FedEx Makes Bid for TNT

This story appears in the April 13 print edition of Transport Topics.

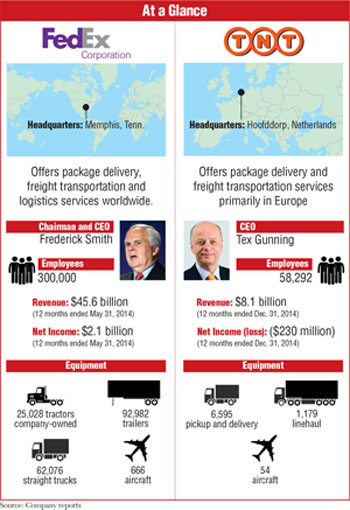

FedEx Corp. said it intends to buy Dutch package and freight carrier TNT Express for $4.8 billion in an effort to bolster its operations in Europe and challenge U.S. rival UPS Inc. and Germany’s Deutsche Post DHL Group for a share of global freight transportation leadership.

The all-cash acquisition will be funded through FedEx’s available cash and debt, according to analysts. It is expected to close by June 30, 2016.

The deal “will transform FedEx’s European capabilities and accelerate global growth,” Frederick Smith, CEO of Memphis, Tennessee-based FedEx Corp., said in a statement April 7.

Tex Gunning, CEO of Hoofddorp, Netherlands-based TNT, said the offer comes at a time of restructuring for the company, which had received a 2012 acquisition offer from UPS.

UPS withdrew the offer, valued then at $6.8 billion, after European regulatory authorities said they would block the deal for competitive reasons if it were presented formally. Since then, UPS pledged to invest $1 billion to expand its European operations over the next three to five years.

FedEx ranks No. 2 on the Transport Topics Top 100 list of the largest U.S. and Canadian for-hire carriers; it is No. 3 in the world among transportation service providers behind No. 1 UPS and No. 2 DHL, according to an industry analyst’s report.

TNT operates an extensive air and ground freight network in Europe but has not been profitable in recent years, leading to the nearly 30% discount relative to the UPS offer — though FedEx still paid a 33% premium over TNT’s April 2 closing price, analysts said.

FedEx said it will use TNT’s assets to compete more effectively with DHL and UPS and to meet demand for package delivery due to growth in online sales.

“We have long recognized our need for a complementary, pan-European ground network,” Smith said in a conference call with analysts after the announcement. The TNT assets will reduce expenses for picking up and dropping off goods “dramatically,” Smith said.

“FedEx noted the TNT acquisition will be significantly accretive in 2018, based on productivity improvements, rather than redundancy savings, as 2016 and 2017 gains would be offset by amortization, closing costs and major upgrade investments within the TNT network to integrate TNT and FedEx’s European operations,” said Ken Hoexter of Bank of America Merrill Lynch.

FedEx said it will maintain the TNT hub in Liege, Belgium, and a regional headquarters of the combined companies in the Amsterdam suburb of Hoofddorp. TNT said it would sell off its airline operations to comply with regulations that bar ownership of airlines by non-European entities and that TNT would transition the company’s intercontinental air operations to FedEx.

Becoming a major player in Europe has been an elusive goal for FedEx, said Richard Armstrong, chairman of Armstrong & Associates, a logistics consulting firm based in West Allis, Wisconsin.

After FedEx entered the European market about 15 years ago, Armstrong said, service problems forced the company to briefly pull out. FedEx’s business has grown more rapidly in recent years but still greatly lags other companies in terms of market share.

TNT officials estimate their share of the freight market in Europe is 12% and FedEx’s at 5%, while DHL holds 19% and UPS 16%.

FedEx has a bigger share of the market for package deliveries — about 10% — but trails DHL at 41%, UPS at 25% and TNT at 12%.

The purchase of TNT would be FedEx’s most expensive acquisition, according to Bloomberg News. Prior deals included $2.6 billion for Caliber System — now FedEx’s Ground and Custom Critical units — and $1.2 billion for American Freightways, which became FedEx Freight in 2000 along with the smaller Viking Freight. FedEx paid $2.4 billion for Kinko’s, the basis of FedEx Office, and $1.4 billion for Genco, a product-return and distribution company acquired in January.

Industry researcher Satish Jindel, owner of SJ Consulting Group in Sewickley, Pennsylvania, said FedEx’s purchase of TNT Express represents a personal triumph for Smith, who

single-handedly created a market for express deliveries by founding Federal Express in 1971.

Smith is a “visionary,” Jindel said. “This acquisition, along with Genco, means FedEx will be very close to being No. 2 in the world — a terrific accomplishment.”

Ben Gordon of BG Strategic Advisors, said the FedEx-TNT deal “reflects the continuing consolidation of parcel and transportation” and likely will encourage UPS and DHL to pursue opportunities to buy companies in adjacent markets.

TNT traces its origins to postwar Australia with Thomas Nationwide Transport and a single truck. That company later merged with Alltrans in 1967 to form TNT Ltd. By the 1980s, the company had operations in 180 countries, including extensive trucking and logistics operations in North America.

FedEx and TNT said they are “confident” that any antitrust concerns can be addressed “in a timely fashion.”