Senior Reporter

Dana Builds Its Way Into Expanding Commercial EV Market

[Stay on top of transportation news: Get TTNews in your inbox.]

Tier One supplier Dana Inc. invested more than $400 million over the past three years to get its electrification product portfolio in shape as it aims for a revenue target of $500 million from that by 2023, riding along at this point on the much improved commercial vehicle market.

“Medium-duty is a great example. We are winning more than our fair share of business on the medium-duty side, and our customers are asking us to do more than we originally anticipated,” Chief Financial Officer Jonathan Collins said during a recent web event.

Collins said its automotive customers’ early investments in electrification largely have been in unibody or passenger car-style vehicles, “which is not where we participate.” But he is seeing signs that the full-frame trucks are going electric, such as Ford’s F-150, calling that a real positive.

Collins

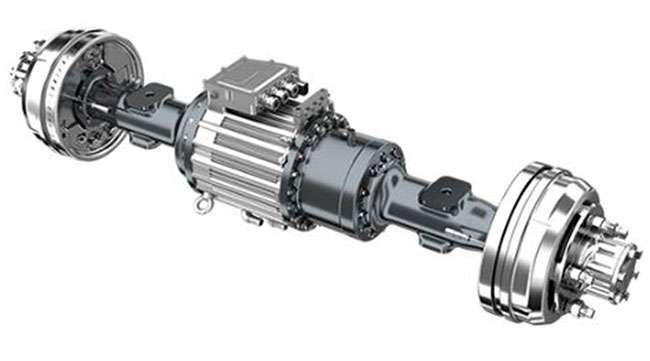

“If I were to show you a rigid electrified axle for a medium-duty truck compared with the type of axle that will work well with a full-frame [pickup] truck, it probably would be pretty hard to distinguish that,” he said. "We focused on medium-duty because it was going first, but also because that integration of that mechatronic system is highly transferable to our core markets of full-frame truck and light vehicle.”

Dana, a $9 billion company, is aiming to become a $10 billion company over the next few years, with the predicted growth in vehicle electrification, Collins said.

“We have indicated we would expect our content [per vehicle] to at least double and that is by electric motors and inverters becoming part of an electric axle, and the electric axle being more expensive compared with the traditional axle,” he said.

And it might go to three times, he added.

Dana is pulling together battery packs, writing software to monitor and manage the battery systems, and doing full embedded software for medium-duty to support integration of EV platforms.

A view of Dana's manufacturing facility in Lafayette, Ind. (Dana Inc. via Facebook)

“And many of these applications are going to be very attractive for fleet operators from a cost standpoint, not to mention the emissions benefits,” Collins said. “So we’re really encouraged.”

Dana announced its first heavy-duty e-axle win just a few months ago, he said, but did not provide more details.

Demand for heavy-duty vehicles, typically, is a market that when it starts to move, it moves quickly, Collins said. “So the signs of life we are seeing in the first half of the year are quite encouraging.”

The promise of fuel cells continues to improve in the heavy-duty segment, as well.

Dana also is encouraged by the electrification of the off-highway segment, too, including on smaller construction equipment and material-handling platforms.

When the pandemic started, drivers faced crowded parking lots, closed rest areas and minimal roadside support. And almost a year and a half later they still face the fear of not finding a place to park, which means having no place to rest. In this episode, host Michael Freeze seeks answers from those on the forefront of research and legislative action. Hear a snippet above, and get the full program by going to RoadSigns.TTNews.com.

“Dana supplies both lithium nickel manganese cobalt and lithium ion phosphate-based battery chemistries, depending on the requirements of each application,” Steve Slesinski, director of global product planning told Transport Topics earlier.

These batteries are packaged to sustain vibrations and are thermally managed to offer performance in environments from minus 22 to 113 degrees Fahrenheit. They can sustain more than 4,000 charge and discharge cycles with less than 20% capacity degradation, Slesinski said.

Some of Dana’s batteries won’t need cooling, but all will have heating available for extreme cold.

Meanwhile, in March, Dana announced it acquired Pi Innovo a developer of embedded software solutions and electronic control units to support the light-vehicle, commercial-vehicle and off-highway markets. Dana previously held a noncontrolling interest.

The acquisition enables Dana to add a library of turn-key electric vehicle application software, vehicle level controllers and auxiliary controllers.

Collins said it was possible Dana could be making more software-related investments to differentiate the systems it produces as opposed to its initial investments in hardware building blocks.

There is much more to be done.

“Our electrification business for us is not yet profitable. It is creating margin headwinds for us in the near term,” Collins said. “It is going to be a few years before we see the business become profitable and beyond that before it becomes margin accretive.”

John Baxter contributed to this story.

Want more news? Listen to today's daily briefing below or go here for more info: