Consumer Prices Trail Estimates, Testing Fed Chairman Jerome Powell’s View

A key measure of U.S. consumer prices rose by less than expected in April on lower used car and apparel costs, testing the Federal Reserve’s message that muted inflation will prove transitory.

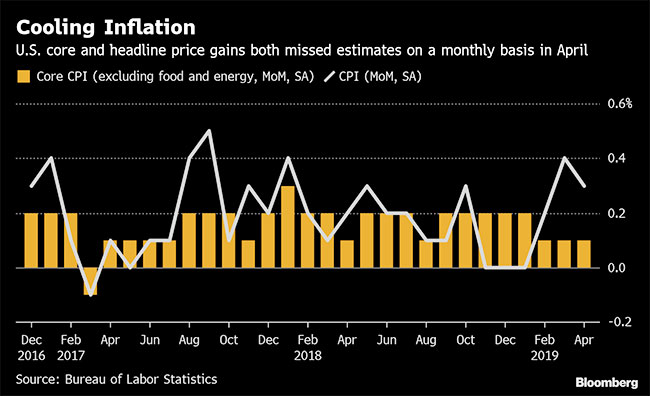

The core consumer price index, which excludes food and energy, rose 0.1% from the prior month, missing estimates, and 2.1% from a year earlier as forecast, according to a Labor Department report May 10. The broader CPI rose 0.3% monthly and 2% annually, with both figures less than projected.

The data suggest a sustained pickup in inflation may remain elusive for some time despite the lowest jobless rate in 49 years and consistent wage gains. However, prices could get a boost in coming months after President Donald Trump increased tariffs on Chinese imports May 10.

The 10-year Treasury yield briefly slipped to a session low after the CPI report, and fed funds futures showed a slight increase in odds for a 2019 rate cut by the central bank. The dollar fell.

The three-month annualized change in the core gauge was 1.6%, the lowest in almost two years.

Energy prices climbed 2.9% from the prior month as gasoline prices jumped 5.7%. Food costs decreased 0.1%, while medical care costs were up 0.3%.

At the same time, apparel prices dropped steeply for a second month, falling 0.8% in April after a 1.9% March drop that was the most since 1949. Apparel only accounts for just more than 3% of the CPI, but a new methodology in March had dragged down the overall index.

Fed Chairman Jerome Powell has suggested the too-low inflation will prove temporary as it is driven by “transitory” factors, indicating at his latest press conference that the central bank is not leaning toward either a cut or a hike in borrowing costs.

Great Consumer Price Index just out. Really good, very low inflation! We have a great chance to “really rock!” Good numbers all around. — Donald J. Trump (@realDonaldTrump) May 10, 2019

Trump has pressured the Fed for a reduction in interest rates to supercharge the economy amid muted inflation, even as the tight labor market has raised wages and lowered unemployment.

Fed officials typically focus on the less-volatile core inflation measure to gauge underlying trends. Their separate preferred index — which is linked to consumer spending tallied by the Commerce Department and tends to run slightly below the CPI — rose 1.5% in March from a year earlier, below the 2% target, as core prices eased to a one-year low of 1.6%. The April figures are due May 31.

The May 10 report showed used car prices slumped for a third month, dropping 1.3%, the most since September, while new vehicle prices rose 0.1%, less than the prior month.

Shelter costs, which make up about a third of total CPI, continued to underpin inflation. The index climbed 0.4% for a second straight month, with owner’s-equivalent rent rising 0.3%.