Senior Reporter

Diesel Hits 11-Year Low

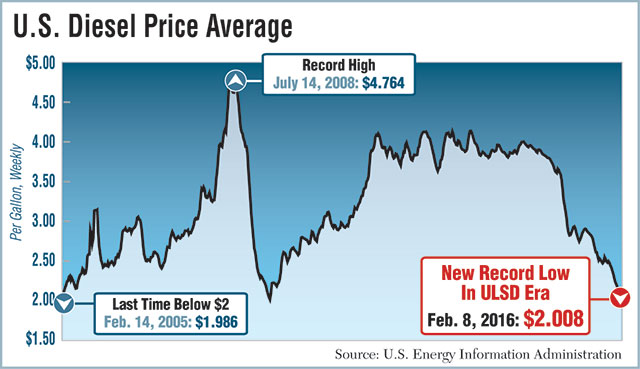

The average diesel retail price fell 2.3 cents last week to $2.008 a gallon, the lowest price in nearly 11 years, when it was $1.986.

That also put diesel at the lowest price since the United States switched to the use of ultra-low-sulfur fuel nearly a decade ago.

Diesel has declined a total of 47.4 cents over the past 13 weeks, moving it below the previous ULSD low of $2.017 set on March 16, 2009, the Department of Energy reported after its Feb. 8 survey of fueling stations.

The ULSD era kicked off in October 2006, ahead of emissions-cutting engines coming in 2007 and equipped with diesel particulate filters. The catalysts in the filters would be destroyed if exposed to higher-sulfur fuel, the Environmental Protection Agency said at the time.

Diesel is also 82.7 cents a gallon cheaper than a year earlier.

“In terms of what is driving diesel prices down, I’d say it’s in large part due to lower crude oil prices,” Hannah Breul, an analyst with DOE’s Energy Information Administration, told Transport Topics. “And the fact that we have had a warmer winter than normal means that the incremental distillate use for heating buildings of all kinds has been a lot less. We are not getting the seasonal uptick you sometimes see at this time of year.”

DOE also reported the average retail price of gasoline fell to $1.759 a gallon, down 6.3 cents from the previous week and 43.2 cents from a year earlier. Gasoline has fallen 26.9 cents over the past six consecutive weeks.

The average retail price for regular gasoline in January was $1.95, a decrease of 9 cents from December and the first time monthly gasoline prices averaged below $2 since March 2009, EIA said in its most recent Short-Term Energy Outlook.

It added that the oversupply of oil is projected to continue through 2016 and the first half of 2017. The U.S. regular gasoline retail price, which averaged $2.43 in 2015, is projected to average $1.98 this year, which would be the lowest annual average since 2004. It also said projected $2.21 a gallon for 2017.

The diesel retail price, which averaged $2.71 in 2015, is projected to average $2.22 this year — 6 cents lower than in EIA’s outlook last month — and $2.58 in 2017.

On Feb. 10, crude oil futures remained below $30 and closed on the New York Mercantile Exchange at $27.45.

The glut of oil pushed diesel prices to a place that is “really crazy low compared with what it has been,” Allen Schaeffer, executive director of the Diesel Technology Forum, told TT.

Schaeffer said ULSD, with 15 parts per million of sulfur compared with the previous standard of 500 ppm, has a higher built-in cost to refine that sparked industry concerns over higher prices when the fuel was introduced.

“That was well-documented and discussed back in the day, but I think now that has been overshadowed by all the dynamics in the marketplace, and you would be hard-pressed to try and tease out of today’s price what the environmental component actually adds to it,” he said.

Besides lower fuel prices, Schaeffer said, truckers are getting an added benefit if they are running the new trucks.

“Based on our data, about 36% of all the Class 8 trucks registered in 2014 were 2007 and newer, and about 16% were 2010 and newer. The 2010 ones are probably 3%, 4%, 5% better fuel economy than the previous generation.”

Jamie Pierson, chief financial officer of YRC Worldwide Inc., said during a recent earnings conference call that the less-than-truckload carrier was continuing to refresh its fleet with new Class 8 trucks to leverage the benefits of low-cost diesel.

“We are seeing the new revenue equipment yield about 0.6 more miles per gallon than our existing fleet, and when you drive a billion miles a year, that tends to add up pretty rapidly,” Pierson said.

He added: “It doesn’t mean as much when diesel is [low] at $2.20. But you know what? We are not going to pass on that. We are going to continue to clip that coupon.”

YRC Worldwide ranks No. 5 on the Transport Topics Top 100 list of the largest U.S. and Canadian for-hire carriers.