Special to Transport Topics

The Eyes of Autonomy

Advances in sensor technology will play a key role in the development of increasingly sophisticated driver-assist systems and the eventual deployment of self-driving trucks in commercial fleets.

Radar and cameras, which already serve as the eyes for onboard safety systems that are on many trucks today, also could enable manufacturers to begin to introduce trucks with limited automated driving capabilities, including systems with active steering features, in the years ahead.

These same sensors, along with lidar, also are supporting autonomous trucks that already have piloted themselves over long distances without driver input.

However, finding the best way to combine the capabilities of these types of sensors remains a work in progress.

“There are a wide variety of sensors, and all have their strengths and weaknesses in terms of operating conditions, speed, resolution and physical limitation,” said Derek Rotz, director of advanced engineering at Daimler Trucks North America. “The most appropriate approach to overcome their inherent weaknesses is to deploy a combination of different sensor types.”

Different developers of automated driving systems are pursuing a range of sensor combinations.

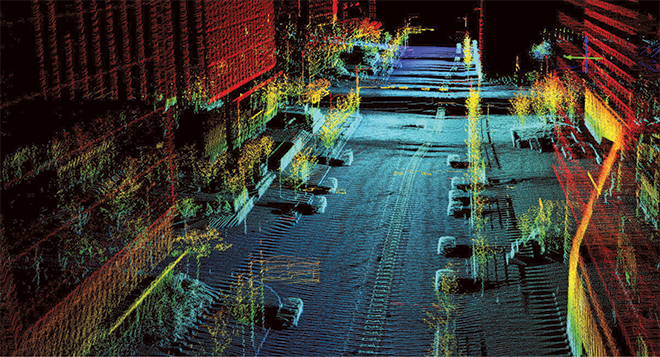

Some see lidar sensors as a high-powered way to capture three-dimensional scans of the environment surrounding the vehicle.

A 3-D scan of a streetscape captured by a lidar sensor from Quanergy. Lidar systems emit pulses of light to scan a vehicle's environment.

Lidar, which stands for light detection and ranging, does this by emitting lasers that can scan areas around trucks for hundreds of feet. With the use of chipsets, the sensor’s 3D scans of the vehicle’s surroundings help the onboard computer make better self-driving decisions.

Lidar had been in use for many years by the military and other industries before gaining momentum as a technology option for autonomous vehicles. Historically, for the automotive industry, lidar’s main drawback has been its price.

iTECH Cover Story

iTECH Cover Story

How drivers and autonomous trucks could work together to move freight

However, lidar suppliers such as Quanergy, Valeo and Velodyne have begun to offer the devices in higher volumes, thus bringing prices down to levels they say truck makers can afford.

“We are ramping up production for volume pricing for solid-state lidar for carmakers, and we can pass on the savings to truck customers,” Quanergy CEO and founder Louay Eldada said.

Solid-state lidar, which lacks the moving parts of older lidar systems, promises to reduce the cost and improve the reliability of the technology.

These solid-state lidar sensors should see deployment in the “near future” to provide sweeping 360-degree views around trucks for blind-spot detection and automatic braking, said Guillaume Devauchelle, innovation vice president for Valeo.

In our debut episode of RoadSigns, we ask: What does the move toward autonomy mean for the truck driver? Hear a snippet from Alex Rodrigues, CEO of Embark, above, and get the full program by going to RoadSigns.TTNews.com.

“Lidar is enough to see what is going on behind the truck,” he said. “The sensors are ready.”

Taking into account the wear and tear from weather and driving conditions, solid-state lidar is seen as a robust alternative by at least one established truck maker.

“Heavy-truck environments are subject to a lot of vibrations, so we hope in the future there will be a complete solid-state system,” said Keith Brandis, vice president for product planning at Volvo Trucks North America. “That will not only bring costs down but add reliability to the equation.”

Reliability-wise, Quanergy’s Eldada said a traditional mechanical infrared lidar’s mean time between failures is about 2,000 hours of operation, compared with more than 100,000 hours for a solid-state device.

The car industry may offer a preview of how trucks will adopt lidar in the near future.

The new Audi A8, for example, uses Valeo’s lidar for so-called Level 3 self-driving, where the driver can disengage but must remain ready to retake the wheel if needed.

BMW’s autonomous vehicle platform will incorporate solid-state lidar devices supplied by Magna and Innoviz Technologies.

Mercedes-Benz’s research and development division is using a Velodyne lidar for fully automated and driverless vehicle tests.

Evaluating Lidar

In trucking, a number of technology developers and startups have used lidar as part of the sensor suites for their self-driving truck prototypes.

Other developers, however, have said radar and cameras alone without lidar are good enough for advanced self-driving trucks, including Level 4 self-driving trucks that could travel from Point A to Point B with no input from a human driver.

Among the startups that use lidar, Embark completed a coast-to-coast, self-driving run from Los Angeles to Jacksonville, Fla., earlier this year with a Peterbilt truck it equipped with an array of cameras, radar and lidar sensors.

Also, earlier this year, Uber’s Advanced Technologies Group began testing its lidar-equipped, self-driving trucks in Arizona.

And Waymo recently began using self-driving trucks with a dome-like lidar unit noticeably situated on top of the cab to make deliveries in the Atlanta area to sister company Google’s data centers.

Traditional truck makers generally have been less vocal about whether they will use lidar in future models. Volvo Trucks, however, has used lidar on its self-driving test vehicles, including an autonomous mining truck in Sweden.

In contrast, electric carmaker Tesla and some autonomous truck startups have eschewed lidar, choosing instead to build their automated driving systems around cameras and radar.

Tesla founder and CEO Elon Musk has been especially vociferous about how Tesla has no plans to use lidar.

Tesla’s Autopilot system offers Level 2 self-driving in its Model S, X and 3 cars by relying mainly on radar and cameras. However, Tesla has yet to publicly describe the final sensor configuration for future versions of Autopilot with more advanced self-driving capabilities.

Autonomous truck startups Starsky Robotics and TuSimple also have shunned lidar.

However, industry analyst Richard Bishop, president of Bishop Consulting, predicted that most, if not all, truck makers likely will adopt lidar for autonomous vehicles at some point.

“As lidar [prices] becomes fairly low, then there’s no reason not to use lidar, as lidar will yield useful data that radar and cameras may not provide,” he said. “I would say that as traditional truck OEMs get into Level 4 automation, they will use cameras, radar and lidar — although they don’t talk much about it yet.”

Cameras and Mapping

Cameras, like lidar, serve to scan a vehicle’s surroundings and send the information to the motion controller. In that way, cameras offer 360-degree, real-time video of the immediate environment around the truck. These cameras also are relatively cheap and have fallen in prices to well below $500 per unit during the past year.

Cameras already are key components of the latest active safety systems available in heavy-duty trucks.

Cameras are used in lane-keeping functions, object detection for forward collision warnings, road sign detection and with radar for automatic emergency braking, said Jason Roycht, vice president and regional business leader for commercial vehicle and off-road at Bosch North America.

Cameras also are expected to play an instrumental role in GPS-assisted mapping applications. Mobileye is vying for position for its GPS-assisted mapping interface for self-driving trucks by offering a system that combines camera, chipset and software for autonomous driving. Its self-driving platform also includes computer chips from Intel, which purchased Mobileye last year for $5.3 billion.

Mobileye said its mapping platform will benefit from being able to crowdsource data from what it says are “millions of cameras” in BMW, Nissan, Volkswagen and other cars.

These cameras have begun to upload video data that is processed to continually update maps, thus taking into account construction and other differences in environmental road conditions, said Dan Galves, chief communications officer for Mobileye NV.

Similarly, Bosch is developing an application that collects data using radar that is uploaded to the cloud and then downloaded to vehicles to enable localization.

“This technology is currently more passenger-car focused, but it could be applied to commercial vehicles at some point in the future,” Bosch’s Roycht said.

Sensor Limitations

Each sensor type has its own limitations and weaknesses.

Cameras, for example, often are dependent on ambient light conditions to function properly. Heavy rain, fog or even drizzle can limit cameras’ ability to detect objects.

Much like cameras, lidar sensors also can experience challenges in fog or drizzle conditions, but lidar’s infrared light emitter has the ability to generate its own infrared light. This capability allows it to overcome the limitations of poor visibility under low-light conditions, DTNA’s Rotz said.

However, during tests, lidar data has sometimes been skewed by overexposure from reflective surfaces such as road signs, he added.

Furthermore, lidar’s inability to operate in a narrow light band can prevent lidar from detecting color and contrast, making it more difficult to detect lane markings, determine traffic light colors or read characters on traffic signs, Rotz said.

Comparatively cheap, radar can continue to work well in snow and rain, and its range of up to several hundred feet is longer than that of lidar. However, the radio waves it emits cannot replace lidar’s ability to scan and detect 3D objects to the extent lidar can.

The end result is that sensors can allow a self-driving truck to travel more easily in clear conditions than in adverse weather.

“In bad weather conditions, the sensors can literally go blank,” said Fred Andersky, head of the controls business and government and industry affairs at Bendix Commercial Vehicle Systems, a major supplier of braking and safety systems.

In the case of Volvo Trucks’ mining truck prototype tests, dirt and other contamination often covered the lidars’ lenses.

“We found that we had to install covers and protection. Keeping the surfaces clean was an issue so the trucks could continue to operate,” Volvo Trucks’ Brandis said. “We were just running bench tests, so when lidars will be put on commercial trucks, there are going to be demands placed on the suppliers.”

However, Valeo says it has since developed a solution for cleaning lidar surfaces. Its lidar cleaning system features a small retractable arm and nozzles that clean sensors automatically by spraying cleaning fluid.

However, more development work remains to ensure that lidar and other sensors continue to function 100% of the time, regardless of driving conditions, Valeo’s Devauchelle said.

“Sensors have yet to be able to provide completely accurate results in all conditions,” Devauchelle said.

Sensor technologies likely will continue to evolve, while suppliers and truck makers will continue to mix and match different sensor types.

“Cameras, radar and lidar sensors will likely still be here in five to 10 years,” Bendix’s Andersky said. “But you are also going to see other sensor technologies under consideration eventually.”