Senior Reporter

Freightliner Catapults September Class 8 Sales to Record High

[Stay on top of transportation news: Get TTNews in your inbox.]

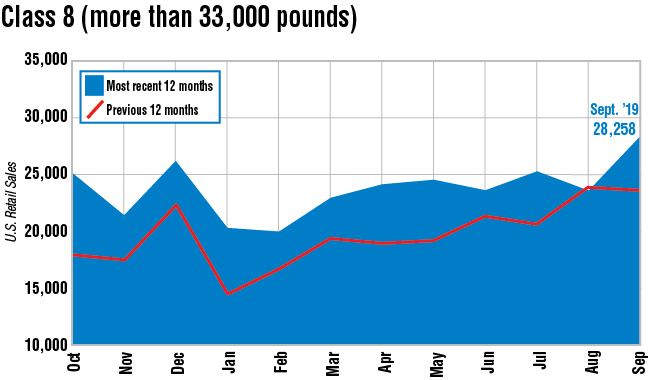

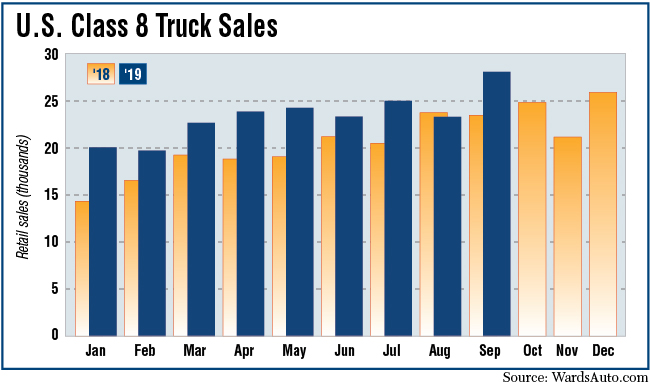

U.S. Class 8 retail sales punched through to an all-time record high of nearly 29,000 in September, WardsAuto.com reported, but analysts cautioned against reading it as a turnaround.

Sales hit 28,258, according to Ward’s. That was 19.5% higher than a year earlier, when sales were 23,648.

The sales record had been 26,462, set in December 2006.

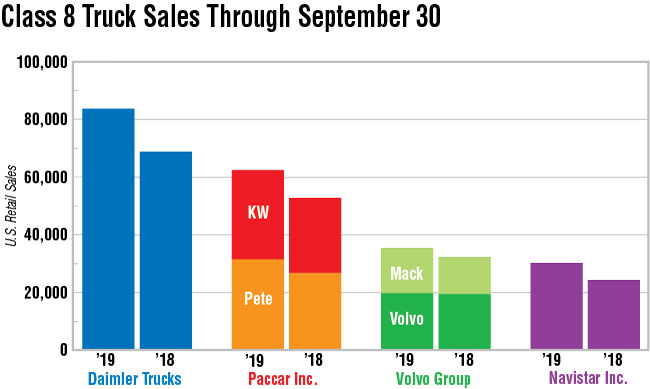

Year-to-date sales were 211,720, compared with 178,199 a year earlier.

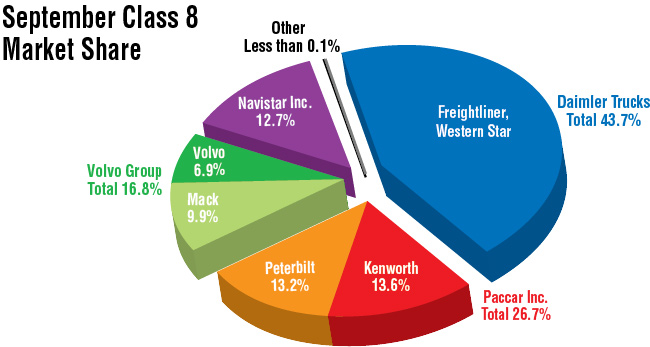

Most of September’s gain can be attributed to market leader Freightliner, a brand of Daimler Trucks North America.

Freightliner posted sales of 11,654, up 38.5% from 8,415 a year earlier. Its September total was about 3,300 more than Freightliner’s monthly average of 8,300 from January to August, according to Ward’s.

“As the market normalizes and our supply constraints ease, we are well-positioned to deliver what our customers want, when they want it, and remain the undisputed market leader,” said Richard Howard, senior vice president of sales for DTNA.

Freightliner and Western Star are brands of DTNA.

“Looking at our success holistically, both of our brands’ Class 8 sales are doing extremely well this year, with Freightliner and Western Star up roughly 22% and 19.6%, respectively, year-to-date,” he added.

Western Star saw sales climb to 717 compared with 386 a year earlier.

Going forward, ACT Vice President Steve Tam doesn’t expect the market to top September’s volume. “I don’t think we are going to see something above the September number,” he said. “I think it was just an anomalous reading.”

Tam suggested September’s sales could be attributed to buyers other than large fleets.

“Some of the mid-sized fleets that typically run older equipment — from a freight perspective, from a profitability perspective, even though that all has started to slow — they’re still doing pretty well, better than normal. So I think they are taking advantage of those profits to refresh, renew, or lower their average fleet age,” he said.

Ake

Don Ake, Freight Transportation Research’s vice president of commercial vehicles, agreed September’s pop is “definitely” not a trend.

“The other thing September explains is why inventory numbers were spiking in the summer,” Ake said. In August, inventory hit an all-time record of about 80,000 Class 8 trucks, “with market conditions, freight and what have you, slowing down.”

At the same time, ACT reported the key risk to all vehicle market forecasts — and the U.S. economy broadly — remains the trade war with China. U.S. manufacturers and farmers are struggling to compete on the tilted global playing field, according to ACT, which cited the U.S. consumer as the key driver of mid-term growth.

Others have cited record levels of consumer debt as a cautionary tale.

The Center for Microeconomic Data’s latest Quarterly Report on Household Debt and Credit found total household debt increased by $192 billion (1.4%) to $13.86 trillion in the second quarter of 2019.

That was the 20th consecutive quarter with an increase, and the total is now “$1.2 trillion higher, in nominal terms, than the previous peak of $12.68 trillion in the third quarter of 2008,” the report found. As the third quarter of 2008 began, the Great Recession took off, and it would last 18 months.

Among truck makers, Mack Trucks in September posted a 79.1% jump to 2,794. Through August, its monthly sales average in 2019 was 1,600.

“Though lower than recent historical highs, the majority of economic indicators, such as construction and consumer spending, remain relatively solid,” said Jonathan Randall, senior vice president of North American sales for Mack Trucks.

“The trucking industry is also still working through a large, though diminishing, backlog. Combined, these factors are what continue to drive positive Class 8 retail sales figures, which we anticipate will carry through the fourth quarter toward our North American Class 8 forecast of 325,000 units for 2019,” he added.

Volvo Trucks North America saw sales fall 15.7% to 1,951.

Mack and VTNA are brands of Volvo Group.

International, a unit of Navistar Inc., saw a 1.5% decline in sales to 3,590 compared with a year earlier.

“Right now we see that customers are valuing us more than just for the product that we deliver to them. So we hope that will continue into 2020,” said Persio Lisboa, chief operating officer of Navistar Inc. in September during the company’s most recent earnings call. “We’ve launched a very aggressive plan to transform our dealer network.”

Peterbilt Motors Co., a Paccar Inc. brand, saw sales rise 2.2% to 3,718 compared with the 2018 period.

Neil Frohnapple, an analyst with The Buckingham Research Group, recently surveyed Paccar dealers, and was told by a dealer in the West, “Peterbilt has been getting more aggressive with discounting lately, but right now everyone is getting more competitive on pricing to try to fill out their order boards for this year. Freightliner and Navistar continue to be very aggressive on pricing.”

Kenworth Truck Co., also a Paccar brand, posted sales of 3,832. That was an increase of 3.8% from a year earlier.

Want more news? Listen to today's daily briefing: