Highway Law, Acquisitions, Technology Highlight a Historic Year in Trucking

This story appears in the Dec. 21 & 28 print edition of Transport Topics.

Historians may look back at 2015 as the most important year for the U.S. trucking industry since deregulation in 1980.

In some cases, history was made by the federal government for finally making good on agenda items years in the making, including long-term highway funding legislation and a final rule mandating use of electronic logs. The government’s greenhouse-gas proposal, laying out suggested standards through 2027, also ensured that 2015 would be remembered for a long time to come.

BEST CARTOONS OF THE YEAR: From TT cartoonist Philip "Shade" Kightlinger

TOP NEWS STORIES OF THE YEAR: Captured as a photo gallery

LIVEONWEB: Video review of 2015, preview of 2016

INTERACTIVE GRAPHIC: Week-by-week 2015 national diesel price

In other areas, history was made through the continued explosion — and rapid maturity — of technology.

The debut of Freightliner’s autonomous-driving Inspiration truck at the Hoover Dam in early May received international attention, with developments being monitored as closely by publications such as “Wired” as the one you are reading.

Other companies, including Peterbilt Motors Co., also demonstrated autonomous-driving capabilities, and techniques such as platooning and automatic braking seem closer to reality than science fiction compared with just 12 months ago.

Likewise, an unprecedented level of billion-dollar mergers and acquisitions is reshaping the domestic trucking and global freight-transportation markets, including XPO Logistics’ purchase of Con-way Inc. and purchases by UPS Inc. and FedEx Corp.

This activity took place with diesel and gasoline prices falling to levels some experts had suggested might never be seen again.

The U.S. diesel average is ending the year under $2.40 a gallon, more than 70 cents below where it started 2015. The gas average was threatening to slip below $2 as the year came to a close, down more than 60 cents from the start of the year.

Despite these savings, costs for almost everything else, including driver compensation, equipment, maintenance and parts, still were increasing, reports during the year showed.

Still, retail truck sales through November were 228,024, up 15.1% from a year earlier, and the third-highest total of any November since 2000. Coming off a record year in 2014, trailer orders trailed year-ago levels but remained above historic norms. Manufacturers said they remained busy working off existing backlogs.

History also was witnessed at American Trucking Associations, with Pat Thomas, senior vice president of state government affairs at UPS Inc., becoming the federation’s first chairman from the nation’s largest transportation firm. He succeeded Duane Long, president of Longistics in Raleigh, North Carolina, at the conclusion of the federation’s Management Conference & Exhibition.

During that annual event in October, ATA President Bill Graves informed Transport Topics he planned to depart the organization he has led since 2003 at the conclusion of 2016.

Here is a closer look at the year in trucking:

Legislation

The signing of the Fixing America’s Surface Transport Act, the country’s first multiyear highway funding bill signed into law in more than a decade, was the biggest transportation news out of Washington. It made major changes to trucking policies, such as the removal from public view of controversial Compliance, Safety, Accountability scores. Those scores, managed by the Federal Motor Carrier Safety Administration, came down minutes after President Obama signed the FAST Act on Dec. 4.

The five-year, $305 billion FAST Act establishes a pilot program meant to bring in younger veterans and reserve members to interstate trucking, and it paves the way for the use of hair testing to become a pre-employment screening tool as an alternative to urinalysis.

It took years of negotiations, as well as 36 highway funding extensions since 2009, for policymakers to agree on a highway bill that ensures long-term funding for nationwide infrastructure projects without raising federal fuel taxes.

A week after the FAST Act was signed, FMCSA announced its final rule mandating the use of electronic logging devices by truckers to enforce hours-of-service regulations. The rule, which goes into effect in December 2017, “will improve compliance with the HOS rules,” FMCSA said.

Several weeks earlier, another final rule was issued to prevent coercion of truck drivers.

Regulators in June also issued a proposal to tighten greenhouse-gas emissions for trucks. The Environmental Protection Agency and National Highway Traffic Safety Administration jointly proposed phasing in more stringent standards for heavy- and medium-duty trucks from 2021 through 2027. It also includes the first-ever trailer regulation, starting in 2018, and includes separate standards for engines and vehicles. A final proposal is expected during 2016.

In August, Obama nominated Scott Darling to become FMCSA’s permanent administrator. Now the agency’s acting administrator, Darling awaits confirmation by the Senate Commerce Committee. At an address to trucking leaders in October, Darling said 2016 would be “the year of partnerships” for FMCSA and industry stakeholders.

The Senate in 2015 confirmed several top DOT officials, including Obama’s picks to lead the Federal Highway Administration, the Federal Railroad Administration, and the Pipeline and Hazardous Materials Safety Administration.

Meanwhile, the restart provision of the HOS rule remained suspended in 2015 as FMCSA said it still was working on a congressionally mandated review. The agency said it expects to finalize the study in February.

Ahead of the e-log mandate, regulators in November issued a final rule that prohibits fleets, shippers and brokers from coercing truck drivers to violate HOS and other safety regulations. The rule was developed in response to the 2012 transportation law, MAP-21.

Over the course of the year, the federal government worked on a number of other rules, including minimum training standards for entry-level commercial vehicle drivers, safety fitness determination and speed limiters.

The year began with the Department of Transportation announcing that Mexican carriers that meet operating and financial standards would be granted operating authority in the United States. The opening of the border, a mandate under the North American Free Trade Agreement, marked the end of more than two decades of disputes. The announcement, which came three months after a pilot program for Mexican carriers ended, happened despite a DOT’s Inspector General report noting there were too few participants in the pilot program to determine key safety metrics.

Economy

The U.S. economy continued at an uneven, slow improvement pace, illustrated by gross domestic product growth that was less than 1% in the first quarter but nearly 4% in the second quarter.

This pattern led to truck tonnage growth seesawing, but eventually rising to the point that the most recent readings were back at record levels first set in January, when the index stood at above 135.

The result, when combined with a slight increase in capacity due to changes in hours-of-service rules in December 2014, was a general balance of freight demand with the supply of trucks. Although contract rates had risen as much as 7% in 2014 compared with 2013, the pace of rate growth slackened throughout 2015.

Driver retention and recruitment continued to be cited as a headache for truckload fleets, but most turnover rates during the year showed little change. By year-end, the turnover for large and small fleets was nearly identical at about 95%, but short of record levels. Less-than-truckload turnover remained in the 10% range.

The year also will be remembered as the first one that saw intermodal rail shipments surpass all other forms of cargo movement, reflecting increasing service offering provided by truckers and freight railroads.

