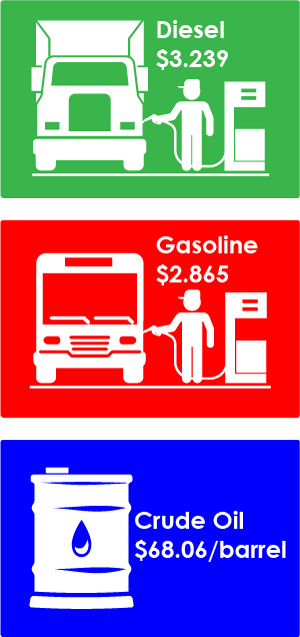

Diesel Flat at $3.239 Per Gallon

The U.S. average retail price of diesel fuel virtually was flat last week, falling 0.4 cent to $3.239 a gallon, according to the weekly report from the U.S. Department of Energy’s Energy Information Administration.

Diesel remains more expensive than a year ago, up 74.8 cents per gallon compared with the same period in 2017.

Changes in the average price of diesel were mixed across the regions that EIA tracks. California remained the most expensive place to buy diesel at $3.968 a gallon, though it did drop 0.2 cent last week. Diesel in California has gone up $1.103 a gallon in the past year.

The West Coast not including California saw diesel at $3.456 a gallon last week, a decline of 1.5 cents. New England was the only region where diesel rose in price, creeping up 0.4 cent to $3.283 a gallon.

There was no change in price in the Central Atlantic, Gulf Coast and Rocky Mountain regions. The Gulf Coast was the cheapest region nationally with a gallon of diesel going for $3.004.

Gasoline at the pump also was nearly flat, rising 0.8 cent a gallon to $2.865 nationally. Gasoline is up 58.7 cents in the past year. The West Coast including California topped the price list with $3.378 a gallon, down 1.6 cents. At $2.602 a gallon, the Gulf Coast was the cheapest place to buy gas. It fell 1.7 cents there last week.

Crude oil futures settled July 18 on the New York Mercantile Exchange at $68.76 a barrel.

Fuel prices rose to a three-year high in June due in part to a production ceiling imposed in 2017 by Russia and members of the Organization of the Petroleum Exporting Countries. Upside pressure on prices was bolstered by Venezuela’s economic crisis, production problems in Libya and the renewal of U.S. sanctions on Iran.

But futures prices have been wavering this month after Saudi Arabia and Russia agreed to increase production and news reports that President Donald Trump would open up the United States’ emergency oil supply.

In addition, Bloomberg reported that Saudi Arabia was marketing greater supplies of crude oil to Asian customers.

Carriers wishing to reduce their fuel costs with solar panels may be both disappointed and intrigued with a recent study from the North American Council for Freight Efficiency, the group working to develop the adoption of efficient, environmentally-friendly, cost-reducing technologies.

NACFE’s Confidence Report “Solar for Trucks and Trailers” found that solar panels designed for the trucking industry are flexible, durable, thin and lightweight and can be fitted to a tractor. Solar applications for trailers include support for liftgates, telematics and refrigeration units.

“If a trailer has small electrical loads like a telematics system, then a small solar panel that ensures that the system will have virtually 100% availability for trailer location and other related data makes a great deal of sense,” NACFE Executive Director Mike Roeth said.

The report also found that a solar panel on a tractor can extend the run time of a battery HVAC system so it can run for a night without draining a truck’s batteries and reduce the load on the alternator the next morning,

The panels almost doubled the life of batteries in some instances, but there’s “limited hard evidence” from fleets that solar panels on trucks will reduce fuel use, NACFE concluded.

An ACT News webinar on solar panels and trucking is scheduled for July 25 at 1 p.m. EDT. It will feature Roeth, Trimac Transportation Vice President Marcel Populist and Director of Fleet Distribution Gord Max along with Bergstrom’s Toby Tuckley, director of global business development for solar products.

Going forward, EIA forecasts U.S. crude oil production to average 10.8 million barrels a day in 2018, up from 9.4 million barrels a day in 2017, and to average 11.8 million a day in 2019. If these forecasts prove accurate then U.S. crude production would surpass the previous record of 9.6 million barrels a day set in 1970.

At the same time, EIA is predicting that total U.S. crude oil and petroleum product net imports will fall from an annual average of 3.7 million a day in 2017 to an average of 2.4 million a day this year and to an average of 1.6 million a day in 2019, which would be the lowest level of net imports since 1958.