Driver Turnover Rates Down in 4Q

Driver turnover rates fell at the end of 2017 as tonnage volume rose and trucking firms focused on a mix of pay increases, sweetened benefits and other inducements to recruit and retain drivers.

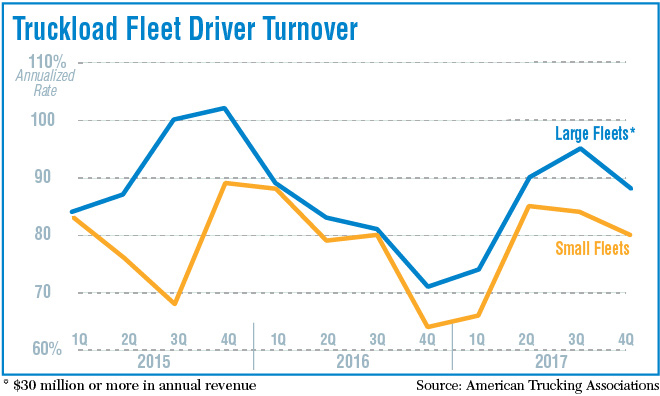

The annualized driver turnover rate at large truckload fleets (those with more than $30 million in revenue) fell seven points to 88% in the fourth quarter, according to American Trucking Associations’ Trucking Activity Report. It was the first time the rate dipped below 90% since the first quarter of 2017.

Turnover at small truckload fleets fell four points to 80%. The turnover rate at both large and small fleets, despite the quarter’s decline, was still 14 points higher than a year earlier.

Costello

Bob Costello, ATAs chief economist, attributed the turnover drop to a strong freight market that kept drivers busy driving more miles and helped to increase their income as they are compensated on a pay-per-mile basis.

Truck tonnage, a measure of the amount of freight hauled by trucking firms, increased 3.8% year-over-year in 2017, according to an index compiled by ATA. So far this year it’s up 7.1%, compared with the same time last year.

A number of fleets have announced pay increases, “so there is some likelihood that drivers stuck with their current fleet due to raises or the anticipation that they would receive raises,” said Jason Miller, assistant professor of logistics at the Eli Broad College of Business at Michigan State University.

“Drivers may have elected to stay with their current carriers given that there is a lot of uncertainty surrounding the consequences of the Electronic Logging Device mandate’s implementation,” said Miller, adding “drivers may have been hesitant to switch employers [during] the holiday season.”

Pay raises are gaining momentum with carriers, said Kenny Vieth, president of ACT Research, the publisher of trucking industry data and analysis.

The researcher found in a recent survey of fleets that nearly all had either just raised driver pay or were about to, said Vieth. The survey was not scientific but the response “fits in with a broad swath of the industry speaking to the difficulty of finding qualified drivers,” he said.

Fleets that rolled out pay raises include:

• Somerset, Ky.-based Super Service, which increased its pay for over-the-road drivers and teams by 4 cents a mile and by 2 cents a mile for regional and student drivers.

• Hudson, Ill.-based Nussbaum Transportation increased its base mileage rate by 2 cents a mile and sweetened a bonus program for top performing drivers.

• Memphis, Tenn.-based Builders Transportation Co. raised its starting pay to 55 cents a mile for flatbed drivers with two years’ experience.

On the recruitment side, Chattanooga, Tenn.-based Covenant Transport launched a $40,000 Teaming Bonus program, aimed at teams and single drivers who are considering converting to teaming. Likewise, J&R Schugel, based in New Ulm, Minn., launched a $15,000 sign-on bonus to get experienced over-the-road drivers on board before the end of 2017.

“We’ve seen examples where compensation increases have changed [driver] turnover rates,” said Michael Belzer, an associate professor of economics at Wayne State University who has studied the trucking industry for several decades. “Turnover is high in trucking because the job is tough and driving doesn’t pay well. Companies that pay their drivers more will see lower turnover rates.”

The fourth quarter may have seen a decline in turnover but that will be temporary if the economy continues on its recent strong pace, said Costello.

“Despite this dip in turnover, the driver market remains tight and the driver shortage remains a real concern for fleets and the industry,” Costello said. “If the economic climate continues to improve, I expect both turnover and driver shortage concerns to rise in the near future.”