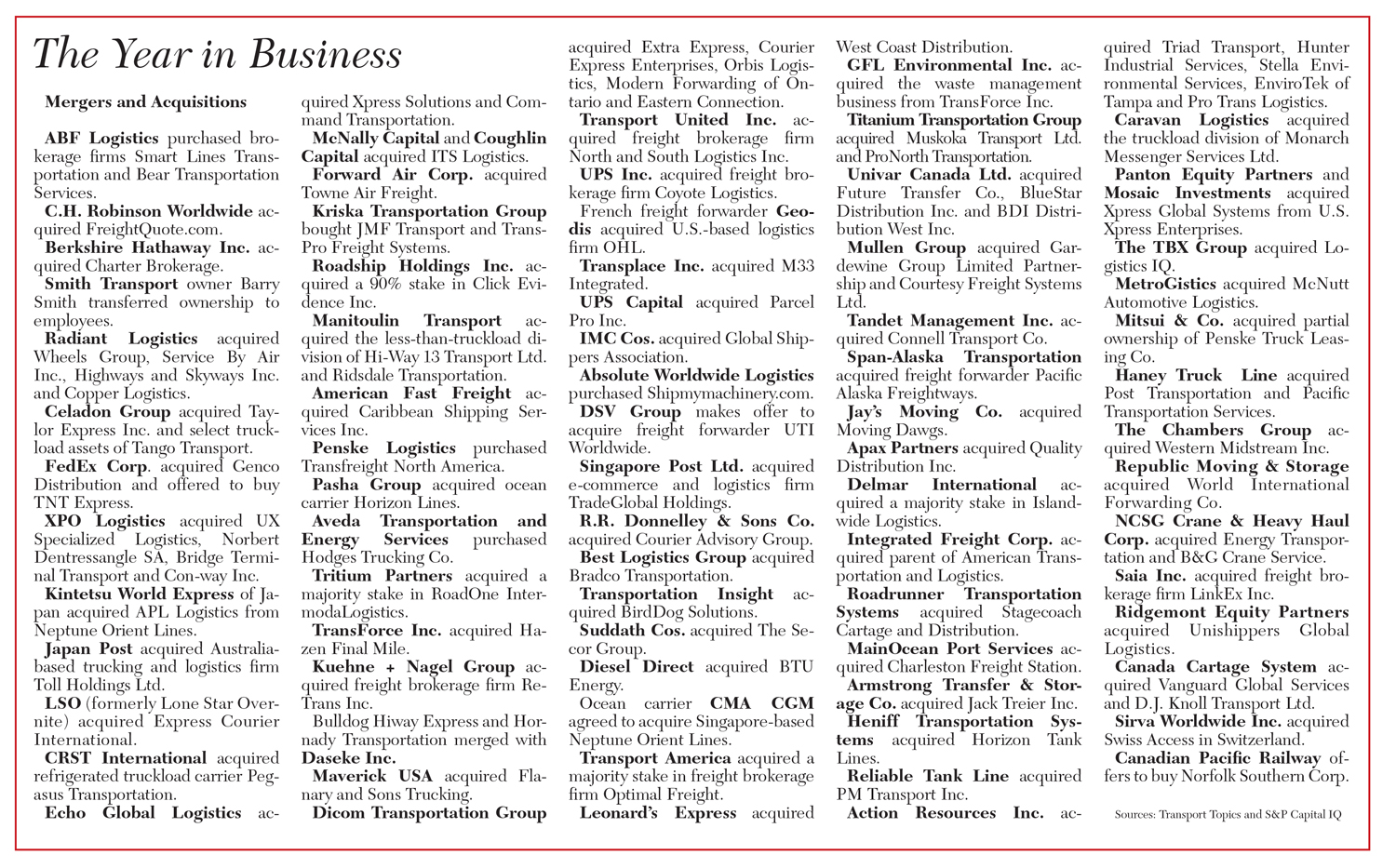

Mergers & Acquisitions

It was an epic year for mergers and acquisitions, with investor Brad Jacobs extending the reach of XPO Logistics to include European contract logistics and freight carrier Norbert Dentressangle, port drayage provider Bridge Terminal Transport and U.S.-based trucking and logistics firm Con-way Inc.

UPS and FedEx, the nation’s two largest for-hire carriers, respectively, were active as well. UPS greatly expanded its freight brokerage presence with the purchase of Chicago-based Coyote Logistics; and FedEx picked up distribution specialist Genco and received the green light from antitrust authorities in the United States and Europe to acquire the international package delivery company TNT Express in the Netherlands.

Tom Nightingale, vice president of transportation and logistics for Genco, said the move by FedEx in February “set the tone” for a year in which the value of mergers and acquisitions globally would exceed a record $4.1 trillion.

A number of monster deals involved international transportation firms, including the sale of APL Logistics and Toll Group to separate Japanese buyers, the purchase of UTi Worldwide by Danish freight forwarder DSV Group and the acquisition of U.S. distribution firm OHL by French forwarder and package delivery group Geodis.

Consolidation among brokerage and trucking firms in North America also was apparent, with C.H. Robinson Worldwide, the nation’s largest freight brokerage firm, acquiring online broker FreightQuote Inc. and Echo Global Logistics buying fellow broker Command Transportation.

Daseke Inc. added Bulldog Hiway Express and Hornady Transportation to its flatbed holdings, while Montreal-based TransForce Inc. bought truckload carriers Transport Corp. of America and Contrans Group in Canada. Additionally, Forward Air Corp. took over Towne Air Freight, its main rival in the business of hauling air cargo.

Apax Capital acquired bulk carrier Quality Distribution in what was a relatively quiet year for private equity investment in trucking.

Toronto-based Element Financial Corp. burst onto the scene with its purchase of PHH Arval and GE Capital Fleet Services, and BMO Financial Group parlayed its expertise in transportation lending to acquire GE Capital Transportation Finance.

Further consolidation continued within the trucking technology space.

PeopleNet purchased Cadec Global in May, expanding its presence in the private-fleet and food-service markets.

Fleet-tracking firms Teletrac and Navman Wireless, both owned by Danaher Corp., merged during the year. Omnitracs, which acquired XRS Corp. and Roadnet Technologies in recent years, consolidated its holdings under a unified brand.

Technology

Freightliner’s Inspiration, which became the first licensed autonomous-driving truck on public highways from the state of Nevada in May, was just one of a number of important trucking technology developments in 2015.

Peterbilt Motors Co. demonstrated a self-driving prototype of its own, with infrared capability to help detect obstacles at night.

Peloton Technology made further inroads with its platooning technology, which electronically links a convoy of two or more trucks. The company said the system would be introduced into fleet operations for testing next year in Texas. Volvo Group, the parent of Volvo Trucks and Mack Trucks, is among the companies that announced investments in Peloton during the year.

Meanwhile, manufacturers continued to invest in remote diagnostics and fleet-management technology.

In June, Daimler Trucks North America purchased a minority stake in Zonar Systems, which has collaborated with the truck maker on the development of DTNA’s Virtual Technician remote diagnostics program.

Kenworth Trucks and Peterbilt, both part of Paccar Inc., each launched its own remote diagnostics systems, while Navistar Inc. said its open-architecture remote diagnostics platform, OnCommand Connection, would be a standard feature on all new International-brand trucks.

In August, Volvo and Mack said they were partnering with Omnitracs to develop integrated fleet-management services. They said those applications would be enabled by the built-in telematics hardware that drives Volvo’s Remote Diagnostics and Mack’s GuardDog Connect platforms. Providers of onboard video technology continued to make progress with fleets seeking to improve safety and add liability protection by capturing video that potentially could exonerate drivers in the event of an accident.

Makers of collision-mitigation systems and related safety technologies also saw wider acceptance, including an announcement from UPS that it was making Bendix Commercial Vehicle Systems’ technology standard equipment on every Class 8 tractor the company orders.

And as the year drew to a close, the proliferation of Uber-like smartphone applications designed to match shipments with freight carriers was rapidly growing and likely would be among the top trends to watch as trucking enters the new year.