Senior Reporter

Diesel Surges 10.9¢ to $3.586 a Gallon

[Stay on top of transportation news: Get TTNews in your inbox.]

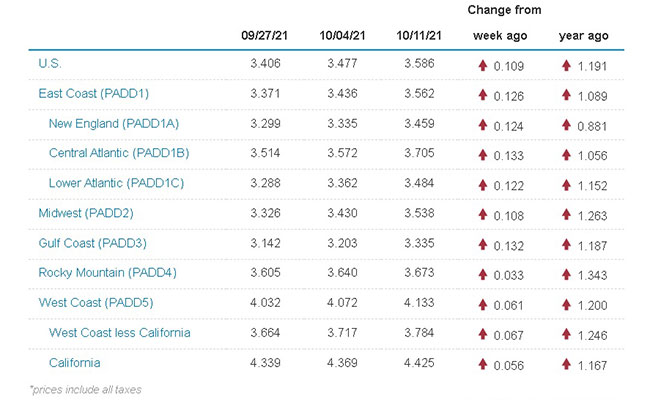

The national average price for diesel surged 10.9 cents to $3.586 a gallon, according to Energy Information Administration data released Oct. 11.

Trucking’s main fuel, which posted a 7.1-cent rise the previous week, costs $1.191 more for a gallon than it did at this time in 2020.

Diesel’s current average price per gallon is the highest since it cost $3.605 on Dec. 1, 2014.

Diesel rose in all 10 regions in EIA’s weekly survey, ranging from a high of 13.2 cents in the Gulf Coast to a low of 3.3 cents in the Rocky Mountain region.

Gasoline also increased dramatically, leaping 7.7 cents to $3.267 a gallon, which is $1.10 more than a year ago.

U.S. On-Highway Diesel Fuel Prices

EIA.gov

“Prices are going up. Crude oil is back above $80 a barrel and it’s holding there, it’s looking like $80 is here to stay, it’s no fluke,” Chicago-based oil industry analyst Phil Flynn told Transport Topics. “The overall global energy crunch is going to keep prices high. There’s the reopening of the economy and the competition for diesel, with home heating oil.”

From an energy standpoint, home heating oil and diesel fuel are mid-weight distillates of petroleum; they produce roughly the same amount of heat and can be burned by the same system.

Flynn said if the northeast U.S. has a particularly cold winter, and supplies are tight, diesel prices will continue to move upward.

West Texas Intermediate crude oil, the industry benchmark, closed at $80.56 on the New York Mercantile Exchange on Oct. 13. WTI is up $1.71 from a week earlier and, according to the EIA, has nearly doubled from this time last year when it was trading at $41.21 a barrel.

In its Winter Fuels Outlook, the EIA is alerting consumers that prices are likely to remain high for the next several months, as demand for petroleum products increase as the economy gains momentum.

For some, truck driving is a passion, and the best are America's Road Team Captains. ABF driver Nate McCarty, former America's Road Team Captain, and Elisabeth Barna, COO and executive vice president for American Trucking Associations, join us. Hear a snippet above, and get the full program by going to RoadSigns.TTNews.com.

“As we head into the winter of 2021-22, retail prices for energy are at or near multiyear highs in the United States,” the EIA report said Oct. 13. “The high prices follow changes to energy supply and demand patterns in response to the COVID-19 pandemic. We expect that households across the United States will spend more on energy this winter compared with the past several winters because of these higher energy prices and because we assume a slightly colder winter than last year in much of the United States.”

Broken down by fuel type, the EIA said the nearly half of U.S. households that heat primarily with natural gas will spend 30% more than 2020 if temperatures remain the same, but 50% more if winter is just 10% colder. If temperatures are moderate, prices will be 22% higher.

Electric heat will cost 6% more if it’s an average winter, but 15% more if it’s colder than usual and 4% if it’s warmer.

Propane heat will jump 54% on average, but 94% more in a colder winter and 29% more in a warmer winter.

Home heating oil will cost on average 43% more, but 59% more in a colder winter and 30% more in a warmer winter.

Flynn says because of the increased petroleum usage, supplies remain tight.

“Supplies are below average for this time of year,” he said. “We’re well below the five-year average.”

The latest report from the American Petroleum Institute showed inventory declines of 4.6 million barrels for gasoline and 2.7 million barrels for distillates last week, including diesel fuel and home heating oil.

The gasoline report showed supplies dipped at a time when demand is expected to remain elevated.

As petroleum prices increase, oil production is becoming more profitable and exploration continues to tick upward. According to the weekly Baker-Hughes rig count, 533 rigs were in operation in the United States on Oct. 8, up five from the previous week. However, when measured against the 2020 results from the same period, the production has nearly doubled. A year ago, 269 were in operation.

In Canada, the rig count is now at 167, up two in the past week and an increase of 87 from a year ago.

Want more news? Listen to today's daily briefing below or go here for more info: