Bloomberg News

Goods-Trade Deficit Widens for the First Time Since March

[Stay on top of transportation news: Get TTNews in your inbox.]

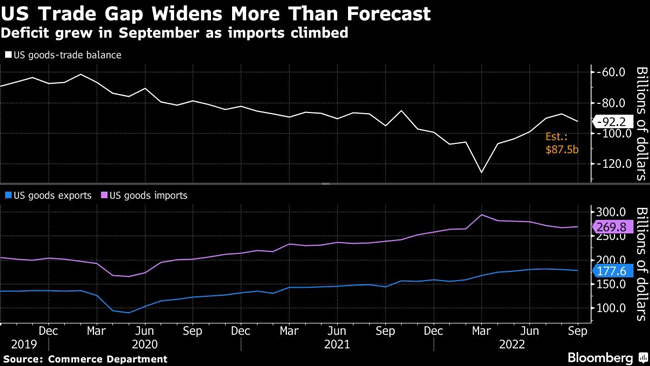

The U.S. merchandise-trade deficit widened in September for the first time in six months as imports grew and some exports plunged.

The shortfall widened 5.7% to $92.2 billion last month, Commerce Department data showed Oct. 26. The figures, which aren’t adjusted for inflation, compared with a median estimate for a gap of $87.5 billion in a Bloomberg survey of economists.

Exports declined 1.5% to $177.6 billion. Imports rose to $269.8 billion, also the first increase since March.

Inbound shipments of consumer goods rose 1.4% to $69 billion. While imports of consumer merchandise have fallen from a record earlier this year, they remain well higher than the pre-pandemic average.

A 3.1% drop in the value of exports of industrial supplies led the overall decline. Outbound shipments of foods, feeds and beverages plummeted 14%, but account for less volume. Meantime, exports of autos jumped 5%, reversing much of the prior month’s decrease.

The Federal Reserve’s most aggressive monetary tightening since the early 1980s has sent the U.S. dollar surging, with the currency strengthening for a fourth straight month in September. While that lowers the cost of imports, it also weakens demand in international markets for U.S.-produced goods.

That’s showing up in earnings of domestic companies. Microsoft Corp. posted its weakest quarterly revenue growth in five years, partly because of foreign-exchange rates. Tesla Inc. blamed weaker-than-expected third-quarter sales in part on the dollar, along with production and delivery bottlenecks.

However, as the Fed charges on with its aggressive rate-hike campaign, recession concerns are mounting and upping bets that the central bank will have to slow its pace of increases or reverse course. A gauge of the dollar’s strength fell to a three-week low Oct. 26, and a sustained weakening could be a boon to U.S. exporters.

TT's Eugene Mulero joins host Mike Freeze to discuss the midterm elections, and what the fight for control of Congress will mean for trucking. Tune in above or by going to RoadSigns.ttnews.com.

U.S. ports had for months been overwhelmed by an influx of goods that triggered supply chain logjams and delivery delays, but that is showing signs of abating due to logistics improvements and as interest-rate increases start to weigh on demand.

The data precede the government’s first estimate of third-quarter gross domestic product on Oct. 27, which is forecast to show positive growth for the first time this year, due in part to fewer imports.

Retail inventories increased 0.4% in September to a record $744 billion from a month earlier as companies stock up on merchandise amid still-uncertain supply chains. That also likely portends discounts ahead for the holiday shopping season.

Stockpiles at wholesalers climbed 0.8% to $921.7 billion.

More complete September trade figures that include the balance on the services account will be released on Nov. 3.

— With assistance from Chris Middleton.

Want more news? Listen to today's daily briefing below or go here for more info: