Senior Reporter

Class 8 Sales Plunge 29.3%

This story appears in the Nov. 21 print edition of Transport Topics.

U.S. retail sales of Class 8 trucks sank nearly 30% in October in a market beset by weak demand for freight hauling, cautious fleets and uncertainty about the incoming presidential administration’s regulatory approach, analysts said.

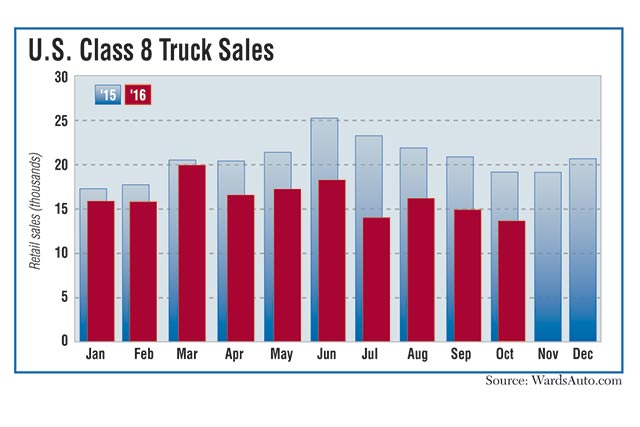

Sales were 13,618 vehicles, down 29.3% compared with 19,252 a year earlier. It was the low point for the year and the fewest since 13,101 in March 2013, WardsAuto.com reported Nov. 10.

Year-to-date sales were 163,091, down 21.9% compared with 208,793 in the 2015 10-month period.

International Trucks, the brand of Navistar Inc., posted a 1.5% sales increase to 2,188 units, good for a 16.1% market share. October was the final month of Navistar’s fiscal year.

All other original equipment manufacturers reported declines.

Sales at market-leading Freightliner Trucks plummeted 45.6% to 4,371 vehicles and a 32.1% share. Western Star, the smallest truck manufacturer, posted a 17.6% sales slide to 323 units for a 2.4% share. Both are brands of Daimler Trucks North America.

The two brands of Paccar Inc. — Peterbilt Motors Co. and Kenworth Truck Co. — combined to nearly equal DTNA’s market share of 34.5%.

Sales at Kenworth were 2,108 big trucks, down 27.8% year-over-year but good for a 15.5% share. Peterbilt dropped 6.5% to 2,069 Class 8s, earning it a 15.2% share.

Sales at Volvo Trucks North America fell 39% to 1,414 heavy trucks, for a 10.4% share. At Mack Trucks, sales were off 6.4% to 1,142 vehicles for an 8.4% market share. Both OEMs are brands of Volvo Group.

Navistar executives are watching for any course correction in the federal regulatory agenda because that could affect sales.

“The thing that is most interesting about a Trump administration is what is going to happen with the Environmental Protection Agency,” Jeff Sass, Navistar senior vice president for North American truck sales and marketing, told Transport Topics. “Uniformity is the key to this whole thing.”

Eleven other states follow the California Air Resources Board emissions regulations, which are created independent of federal standards, Sass said. Loosening the EPA’s greenhouse-gas regulations could mean CARB gets even more stringent.

“And having them be different than the other 38 states would just make it crazy on how we build out trucks … the actual cost of the truck based on what has to be done with aftertreatment,” he said.

Sass attributed the October gains to “a lot of cleanup with company inventory, invoicing with the [U.S.] General Services Administration, the state of New York and a couple of our municipal customers, so traditionally, we have a really strong October Class 8 retail sales.”

Navistar also has sold 1,150 of its new LT model linehaul trucks that came with 2017-compliant engines from Cummins Inc. “with the single-can aftertreatment systems to be built in November and December,” Sass said.

Familiar economic factors continued their dampening effect, said Magnus Koeck, vice president of marketing and brand management at VTNA.

High inventory-to-sales ratios across the economy, leading to weak manufacturing levels and reduced freight volumes, continue, Koeck said. “The majority of these impacts have been seen in the longhaul market, which is core to Volvo Trucks. Despite these challenges, we’re helping drive our customers’ success with improved productivity and profitability delivered by our full range of innovative, fuel- efficient trucks.”

The “relative strength continuing in construction [is] enabling Mack to grow market share in 2016 as customers respond to our durable and reliable trucks,” said Jonathan Randall, senior vice president for North American sales at Mack.

“2017 will be a year of modest growth in nonresidential construction, possibly marked by moderating growth in commercial, offset by stronger growth in institutional,” Robert W. Baird & Co. analyst Timothy Wojs wrote in a recent note to investors.

At the same time, President-elect Donald Trump has promised to invest in repairing the nation’s infrastructure.

International is “not building extra trucks right now just in case, but as projects come about, we are well-positioned with our HX model to capitalize on any additional projects that come our way,” Sass said.

Truckload carrier Knight Transportation Inc. has extended the trade cycle of its tractors, pushing the average age of its fleet to 2 years, as of the quarter ended Sept. 30, up from 1.8 years in the second quarter. In its earnings report, Knight cited rising new equipment prices and a weak used-equipment market as factors.

“We’re very sensitive to when we add additional trucks because we know it puts pressure on that miles per truck, which ultimately affects your revenue per truck,” CEO David Jackson said during a conference call with analysts Oct. 26.

Knight ranks No. 29 on the Transport Topics Top 100 list of the largest U.S. and Canadian for-hire carriers.

Other truck manufacturers declined to comment.