Ford’s Global Cost Purge Hits Europe With Thousands of Job Cuts

Ford Motor Co. said it will cut thousands of jobs, weed out slow-selling variants and potentially close entire factories in Europe, as the carmakers’s global cost-cutting drive targets a region that has been a drag on earnings for years.

The manufacturer, which employs some 54,000 workers across the region, mainly in Germany, the U.K. and Spain, also will review its joint venture in Russia, part of a host of measures that Steven Armstrong, Ford’s head of Europe, called a “step-change in the performance of the business.” He didn’t specify the number of possible job cuts and said that plant closures are an option to streamline the operations.

“There’ll be significant impact across the region,” Armstrong said. “This isn’t a one- or two-year issue. We have had periods of profitability but not on the level it should be.”

Ford last year kicked off a company-wide $11 billion restructuring after both Europe and Asia swung to losses and as costs to invest in electric and self-driving vehicles mount. Like many other carmakers, Ford warned it wouldn’t meet its targets for 2018, and CEO Jim Hackett jettisoned a goal to reach an 8% profit margin by 2020.

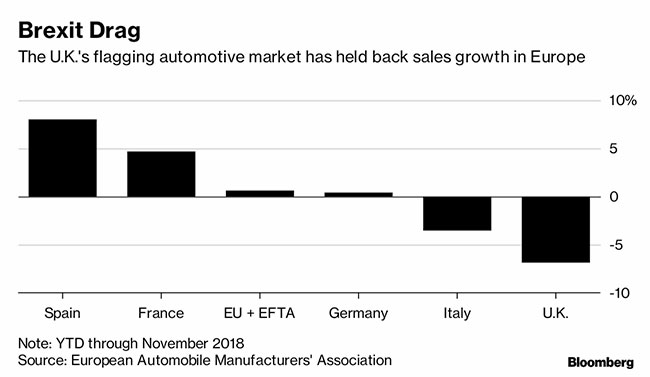

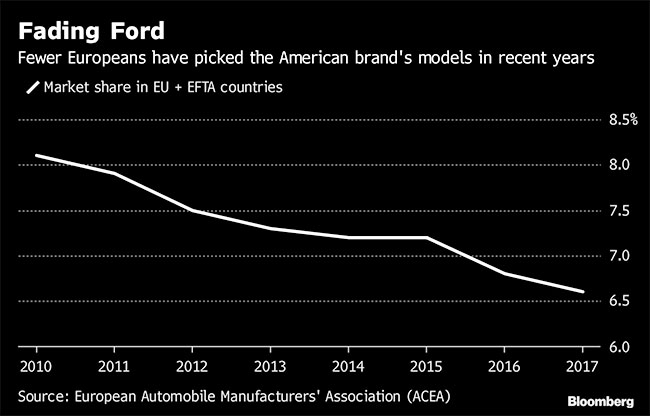

As the global car market shows its first signs of a slowdown after years of growth, Ford has overhauled its global operations, exiting the sedan business in America to focus on bigger vehicles and shifting its Chinese business to more local production. Europe has been particularly tough for the company because of the key market in the U.K., where the chaos surrounding Brexit has thrown up an additional challenge for the company.

The overhaul marks another sign of pressure on traditional automakers as they grapple with fundamental technology changes, tougher environmental regulations and trade tensions. Tata Motors Ltd.’s Jaguar Land Rover, formerly part of Ford, plans to cut as many as 5,000 jobs in the U.K., the BBC reported.

Ford was among U.S. carmakers that fell short of expectations when the industry presented sales for last year, adding to concern that a slowdown may occur in 2019. China, which has fueled the industry’s growth, disclosed on Jan. 9 that auto sales fell for the first time in more than two decades.

Armstrong said on a call that the future of the European operations lies in crossover vehicles and SUVs, and that sedans and compact vans are in decline. He cautioned that whatever action the company takes might have to be significantly more dramatic should a no-deal Brexit occur at the end of March.

Volkswagen AG, which is in talks with Ford about a deeper alliance, said Jan. 10 its namesake brand will redouble its focus on returns amid another year of “enormous challenges,” foreshadowing more belt-tightening. Audi, VW’s biggest profit center, likewise noted more struggles ahead, reporting a 3.5% drop in sales last year.

Ford shares, which have slumped 33% over the past 12 months, rose 0.9% to $8.80 in pre-market trading.

Ford will seek to reduce European staff through voluntary measures as far as possible, the Dearborn, Mich.-based manufacturer said in a statement. The review also includes “rescaling the footprint of the business” with Ford reviewing the efficiency of its plants, Armstrong said.

Ford already has said it will cease production at a transmission plant in Bordeaux, France, and has started labor talks at the Saarlouis factory in Germany to end production of the C-MAX compact van. A review of the Ford Sollers joint venture in Russia is expected to conclude in the second quarter, it said.

Ford’s European business, which relies on models like the recently revamped Fiesta and Focus hatchbacks, reported a $245 million loss during the third quarter, widening from $192 million a year earlier. Similar to America, Ford will swing to a lineup of crossovers and SUVs, and drop several derivatives to streamline its offering, Armstrong said.

Over the long term, Ford is targeting earnings before interest and taxes of 6% of sales in Europe. This year, performance already will be “significantly better” than 2018, Armstrong said.

Ford, whose business in Europe includes a “solidly profitable” commercial vehicles unit, said it will establish three separate groups for passenger cars, its vans business and imports like the iconic Mustang.

“We are continuing to invest in the business, especially in electrified cars,” said Armstrong. “We will still have a comprehensive lineup of cars in the future with primarily SUVs and crossovers.”