Commodities Roiled as Trump Pours Gasoline on Trade War Inferno

[Stay on top of transportation news: Get TTNews in your inbox.]

Raw materials are reeling after President Donald Trump threatened new tariffs on Chinese goods, dashing hopes that the two sides might soon negotiate an end to the trade war that’s sapping global growth and demand for commodities.

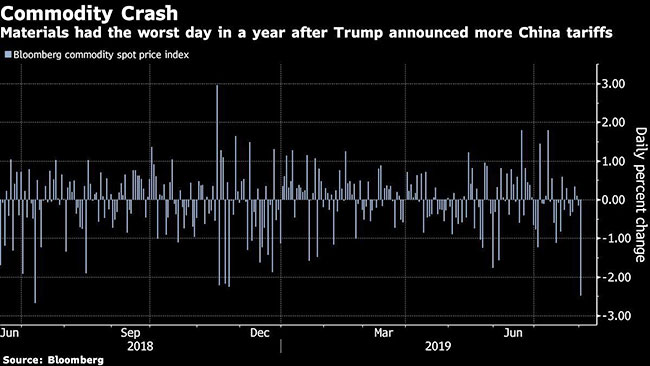

The Bloomberg Commodity Spot Index fell 2.5% Aug. 1, the biggest one-day drop in more than a year, before most markets began to stabilize Aug. 2. The Aug. 1 fall was led by oil’s biggest sell-off in four years. Hog and soybean futures also fell as Trump questioned Chinese promises to purchase more U.S. farm goods. Among metals, copper in London extended losses into Aug. 2, while mining equities, including Glencore Plc and BHP Group Plc, slumped.

Commodities have been held hostage to trade-war fluctuations over the past year as the two top economies slug it out. Trump escalated his fight with Beijing Aug. 1, saying 10% levies will now be imposed Sept. 1 on $300 billion of Chinese goods after a round of talks July 31 ended without a breakthrough. The sell-off in energy and building goods indicates investors see an end to the truce Trump struck with President Xi Jinping in June.

...during the talks the U.S. will start, on September 1st, putting a small additional Tariff of 10% on the remaining 300 Billion Dollars of goods and products coming from China into our Country. This does not include the 250 Billion Dollars already Tariffed at 25%... — Donald J. Trump (@realDonaldTrump) August 1, 2019

“We’ve been bearish on the expectation that the situation would continue to deteriorate,” Vivienne Lloyd, an industrial metals analyst at Macquarie, said by phone from London. “It’s become clear that there are structural difficulties in achieving a deal, because some of the American demands just run counter to the spirit of China.”

Some of the Trump-inspired swings began to reverse themselves by Aug. 2. Gold, which had risen to a six-year high on a renewed demand for havens, began to retreat, with spot prices losing as much as 1%. Brent crude bounced back, while still heading for a 2.4% weekly loss.

As hopes for a deal fade, investors are left focusing on a contraction in manufacturing and heavy industry across many major economies. Copper — with its close links to shifts in economic growth — could have a few hundred dollars left to fall if it breaks below resistance levels at around $5,800 a ton that have held throughout the trade war, Lloyd said. “In terms of the impact on metals, we see it as a spectrum, with copper at the worst end of it, given its sensitivity to macro conditions,” Lloyd said. “At the other end would be the bulk commodities, which are typically traded by people who are much closer to the underlying physical markets. The distinction between the two is going to be key.”