Coke Shares Drop Most Since 2008

Coca-Cola Co. plunged the most intraday in more than 10 years on Feb. 14 after the company released a lackluster forecast for 2019 and highlighted upcoming obstacles such as currency pressures, geopolitical tensions and weakening consumer sentiment. Shares of rival soft-drink bottler PepsiCo Inc. also declined.

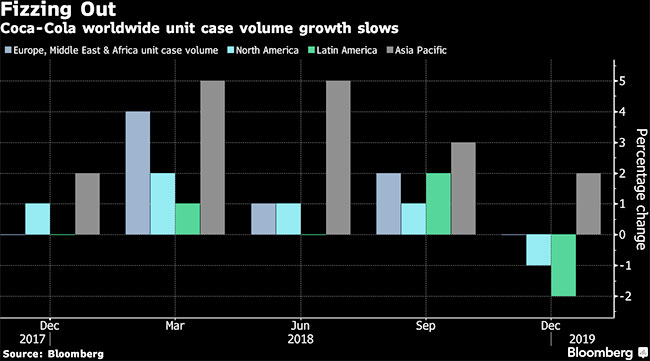

Unit case volume fell 1% in North America and 2% in Latin America in the quarter ended Dec. 31, though adjusted earnings per share matched analyst forecasts. The company sees this year’s earnings essentially flat.

While the beverage giant has made progress with its Diet Coke and Coke Zero Sugar brands, the results show that a broader decline in soda consumption still may be weighing down performance. Coke, like its rivals in the beverage business, also is facing higher transportation costs. CEO James Quincey has been banking on a pivot from sugary soda at the world’s largest beverage company.

He is under pressure to show his company’s big bet on U.K. coffee chain Costa can drive growth. Coke, like Pepsi, has raised prices to offset higher costs — moves the company said caused some consumer backlash in the quarter. In addition, it sold less juice, dairy and plant-based beverages. The drinks business has become more competitive in the United States, with sparkling water, bottled coffee and other options gaining popularity.

Coca-Cola Bottling Co is No. 20 on the TT Top 100 list of the largest private carriers in North America.