Fed Raises Rates, Trims Forecast for Hikes in 2019 From Three to Two

The Federal Reserve raised borrowing costs for the fourth time this year Dec. 19, ignoring a stock market sell-off and defying pressure from President Donald Trump, while dialing back projections for interest rates and economic growth in 2019.

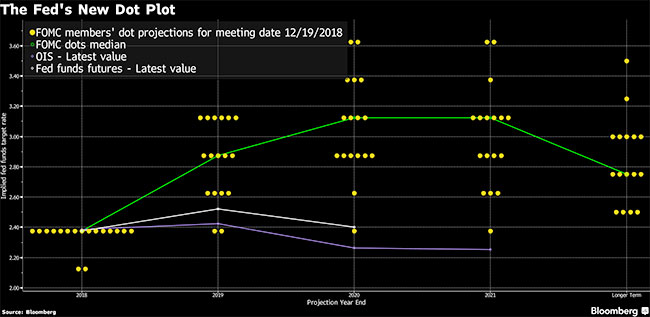

By trimming the number of rate hikes they foresee in 2019, to two from three, policymakers signaled they soon may pause their monetary tightening campaign. Officials had a median projection of one move in 2020.

After the decision, stocks pared gains and 10-year Treasury yields fell while the dollar bounced off its lows of the day. Investors may have been swayed by the Fed’s generally upbeat analysis and expectation of more rate increases than markets anticipate.

Chairman Jerome Powell and his colleagues said “economic activity has been rising at a strong rate’’ in a statement Dec. 19 after a two-day meeting in Washington. While officials said risks to their outlook “are roughly balanced,’’ they flagged threats from a softening world economy.

The Federal Open Market Committee “will continue to monitor global economic and financial developments and assess their implications for the economic outlook,” the statement said. The unanimous 10-0 decision lifted the federal funds rate target to a range of 2.25% to 2.5%.

The quarter-point hike came after Trump assailed the Fed on Twitter for two straight days, urging it to hold rates steady in the most public assault on its political independence in decades. Investors also are fretting over the economy, with the S&P 500 Index falling significantly in recent weeks.

Officials also altered key language in their statement, saying FOMC “judges that some further gradual increases” in rates likely will be needed, a shift from previous language saying FOMC “expects that further gradual increases” would be required.

In addition, the median estimate among policymakers for the so- called neutral rate in the long run fell to 2.75%, from 3% in the previous forecasts from September. The median projection is for the benchmark rate to end 2021 at 3.1%, down from a prior estimate of 3.4%.

Those are more acknowledgments that rates are moving closer to the point where policymakers will at least take a break from the quarterly procession of hikes they pursued throughout 2018.

When taken together, the latest quarter-point move, language changes and shift in rate projections indicate continued confidence in the economy, yet also greater caution over how far and fast the Fed expects to move with future hikes. As Powell has said, the Fed now is feeling its way forward and will act in line with how the economy performs.

Investors have had a more pessimistic view than the Fed, foreseeing one increase at most in 2019, according to interest-rate futures prices.

In a related move, the Fed lifted the interest rate it pays on bank reserves deposited at the central bank by just 20 basis points, instead of the usual 25 basis points that would match the quarter-point increase for the fed funds target range. As with a similar move in June, the action was aimed at containing the effective fed funds rate inside the target range.

Powell will be aiming to strike a careful balance, expressing a still-positive view on the U.S. economy without telegraphing a policy outlook that investors might view as too aggressive for an economy that appears somewhat more fragile than just a few months ago.

While job creation has slowed slightly, over the past several months it still has easily outstripped the number needed to accommodate population growth. Unemployment in November remained at 3.7%, its lowest since 1969. That has helped lift wages but hasn’t provoked any serious signs of excessive inflation.

Still, many forecasters expect growth to slow in 2019 and into 2020, and the Fed’s median estimate for gross domestic product expansion in 2019 fell to 2.3% from 2.5%.