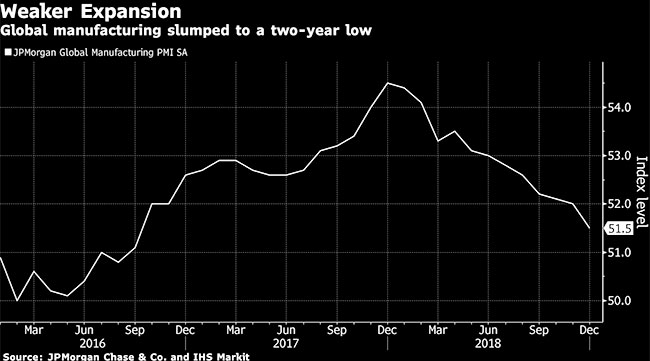

Global Factory Slump Adds to 2019 Central Bank Challenges

Manufacturing gauges across the world’s largest economies stumbled at the end of last year, starting 2019 with fresh challenges for global growth and central banks.

The global manufacturing index from JPMorgan Chase & Co. and IHS Markit fell in December to the lowest level since September 2016 as measures of orders and hiring weakened, data showed Jan. 2. That followed other IHS Markit reports showing factory conditions slumped across Asia’s most export-oriented economies, with China’s signaling contraction for the first time since mid-2017 as Taiwan, Malaysia and South Korea also point to declines. Factory growth in the euro area fell to the lowest in almost three years.

In the U.S., evidence is mounting that President Donald Trump’s trade war is becoming a greater headwind for producers. Five Federal Reserve indexes of regional manufacturing all slumped in December, the first time they’ve fallen in unison since May 2016. Another gauge of American manufacturing, due Jan. 3, is projected to fall to an eight-month low.

The growing pile of weaker data may increase pressure on the Fed to signal an immediate pause in its quarterly pace of interest-rate increases. Officials already have said they intend to slow down the pace of hikes this year. As policy makers raised rates in December for the fourth time in 2018, they penciled in just two moves for 2019, according to the median projection of Fed governors and district-bank presidents.

That’s still more than many investors anticipate, with interest-rate futures pointing to no moves in 2019 and a potential rate cut next year. Amid those expectations, financial markets reacted badly to the December hike and the lack of a stronger signal on when the Fed would pause. The S&P 500 stock index in December had its worst month since February 2009.

Bloomberg News

Trade tensions between the U.S. and China are hurting demand across Asia’s manufacturing hubs and export-oriented European economies including Germany. The International Monetary Fund in October cut its 2018 and 2019 global growth projections, citing trade uncertainty.

China’s central bank said Jan. 2 it will adjust the calculation of some banks’ reserve ratios, a move aimed at boosting the impact of a previous easing step as the economy slows. Growth in the world’s second-largest economy is forecast to decelerate to 6.6% in 2018, the weakest pace in almost three decades, and continue slowing this year and next.

Meanwhile, economists project slower U.S. expansion and job growth this year as fiscal stimulus that took effect in early 2018 begins to fade. What’s more, a government shutdown has postponed the release of some U.S. indicators, including those for international trade, adding frustration for economists and investors seeking guidance from fresh data.

Bloomberg’s Global Trade Checkup is softening after an earlier rush to front-load export orders ahead of threatened tariffs. While Trump has signaled negotiations with China are making progress, economists remain wary that talks could stall ahead of a March 1 deadline. U.S. officials are withholding judgment on China’s efforts to ease trade tensions at talks next week, raising the prospect that Beijing’s reforms won’t satisfy Trump’s demands.

On Jan. 4, the U.S. jobs report is projected to show 180,000 net hires in December, the lowest median projection ahead of the report in almost a year. That same day, Fed Chairman Jerome Powell is scheduled to make his first public remarks of 2019 in Atlanta. Investors will be listening closely for any hint that a March increase is unlikely.