Senior Reporter

Class 8 Sales Drop in December, But Still Post Fourth-Best Year

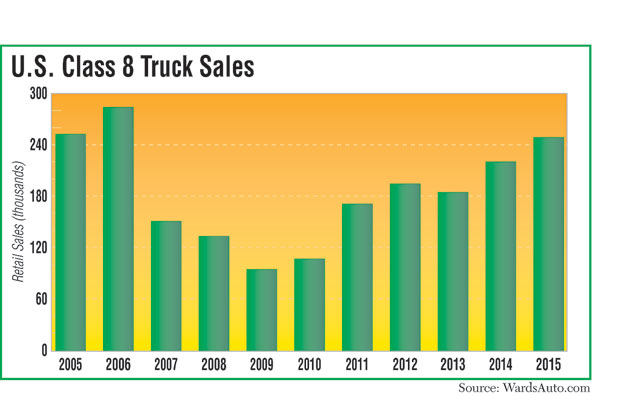

U.S. retail sales of Class 8 trucks fell 11.1% in December from a year earlier but finished 2015 with the fourth-highest annual total on record, WardsAuto.com reported.

The December total was 20,773 units, with Volvo Trucks the only brand to report higher sales. However, for the full year, sales rose 12.9% to 248,804 trucks. That trailed only 1999, 2005 and the record sales of 284,008 trucks in 2006.

“The bigger story is how the year finished,” Steve Tam, an analyst with ACT Research, told Transport Topics. “It sets up where the industry is now and is expected to go, which is slowing; 2016 will still be a good year, but not a record-territory year.”

Truck makers said throughout 2015 that fleets were buying more fuel-efficient replacement vehicles. But as the sales mounted, so did dealer inventories, which persist, analysts said.

Don Ake, with research firm FTR Associates, wrote in a blog that the cyclical industry is transitioning to a more turbulent environment this year.

“My favorite phrase in 2015 was ‘soft landing.’ . . . Now it appears the landing will not be so soft. The latest FTR forecast is for a 19% decrease for 2016 [in Class 8 truck builds], with the market at times operating at a rate more than 20% down from just a short time ago. A bumpy landing but not a crash, as of yet,” he wrote.

Ake suggested that fleets overestimated the capacity they needed in the second half of 2015. Dealers stocked up, but manufacturers were left sitting on “record inventories.”

Daimler Trucks North America’s Freightliner brand ended 2015 again as the market leader, with a 38.3% market share on sales of 95,360 trucks.

“While the U.S. Class 8 market increased 12.9% year-to-date, reaching levels not witnessed since 2006, the 22% sales increase across all our DTNA brands outperformed the positive market development, a reflection of the strength of our product portfolio,” said Markus Pfeifer, DTNA’s director of marketing operations.

DTNA also is the parent of niche nameplate Western Star, whose 2015 market share reached 2% on sales of 4,854 trucks.

Kenworth Truck Co. claimed the second-highest market share with 15% on sales of 37,201 units. Peterbilt Motors Co.’s market share fell to 12.7% from 13.5%, even as sales increased to 31,721.

Kenworth and Peterbilt both are brands of Paccar Inc., which declined to comment for this article ahead of its earnings report Jan. 29.

Neil Frohnapple, an analyst with Longbow Research, said in a note to investors after discussions with several Paccar dealers that inventories remain high “despite an uptick in year-end sales activity in the month of December compared with earlier in the fourth quarter of 2015.”

Frohnapple also said one dealer told him a few fleets put off buying trucks because “it was hard for them to let go of their trucks at current market values.”

Meanwhile, Volvo Trucks earned a 12.4% market share for the year on sales of 30,930 trucks. For December, it also was the only truck maker in positive territory, as sales rose 15.9% compared with the year-earlier period.

“While adding truck capacity has lessened recently, we continue to see solid demand for our trucks in all segments across the country,” said Magnus Koeck, Volvo Trucks’ vice president of marketing.

The market share for Mack Trucks, also a unit of the Volvo Group, slipped to 8% from 8.9% as sales inched up to 19,826.

John Walsh, Mack’s vice president of marketing, said the latest report shows that “we are continuing to transition from 2015’s near-record sales to 2016, a year in which we predict Class 8 retail sales will decrease by roughly 10%.”

“In addition, the market is currently facing more headwinds than at the end of 2014, including lower freight levels thanks to high product inventories across the economy, a decrease in U.S. exports and low oil prices that have caused a big decline in oil and gas investment projects,” Walsh said.

Navistar International Corp.’s market share was 11.6%, down from 14.1% a year earlier, on sales of 28,840. Jeff Sass, senior vice president of sales, said the truck maker is aggressively pursuing new Class 8 customers.

“Our focus in the heavy-duty market this year is to get in front of as many customers as we can and continue gaining conquest deals,” Sass said.