Managing Editor, Features and Multimedia

Daimler Sees Hydrogen Fuel Cells as Part of Trucking’s Future

[Stay on top of transportation news: Get TTNews in your inbox.]

ATLANTA — Daimler Trucks has been investing heavily in battery-electric commercial vehicles, but the manufacturer also sees a place for hydrogen fuel-cell technology in the transportation industry’s long-term move toward zero emissions.

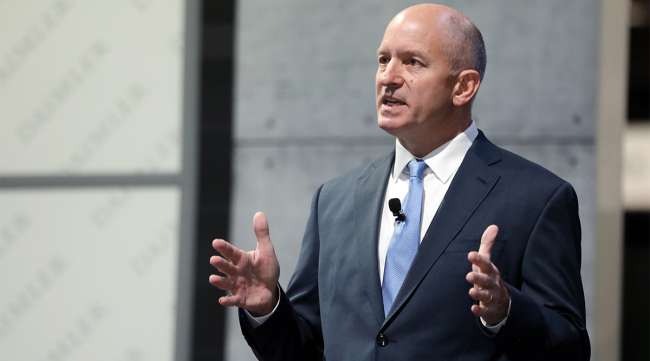

“We are going to — by the end of the 2020s — bring fuel-cell powered vehicles to series production,” Roger Nielsen, CEO of Daimler Trucks North America, said during the company’s Oct. 28 press conference here at the North American Commercial Vehicle Show.

“We believe fuel-cell technology and battery-electric vehicles will exist side-by-side as we head into carbon-free logistics in the next 20-30 years,” he said.

Five days earlier, Daimler’s Mitsubishi Fuso subsidiary presented a fuel-cell concept truck in Japan at the Tokyo Motor Show.

The Vision F-Cell light-duty truck, which incorporates a fuel cell to extend the range of the electric vehicle, was designed to explore the potential for fuel-cell technology in commercial vehicles, the company said.

Dating back to 1994, Daimler has introduced multiple Mercedes-Benz vehicles powered by fuel cells, including passenger cars, vans and buses.

“Daimler has a long history in fuel cells … and you will see us put that to use in the commercial vehicle industry,” Nielsen said at NACV.

DTNA’s plan to develop fuel-cell trucks adds to a growing chorus of manufacturers who are pursuing that technology for commercial vehicles, including other established truck makers and emerging competitors such as Nikola Motor Co., Toyota and Hyundai, as well as industry suppliers Bosch and Cummins.

In a separate interview with Transport Topics, Nielsen said Daimler plans to begin delivering fuel-cell trucks to fleet customers around the world sometime in the next decade.

Daimler Trucks builds Freightliner and Western Star trucks and Detroit engines and components in North America.

“The way things are rolling out and the way costs are coming together, we think we can actually have a viable series production product before we get to 2030,” he said. “But there’s a lot that has to happen between now and then.”

Nielsen said fuel-cell trucks still require significant development work — much more than battery-electric trucks, which DTNA already has begun to place into fleet customers’ freight operations.

“We don’t need a lot of pioneering effort in battery-electric to bring it to series production, but we definitely need a lot of inventions and creativity to get fuel cells to the point they need to be,” he said.

For hydrogen, the primary challenges are cost and efficiency, along with the need for fueling infrastructure, he said.

Today, however, compressed natural gas remains the most widely available alternative to diesel.

The market for CNG trucks is neither deteriorating nor skyrocketing, Nielsen said, and DTNA is supporting it by offering natural-gas engines from Cummins in its vehicles.

“We continue to believe that CNG is a viable alternative for many customers here in North America,” Nielsen said. “We are seeing some new interest in it, as well as the long-term existing customers.”

Meanwhile, traditional diesel trucks and engines will keep advancing as manufacturers prepare for increasingly stringent emission and fuel-economy standards through 2027 under federal Phase 2 greenhouse-gas emission regulations.

Want more news? Listen to today's daily briefing:

Nielsen said DTNA will be able to meet those standards through further enhancements to its existing powertrain platforms.

“You’re going to see a lot tighter integration with the transmission. The transmission becomes a stronger and stronger influencer on compliance with emissions standards,” he said. “Definitely, we are not done developing diesel engine technology.”