Senior Reporter

Diesel Slides 3.2¢ to $3.324 a Gallon

[Stay on top of transportation news: Get TTNews in your inbox.]

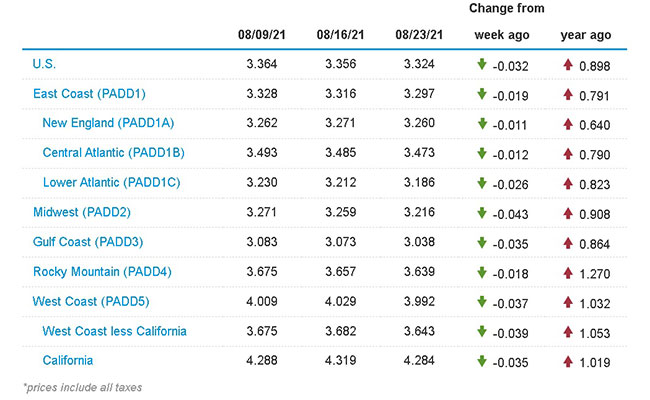

The national average price for a gallon of diesel fell 3.2 cents to $3.324 in the biggest price drop in more than 15 months, according to Energy Information Administration data released Aug. 23.

The price drop was the largest since May 4, 2020, when it fell 3.8 cents, to $2.399 from $2.437.

Trucking’s main fuel has dropped four times in the past five weeks after rising for 12 consecutive weeks from May 3 to July 19.

A gallon of diesel now costs 89.8 cents more than it did at this time in 2020.

Diesel’s price fell in all 10 regions of EIA’s survey, with the largest being 4.3 cents in the Midwest.

One analyst attributed the steady decline to the sharp drop in the price of crude near the Fourth of July.

“So that drop after the Fourth of July into August is now being seen at the pump,” Phil Flynn, senior market analyst at The Price Futures Group, told Transport Topics. “We don’t expect a heck of a lot more downside from this point forward, though we could see prices fall a couple more pennies. Our expectations are the prices are going to stay strong going into winter.”

Flynn

West Texas Intermediate crude futures on the New York Mercantile Exchange closed at $65.54 on Aug. 23 compared with $67.29 on Aug. 16.

Over the past year, WTI prices have ranged between $42.62 and $75.25.

The national average price for a gallon of gasoline also fell significantly, tumbling by 2.9 cents to $3.145.

The trucking industry is in the early stages of a transition leading to electrification and away from near-total reliance on diesel, said Matthias Gründler, CEO of Traton SE, which closed its merger with American truck maker Navistar International Corp. in July.

“In the transition period, that is until there is a comprehensive network of rapid-charging stations, we need highly efficient diesel-powered engines so that the smallest amount of carbon dioxide possible is emitted,” said Gründler during an online interview.

“That’s why we developed the CBE (common base engine), our groupwide 13-liter engine, which Scania will launch on the market soon. The other brands will follow. The powertrain is highly fuel-efficient.”

Earlier, the Department of Energy reported a diesel engine Cummins Inc. developed as part of the SuperTruck II program achieved an unmatched 55% brake thermal efficiency during a test on a dynamometer.

“That is amazing, and translates into probably in the 12 to 14 miles-per-gallon range,” said Allen Schaeffer, executive director of Diesel Technology Forum.

Schaeffer

BTE is a measure of the fuel efficiency of an internal combustion engine, experts said, and is used to evaluate how completely an engine converts fuel to mechanical energy. The higher the percentage, the less fuel is consumed and the fewer the greenhouse gas emissions.

Schaeffer told TT a low to mid-40s BTE is the average now for heavy-duty trucks. “BTE is an indicator of efficiency and complete combustion in a laboratory bench setting. How they got to 55 will inform future commercial engine design, materials, controls and more.”

One oil company recently announced it is looking to increase production of renewable diesel and hydrogen as commercial vehicle fuels.

“We’re continuing to grow lower carbon businesses,” Chevron Chief Financial Officer Pierre Breber said during the company’s latest earnings call. “This quarter, we started co-processing bio feedstock at our El Segundo [Calif.] refinery, growing renewable diesel production in a capital-efficient manner by leveraging existing infrastructure. We recently announced an MOU with Cummins to develop commercially viable businesses in hydrogen.”

Hydrogen engines will offer OEMs and end-users the benefit of continuing to use familiar mechanical drivelines while still providing the power and capability for meeting application needs, Cummins noted.

Several other U.S. refiners are in the midst of partially or totally converting plants to produce certain renewable fuels, particularly diesel, according to recent reports.

How much impact does driver pay have in hiring drivers? And what else can fleets do to recruit and retain quality talent? Hear a snippet from DriverReach founder and CEO Jeremy Reymer, above, and listen to the full program at RoadSigns.TTNews.com.

Meanwhile, the U.S. government plans to sell the largest volume of oil in seven years from its strategic reserves at a time when domestic refiners are gearing up for seasonal maintenance and oil consumption historically drops, Bloomberg reported. That’s weighing on West Texas Intermediate crude prices. The U.S. strategic reserves sale comes at a time when domestic refineries are already scaling back operations earlier than normal with the delta variant starting to impact domestic demand.

Occidental Petroleum Corp. is extending a work-from-home option for some office staff through the end of October, and taking steps to prevent viral spread on offshore platforms. Valero Energy Corp., the second-biggest U.S. fuel maker, is compelling new hires at some refineries to get vaccinated.

None of the country’s top shale drillers have implemented across-the-board vaccine mandates but the requirements for new hires and cash incentives show the level of concern about the spread of the delta variant, Bloomberg noted. Vaccination rates in some of the Permian region’s biggest oil-producing counties are much lower than state and national averages, government data show.

U.S. On-Highway Diesel Fuel Prices

EIA.gov

Want more news? Listen to today's daily briefing below or go here for more info: