Ex-Im Bank Can’t Back New US Exports as Charter Lapses

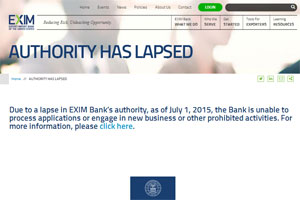

U.S. exporters won’t be able to obtain new financing for overseas deals from the U.S. Export-Import Bank as of July 1.

The situation may be temporary, though, as Congress, which left town prior to July 4 for recess without preventing the lapse in the bank’s charter, may consider reauthorizing Ex-Im later this month. The House and Senate won’t return until the week of July 6.

The 81-year-old institution provides financing arrangements that help U.S. companies such as trucking compete for overseas sales.

Senate Majority Leader Mitch McConnell (R-Ky.), who is opposed to reauthorizing the bank, has said he’ll allow its supporters to combine legislation to extend it with a highway funding bill expected to be considered in July.

Meanwhile, Ex-Im will continue work on existing agreements, though it can’t approve new loans, guarantees or insurance. Pending applications for Ex-Im financing total more than $9 billion, according to the bank.

Due to a lapse in our authorization @EximBankUS is unable to take on new customers or new transactions. More here: http://t.co/whdxoJj7Iw

— Export-Import Bank (@EximBankUS) June 30, 2015

Congress can reauthorize the bank and promote American businesses or “shut down the bank and put manufacturers on their back heels and put Americans out of work,” said Aric Newhouse, a senior vice president for the National Association of Manufacturers.

Sen. Marco Rubio, an Ex-Im opponent and Florida Republican who is seeking his party’s presidential nomination for the 2016 election, called the lapse a “major victory for the country.”

Rubio told reporters on a conference call June 30 that legislation to revive the bank should be considered “on its own merits” rather than being “tagged onto an unrelated bill,” such as the highway-funding measure.

The lapse is a “small step” toward ending “cronyism” in which some U.S. companies benefit from the federal government’s aid and others don’t, said U.S. Rep. Jeb Hensarling, a Texas Republican who is chairman of the House Financial Services Committee.

“There’s no doubt some U.S. companies receive a benefit from Ex-Im, but there’s also no doubt Ex-Im hurts other companies and their workers,” Hensarling said in a statement. “In fact, more are hurt than helped, and nearly 99% of all U.S. exports are financed without Ex-Im. Where is the fairness in giving Washington politicians and bureaucrats the power to pick who gets helped and who gets hurt?”

Ex-Im proponents are set to meet with President Obama on July 8 to plan how to push legislation to revive the institution.

Ex-Im, renewed without controversy for decades, has become a target of conservative Republicans who say it benefits only a few large corporations that don’t need government assistance.

Five public U.S. companies — General Electric, Boeing, Caterpillar Inc. and units of General Dynamics Corp. and United Technologies Corp. — had overseas customers who received about $10 billion in loan authorizations or long-term guarantees from the bank last year.