Diesel Tops Year-Ago Price for First Time Since 2014

This story appears in the Dec. 12 print edition of Transport Topics.

The great slide in diesel prices has ended.

After 124 consecutive weeks of diesel falling compared with its year-ago level, the U.S. retail average price is higher than it was 52 weeks ago for the first time since July 2014.

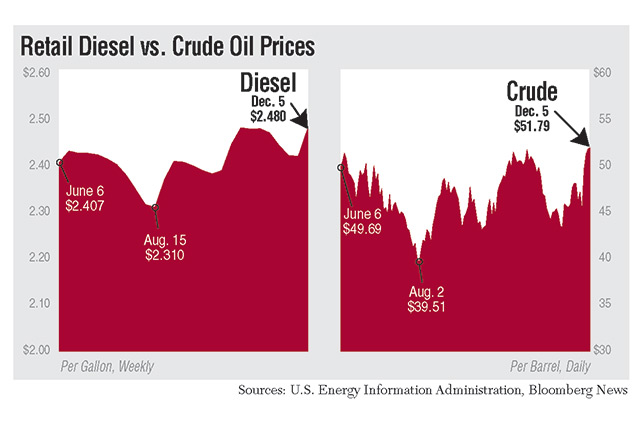

On Dec. 5, the Department of Energy reported the national average was $2.480 a gallon, whereas a year ago it was $2.379 — cheaper by 10.1 cents.

Compared with the previous week, Nov. 28, the average was 6 cents lower at $2.42 a gallon, and still cheaper than a year ago by 0.1 cent, the department’s Energy Information Administration reported.

EIA also said the national gasoline average increased by 5.4 cents a gallon to $2.208 on Dec. 5. A year ago, gas was cheaper by 15.5 cents. The high and low points for gasoline this year were $2.399 on June 13 and $1.724 on Feb. 15.

Worries about an oil-production contraction by OPEC nations sent crude oil prices on the New York Mercantile Exchange to close at $51.79 a barrel Dec. 5, the highest level since July 2015. Then news of ample crude stocks at the Cushing, Oklahoma, oil hub sent the closing price back to $49.77 on Dec. 7.

In March 2014, the diesel average topped $4 a gallon. Then, high levels of domestic oil production sent diesel prices plunging for more than a year to a low of $1.98 on Feb. 15 of this year.

Flatbed executive James Burg said the lengthy price slide helped the profitability of his Warren, Michigan-based carrier, James Burg Trucking Co., but also created a challenge, for his company and the industry at large.

“The worry is that we might get used to cheap fuel, and then we don’t invest in more fuel-efficient trucks and trailers. Even if you don’t invest more, then you have to research new options,” Burg said.

While the diesel average has added 50 cents a gallon, more than 25%, since the February low point, EIA is not predicting a sharp rise in prices.

The agency published its Short-Term Energy Outlook on Dec. 6, and raised its price estimates for crude oil and refined products, but by measured amounts, not large surges.

Retail diesel now is expected to average $2.64 per gallon during the first quarter of 2017, up 1.4% from the previous estimate of $2.60 on Nov. 8.

Second-quarter diesel is supposed to cost about $2.65, up from $2.63 in the previous estimate.

For all of 2017, diesel is expected to average $2.70 a gallon, EIA said, up from $2.31 this year, but similar to the $2.71 average in 2015 and below the $3.83 level in 2014.

Burg said his best guess for the diesel he’s using for his fleet of 90 trucks that pull heavy-haul loads of steel is that the price will range from $2.50 to $2.60 a gallon over the next six months, “but we could go back to $2.25 a gallon before we see $2.75.”

While OPEC’s statement on production cuts Nov. 30 sent prices rising, a Dec. 7 report on high supplies in Cushing, the main supply point for West Texas Intermediate crude, dampened the OPEC-related concerns.

EIA said the Cushing inventory hit 65.3 million barrels for the week ended Dec. 2, up 3.78 million barrels from the previous week. A year ago, Cushing kept 59.4 million barrels in stock.

“The initial euphoria [among oil sellers] that followed the OPEC deal is wearing off,” Matt Sallee, an asset manager at Tortoise Capital Advisors in Leawood, Kansas, told Bloomberg News.

“We’re hopeful that prices will continue to grind higher, but I wouldn’t be surprised if we consolidate around $50 through the end of the year,” Sallee said.

Prior to the 6-cent increase for diesel Dec. 5, the fuel declined for five of the six previous weeks through Nov. 28 for a combined drop of 6.1 cents a gallon.

In its Dec. 5 report, EIA said diesel prices rose in all regions of the country, both for the week and year-over-year.

Gasoline rose in all regions relative to a year ago, but there were weekly price dips in the Rocky Mountain states and on the West Coast.

Most other elements of the U.S. petroleum market were fairly stable in the Dec. 7 EIA report.

Refinery activity rose to 90.4% of capacity from 89.8% the previous week, but well below the 93.1% from a year ago.

Distillate fuel consumed, including diesel, declined to 3.7 million barrels per day from 3.84 million the week before.

The stock of ultra-low-sulfur distillate moved up to 133.1 million barrels the week ended Dec. 2, up from 130.2 million barrels the previous week.