Cummins’ Engine Lead Shrinks as Daimler Hits 30% of Market

As the 2015 North American truck market surged, Cummins Inc. kept its lead in installing heavy-duty engines despite most truck makers carving out a greater share compared with 2014 — a trend Cummins management said will continue this year.

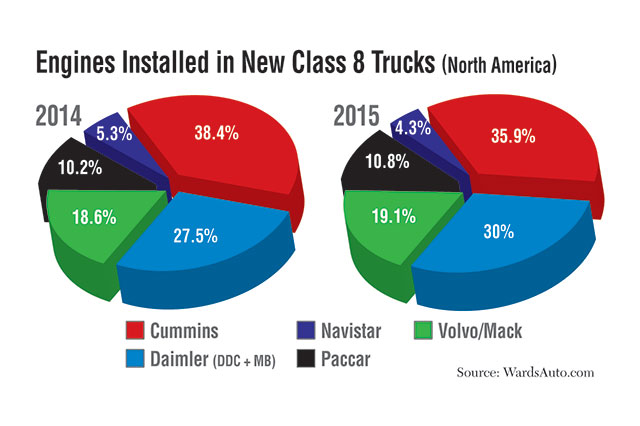

Among all Class 8 trucks shipped from North American factories, 114,690 vehicles, or 35.9%, had a Cummins engine, WardsAuto.com said in a Feb. 2 report.

Daimler Trucks, which grew 5 points compared with 2014, was the runner-up by placing 95,839 of its Detroit brand and Mercedes-Benz engines in its Freightliner and Western Star trucks, giving the company 30% of the total market.

The 5.9-percentage-point lead by Cummins dwindled from 10.9 points in 2014, when Cummins led DTNA 38.4% to 27.5%.

Overall shipments of heavy trucks from the continent’s factories expanded by 8.4% to 319,614 vehicles from 294,855 in 2014. U.S. retail sales grew faster, gaining 12.9% in 2015 over 2014.

Cummins CEO Thomas Linebarger said on a Feb. 4 earnings call, “Industry production for heavy-duty trucks in North America is projected to be 220,000 units, a 25% decrease year-over-year, with our market share projected to be between 30% and 33%.”

Cummins’ market share for truck engines peaked at 40.4% in 2012 and 2013. It is the only engine maker not associated with a truck manufacturer.

Most truck makers, though, are trying to entice customers to select power plants made by in-house engine makers. The truck makers argue that if one company makes the truck, its engine and transmission, the company’s engineers can maximize fuel efficiency in a way that three separate companies could never duplicate.

While DTNA’s gains were most dramatic in 2015, two of its major competitors also gained market share.

Volvo Group supplied 60,892 engines, or 19.1% of the industry total, for the heavy-duty Volvo and Mack trucks that the operating companies shipped in 2015. The year before, it was 54,722 engines, or 18.6% of the total.

The engine share of Paccar Inc. expanded to 10.8% from 10.2% in 2014. Paccar is the parent of Kenworth Truck and Peterbilt Motors, and the companies have moved to expand their share of in-house engines.

The 2015 results were based on installations of Paccar MX-13 engines, but in January, the manufacturer added an 11-liter engine as an option for its Kenworths and Peterbilts.

In its Jan. 29 earnings call, Paccar reported that, during the fourth quarter, the MX-13 was installed in 42% of its new heavy-duty trucks.

Collectively, the MX-11 and -13 compete with the Cummins ISX 12.

Navistar International Corp. was the only truck maker to lose market share on its engines, declining to 13,748 engines, or 4.3%, from 15,723 engines, or 5.3% of the 2014 market.

Analyst Ann Duignan of J.P. Morgan Securities said before the Cummins call that her firm remains “concerned about the impact of a lower North American truck market in 2016, along with continued market-share erosion, particularly in heavy-duty, as well as weakness in emerging markets.”

Four of the five engine makers scheduled earnings reports for times shortly after the Ward’s report came out.

Cummins said its engine business peaked for 2015 in the second quarter, leading to fourth-quarter results worse than the year as a whole.

For the quarter, Cummins earned $161 million, or 92 cents a share, on global revenue of $4.77 billion. For the same period in 2014, the company had net income of $444 million, or $2.44, on revenue of $5.09 billion.

For the year, profits were $1.4 billion on revenue of $19.11 billion, down from $1.65 billion in earnings on revenue of $19.22 billion in 2014.

Paccar’s results, reported Jan. 29, declined for the quarter but improved for the year.

The manufacturer earned $347.2 million, or 98 cents a share, on quarterly revenue of $4.06 billion. In the 2014 period, net income was $394.3 million, or $1.11, on revenue of $4.82 million.

Paccar’s truck deliveries and revenue grew in Europe but declined in North America and the rest of the world.

For the year, Paccar earned $1.6 billion on revenue of $17.94 billion, up from $1.36 billion in profits on revenue of $17.79 billion in 2014.

Cummins and Paccar reported the strong U.S. dollar hurt their results, whereas Daimler AG of Stuttgart, Germany, benefited.

Daimler’s global truck division, the company’s second-largest behind Mercedes-Benz cars, had operating income of $3.04 billion (2.74 billion euros) on annual revenue of $41.74 billion (37.6 billion euros). As reported in euros, annual revenue grew by 16% and profits by 32%.

North American sales were crucial to the results, gaining 19% to 192,000 Classes 6-8 trucks from 161,000 in 2014.

While 2015 sales boomed, orders declined by 22.6% to 168,000 in North America from 217,000 the previous year.