerome Powell’s speech on the economy the evening of Nov. 14 in Dallas may offer more clues on inflation and the path of interest rates.

Based on Nov. 14 numbers, Morgan Stanley projected the Fed’s preferred core price gauge cooled to a 1.8% annual gain in October.

The October advance in the CPI benefited from some bounce-back from September: used-car prices rose 2.6%, the most since 2009, after posting the biggest monthly drop in 15 years. The measure has been volatile since the Labor Department changed its methodology earlier in 2018.

New car prices, by contrast, weighed on inflation in October, falling 0.2% from the prior month, the biggest drop since April. Price gauges for communication, recreation and personal care also declined. Meanwhile, categories showing relatively slow increases included shelter, up 0.2%, while apparel costs rose 0.1%.

The latest report brought the core CPI’s three-month annualized increase to 1.6%, the slowest pace in more than a year.

A separate report released Nov. 14 by the Labor Department showed inflation-adjusted hourly earnings fell 0.1% in October from the prior month. They were up 0.7% from a year earlier.

While the impact of tariffs is yet to show up in a big way in the CPI figures, economists say that may change as 10% tariffs on $200 billion of Chinese imports are due to rise to 25% in January in the absence of a breakthrough in negotiations. The Trump administration has also threatened to escalate tariffs to cover all imports from China.